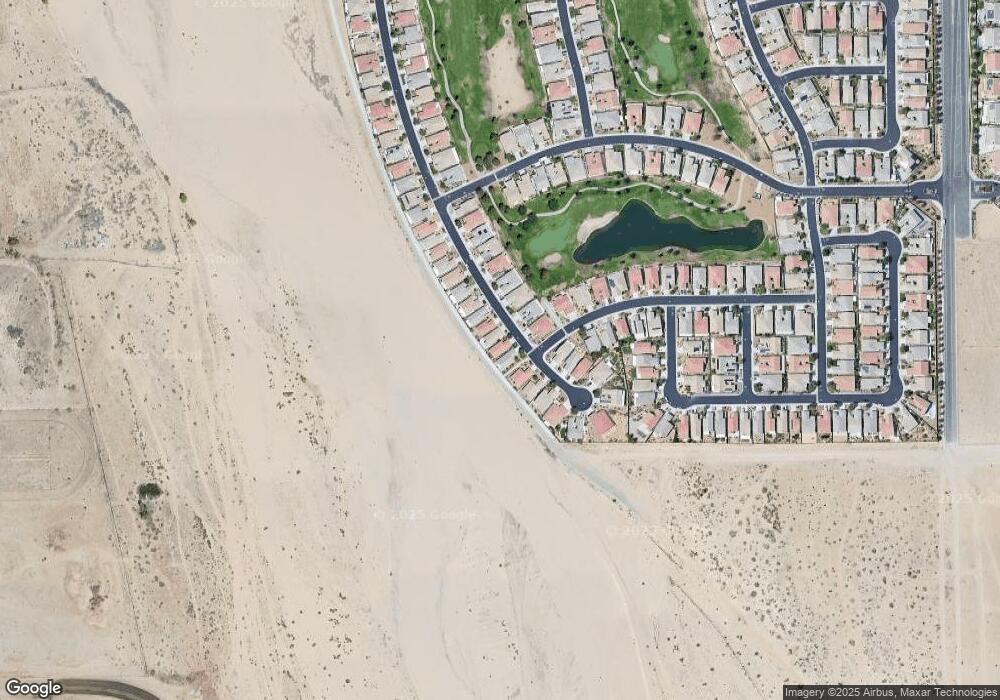

10154 Darby Rd Apple Valley, CA 92308

High Desert NeighborhoodEstimated Value: $347,394 - $369,000

2

Beds

2

Baths

1,198

Sq Ft

$296/Sq Ft

Est. Value

About This Home

This home is located at 10154 Darby Rd, Apple Valley, CA 92308 and is currently estimated at $354,849, approximately $296 per square foot. 10154 Darby Rd is a home located in San Bernardino County with nearby schools including Rio Vista School of Applied Learning and Apple Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 9, 2015

Sold by

Warner Frank A

Bought by

Warner Frank A and Frank A Warner Revocable Trust

Current Estimated Value

Purchase Details

Closed on

Dec 4, 2012

Sold by

Warner Frank

Bought by

Warner Frank

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,755

Outstanding Balance

$105,042

Interest Rate

3.35%

Mortgage Type

VA

Estimated Equity

$249,807

Purchase Details

Closed on

Nov 23, 2010

Sold by

Pulte Home Corporation

Bought by

Warner Frank A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,627

Interest Rate

4.17%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Warner Frank A | -- | None Available | |

| Warner Frank | -- | First American Title Company | |

| Warner Frank A | $150,000 | First American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Warner Frank | $151,755 | |

| Closed | Warner Frank A | $154,627 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,174 | $191,778 | $44,842 | $146,936 |

| 2024 | $2,174 | $188,018 | $43,963 | $144,055 |

| 2023 | $2,152 | $184,331 | $43,101 | $141,230 |

| 2022 | $2,118 | $180,717 | $42,256 | $138,461 |

| 2021 | $2,069 | $177,173 | $41,427 | $135,746 |

| 2020 | $2,082 | $175,356 | $41,002 | $134,354 |

| 2019 | $2,043 | $171,918 | $40,198 | $131,720 |

| 2018 | $1,991 | $168,547 | $39,410 | $129,137 |

| 2017 | $1,962 | $165,242 | $38,637 | $126,605 |

| 2016 | $1,870 | $162,002 | $37,879 | $124,123 |

| 2015 | $1,841 | $159,569 | $37,310 | $122,259 |

| 2014 | $1,816 | $156,443 | $36,579 | $119,864 |

Source: Public Records

Map

Nearby Homes

- 19453 Maple Creek Rd

- 10030 El Dorado St

- 10301 Darby Rd

- 10041 Wilmington Ln

- 10065 Wilmington Ln

- 10364 Lakeshore Dr

- 10215 Wascana Ln

- 19478 Big Horn St

- 19385 Boulder St

- 10479 Bridge Haven Rd

- 10485 Nobleton Rd

- 9983 Choiceana Ave

- 10645 Green Valley Rd

- 10577 Bridge Haven Rd

- 0 Choiceana Ave Unit IV25199738

- 0 Choiceana Ave Unit HD25180587

- 19369 Glaslyn Ct

- 9546 Verdugo Ave

- 10767 Katepwa St

- 10803 Katepwa St

- 10162 Darby Rd

- 10146 Darby Rd

- 10174 Darby Rd

- 10138 Darby Rd

- 10178 Darby Rd

- 10151 Darby Rd

- 10163 Darby Rd

- 10175 Darby Rd

- 10126 Darby Rd

- 10186 Darby Rd

- 10149 Darby Rd

- 10189 Darby Rd

- 10194 Darby Rd

- 10137 Darby Rd

- 19422 Royal Oaks Rd

- 10201 Darby Rd

- 10114 Darby Rd

- 19419 Royal Oaks Rd

- 19424 Royal Oaks Rd

- 10212 Darby Rd