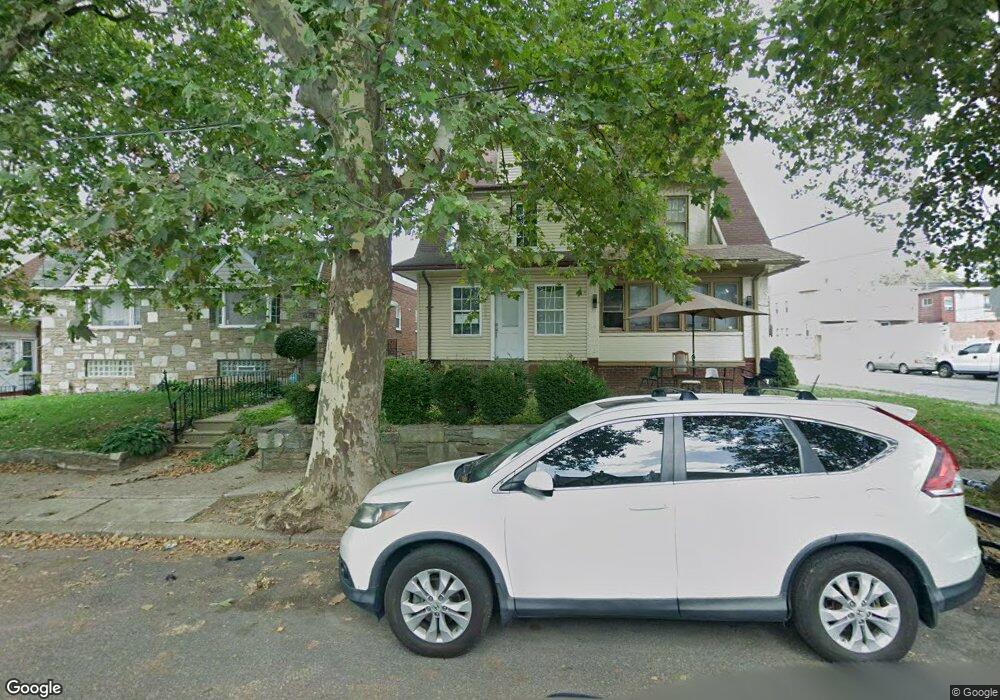

1025 Harrison St Philadelphia, PA 19124

Frankford NeighborhoodEstimated Value: $306,315 - $341,000

4

Beds

2

Baths

2,640

Sq Ft

$122/Sq Ft

Est. Value

About This Home

This home is located at 1025 Harrison St, Philadelphia, PA 19124 and is currently estimated at $322,829, approximately $122 per square foot. 1025 Harrison St is a home located in Philadelphia County with nearby schools including Frankford High School, The Philadelphia Charter School for the Arts & Sciences, and Northwood Academy Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 15, 2020

Sold by

Lemes Property Management Llc

Bought by

Desouza Salatiel M and Pires Maria Aparecida

Current Estimated Value

Purchase Details

Closed on

Oct 14, 2011

Sold by

Thatcher Amy and Erikson James

Bought by

Huarneck Ronald

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,817

Interest Rate

3.87%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 6, 2005

Sold by

Zehren Carolyn M and Zehren Thomas J

Bought by

Thatcher Amy and Erikson Jim

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$89,000

Interest Rate

5.67%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Desouza Salatiel M | $65,000 | None Available | |

| Huarneck Ronald | $165,000 | None Available | |

| Thatcher Amy | $170,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Huarneck Ronald | $160,817 | |

| Previous Owner | Thatcher Amy | $89,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $3,458 | $267,000 | $53,400 | $213,600 |

| 2025 | $3,458 | $267,000 | $53,400 | $213,600 |

| 2024 | $3,458 | $267,000 | $53,400 | $213,600 |

| 2023 | $3,458 | $247,000 | $49,400 | $197,600 |

| 2022 | $2,819 | $247,000 | $49,400 | $197,600 |

| 2021 | $2,819 | $0 | $0 | $0 |

| 2020 | $2,819 | $0 | $0 | $0 |

| 2019 | $2,704 | $0 | $0 | $0 |

| 2018 | $2,704 | $0 | $0 | $0 |

| 2017 | $2,704 | $0 | $0 | $0 |

| 2016 | $2,284 | $0 | $0 | $0 |

| 2015 | $2,187 | $0 | $0 | $0 |

| 2014 | -- | $193,200 | $39,604 | $153,596 |

| 2012 | -- | $18,784 | $2,082 | $16,702 |

Source: Public Records

Map

Nearby Homes

- 1052 Allengrove St

- 1859 Harrison St

- 1208 Haworth St

- 1214 Haworth St

- 4717 Northwood St

- 1001-3 Arrott St

- 926 Foulkrod St

- 1300 Harrison St

- 1204 Pratt St

- 5118 Oakland St

- 4046 E Roosevelt Blvd

- 1218 Pratt St

- 1220 Pratt St

- 1335 Fillmore St

- 5033 Akron St

- 1048 Bridge St

- 1137 Bridge St

- 1359 Dyre St

- 5505 Loretto Ave

- 4632 Oakland St

- 1023 Harrison St

- 1021 Harrison St

- 1027 Harrison St

- 1019 Harrison St

- 1017 Harrison St

- 1015 Harrison St

- 1072 Allengrove St

- 1074 Allengrove St

- 1013 Harrison St

- 1101 Harrison St

- 1064 Allengrove St

- 1011 Harrison St

- 1062 Allengrove St

- 1103 Harrison St

- 1060 Allengrove St

- 1009 Harrison St

- 1100 Allengrove St

- 1022 Harrison St

- 1020 Harrison St

- 1018 Harrison St