Estimated Value: $291,000 - $494,310

--

Bed

--

Bath

--

Sq Ft

27.55

Acres

About This Home

This home is located at 10422 Formica Rd, Tomah, WI 54660 and is currently estimated at $376,828. 10422 Formica Rd is a home located in Monroe County with nearby schools including Tomah High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 2, 2021

Sold by

Mittelstaedt Sharlee R and Schaafs Sharlee R

Bought by

Parlow Michael G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,525

Outstanding Balance

$229,727

Interest Rate

2.93%

Mortgage Type

New Conventional

Estimated Equity

$147,101

Purchase Details

Closed on

Jun 7, 2021

Sold by

Noltner Rachel M and Sharlee R Mittelstaedt Family

Bought by

Mittelstaedt Sharlee R and Schaafs Sharlee R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,525

Outstanding Balance

$229,727

Interest Rate

2.93%

Mortgage Type

New Conventional

Estimated Equity

$147,101

Purchase Details

Closed on

Jun 27, 2006

Sold by

Blair Douglas R

Bought by

Skogen Roy Aand Joyce L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Parlow Michael G | $246,000 | None Available | |

| Mittelstaedt Sharlee R | $208,400 | None Available | |

| Skogen Roy Aand Joyce L | $140,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Parlow Michael G | $252,525 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,335 | $339,300 | $93,400 | $245,900 |

| 2023 | $3,911 | $339,300 | $93,400 | $245,900 |

| 2022 | $3,662 | $209,200 | $65,800 | $143,400 |

| 2021 | $3,508 | $209,200 | $65,800 | $143,400 |

| 2020 | $3,560 | $209,200 | $65,800 | $143,400 |

| 2019 | $3,421 | $209,200 | $65,800 | $143,400 |

| 2018 | $3,341 | $209,200 | $65,800 | $143,400 |

| 2017 | $3,592 | $209,200 | $65,800 | $143,400 |

| 2016 | $3,581 | $209,200 | $65,800 | $143,400 |

| 2015 | $3,988 | $209,200 | $65,800 | $143,400 |

| 2014 | $3,705 | $209,200 | $65,800 | $143,400 |

| 2011 | $3,410 | $162,300 | $53,300 | $109,000 |

Source: Public Records

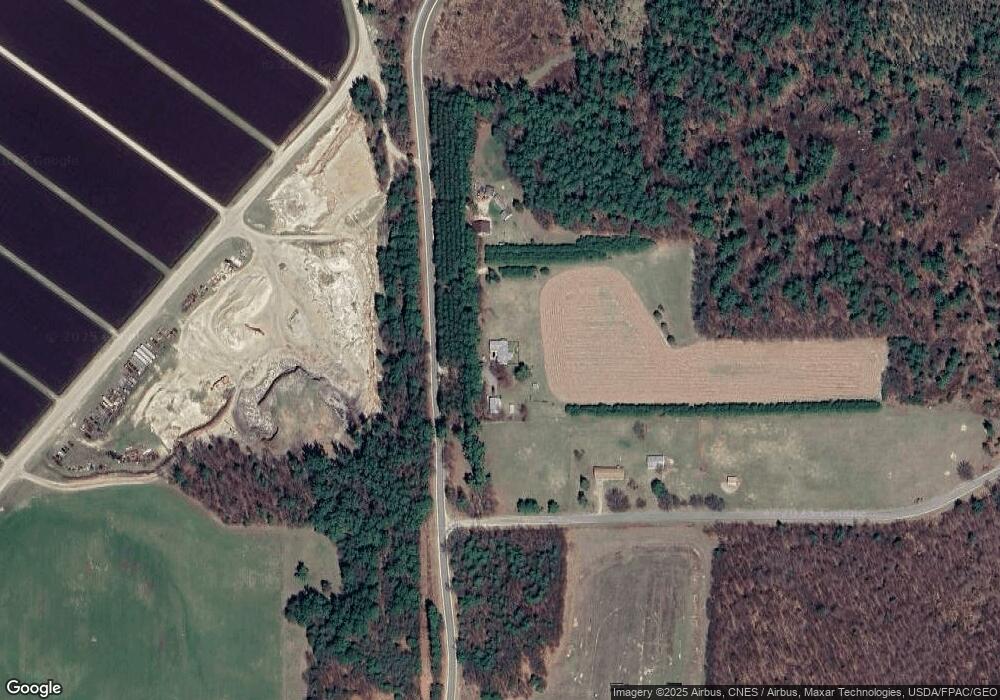

Map

Nearby Homes

- 11809 Formica Rd

- 28133 County Highway Et

- 26073 County Highway G

- 622 Vandervort St

- 535 Collin Dr

- 108 Vandervort St

- 0 Main St

- 125 E Andres St Unit 9

- 24691 Embay Ave

- 1704 N Superior Ave

- 000 Us Highway 12

- 1150 Heeler Ave

- 115 Wisconsin St

- 429 Pine St

- 000 U S 12

- 425 Arthur St Unit 26

- County Highway Et Rd

- 23506 County Road Cm

- Lot 20 Spring Brook

- 403 Green Acres Ave

- 10338 Formica Rd

- 27580 Essex Ave

- 27296 State Highway 21

- 10631 Formica Rd

- 10709 Formica Rd

- 10660 Formica Rd

- 10692 Formica Rd

- 27102 State Highway 21

- 27102 State Highway 21

- 27192 State Highway 21

- 27178 State Highway 21

- 0 Wisconsin 21

- 12.28AC Wisconsin 21

- 10735 Formica Rd

- 10759 Formica Rd

- 10781 Formica Rd

- 10784 Formica Rd

- 27828 Essex Ave

- 27926 Essex Ave

- 27042 State Highway 21