Estimated Value: $633,420 - $694,000

--

Bed

--

Bath

2,559

Sq Ft

$261/Sq Ft

Est. Value

About This Home

This home is located at 105 Lariat Ct, Azle, TX 76020 and is currently estimated at $667,855, approximately $260 per square foot. 105 Lariat Ct is a home located in Parker County with nearby schools including Silver Creek Elementary School, Azle Elementary School, and Azle Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 15, 2007

Sold by

Huffman Timothy Glen and Huffman Trisha Marie

Bought by

Sandoval John Michael and Sandoval Melissa Mignonne

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,000

Outstanding Balance

$39,864

Interest Rate

6.47%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$627,991

Purchase Details

Closed on

Oct 15, 2004

Sold by

Hook Donald C and Hook Phyllis C

Bought by

Sandoval John M and Sandoval Melissa M

Purchase Details

Closed on

Sep 15, 1999

Sold by

Hook Donald C and Hook Phyllis C

Bought by

Sandoval John M and Sandoval Melissa M

Purchase Details

Closed on

May 17, 1999

Bought by

Sandoval John M and Sandoval Melissa M

Purchase Details

Closed on

Jan 1, 1901

Bought by

Sandoval John M and Sandoval Melissa M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sandoval John Michael | -- | Rtc | |

| Sandoval John M | -- | -- | |

| Sandoval John M | -- | -- | |

| Sandoval John M | -- | -- | |

| Sandoval John M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sandoval John Michael | $63,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,447 | $515,871 | -- | -- |

| 2024 | $2,447 | $468,974 | -- | -- |

| 2023 | $2,447 | $426,340 | $0 | $0 |

| 2022 | $7,172 | $437,360 | $137,500 | $299,860 |

| 2021 | $6,831 | $437,360 | $137,500 | $299,860 |

| 2020 | $6,177 | $320,320 | $72,500 | $247,820 |

| 2019 | $6,547 | $320,320 | $72,500 | $247,820 |

| 2018 | $6,628 | $329,400 | $62,500 | $266,900 |

| 2017 | $5,742 | $329,400 | $62,500 | $266,900 |

| 2016 | $5,220 | $267,190 | $50,000 | $217,190 |

| 2015 | $1,924 | $267,190 | $50,000 | $217,190 |

| 2014 | $5,095 | $270,950 | $50,000 | $220,950 |

Source: Public Records

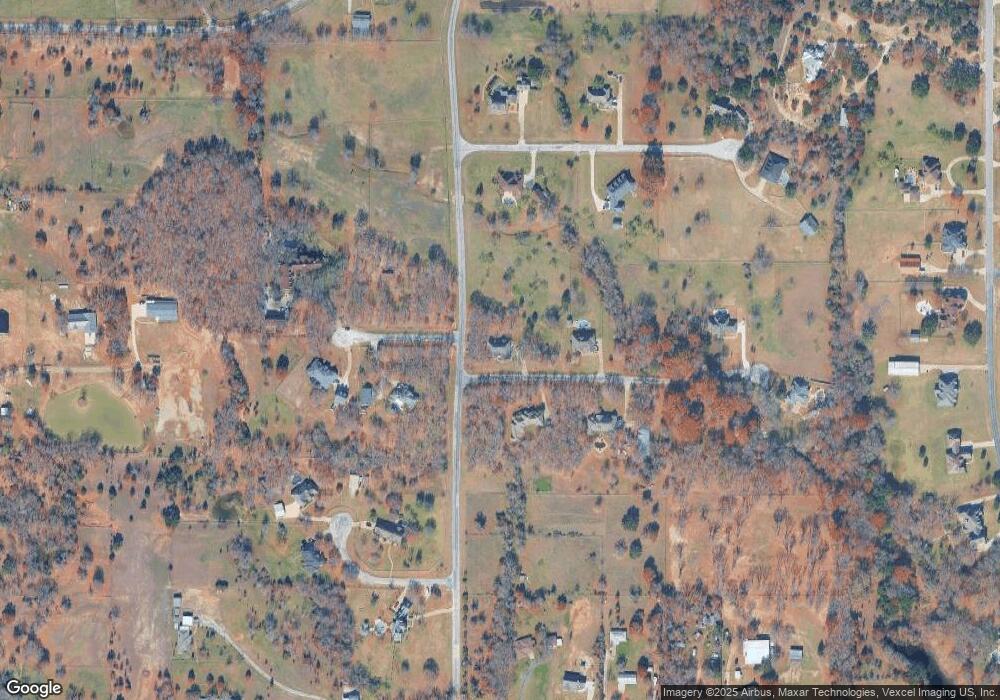

Map

Nearby Homes

- 129 Lariat Ct

- 125 Branding Iron Ct

- 1144 Boling Ranch Rd N

- 1144 Rd

- 900 Reese Ln

- 145 Ranch Creek Dr

- 918 Boling Ranch Rd

- 101 Deer Crossing Way

- 528 Mill Creek Ct

- 694 Boling Ranch Rd

- 175 N Boyce Ln

- 429 Hartley Way

- 742 Boling Ranch Rd

- 704 Glade Park Ct

- 108 Stone Canyon Cir

- 141 E Bozeman Ln

- 255 Chaparrals Run

- 101 E Bozeman Ln

- 100 Stone Canyon Cir

- 200 W Bozeman Ln

- 104 Lariat Ct

- 113 Lariat Ct

- 103 Iron Horse Ct

- 00 Lariat Ct

- 000 Lariat Ct

- 112 Lariat Ct

- 102 Branding Iron Ct

- 109 Iron Horse Ct

- 121 Lariat Ct

- 110 Branding Iron Ct

- 114 Red River Ct

- 108 Iron Horse Ct

- 108 Iron Horse Ct

- 126 Branding Iron Ct

- 103 Branding Iron Ct

- 115 Red River Ct

- 109 Branding Iron Ct

- 109 Red River Ct

- 128 Lariat Ct

- 233 Buckhorn Ln