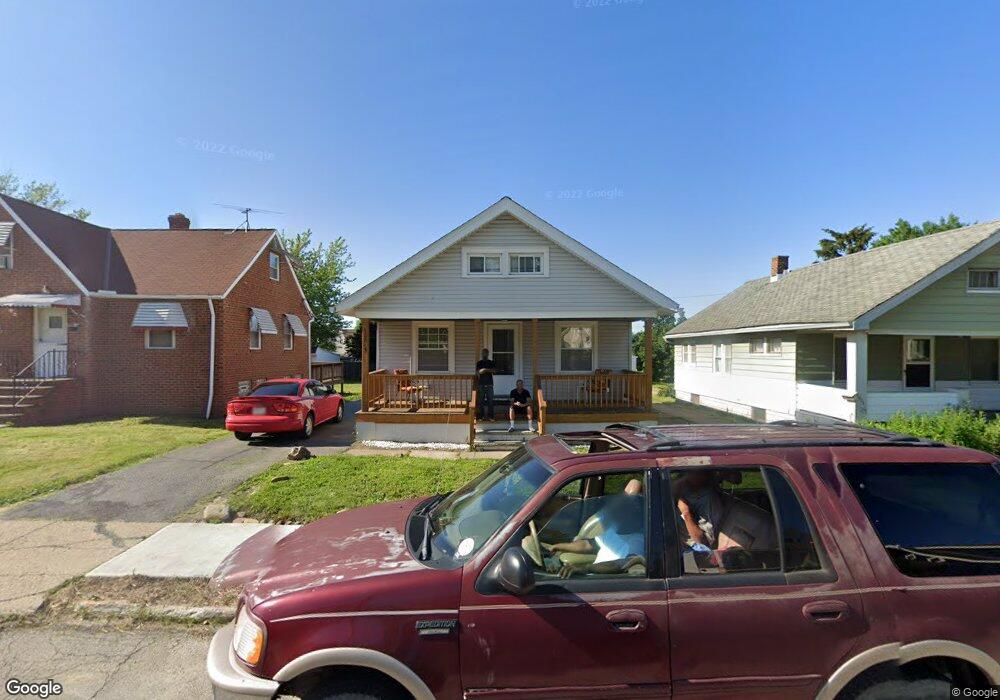

10813 Park Heights Ave Cleveland, OH 44125

Estimated Value: $118,627 - $143,000

3

Beds

1

Bath

1,152

Sq Ft

$111/Sq Ft

Est. Value

About This Home

This home is located at 10813 Park Heights Ave, Cleveland, OH 44125 and is currently estimated at $127,657, approximately $110 per square foot. 10813 Park Heights Ave is a home located in Cuyahoga County with nearby schools including Garfield Heights High School, North Shore High School, and Trinity High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 10, 2017

Sold by

Cuyahoga County Land Reutilization Corpo

Bought by

Nagybabi Maria V

Current Estimated Value

Purchase Details

Closed on

Sep 1, 2015

Sold by

C C M Renovations

Bought by

Cuyahoga County Land Reutilization Corpo

Purchase Details

Closed on

May 27, 2007

Sold by

Us Bank Na

Bought by

C C M Renovations

Purchase Details

Closed on

Jun 7, 2006

Sold by

Penner Brian and Penner Veronica

Bought by

Us Bank Na and Csfb Mortgage Pass Through Certificates

Purchase Details

Closed on

Sep 16, 1998

Sold by

Woodburn David R

Bought by

Penner Brian

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$71,878

Interest Rate

7.02%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 27, 1992

Sold by

Yelsik Barbara J

Bought by

Woodburn David R

Purchase Details

Closed on

Aug 16, 1984

Sold by

Yelsik David and Yelsik B

Bought by

Yelsik Barbara J

Purchase Details

Closed on

Jan 1, 1975

Bought by

Yelsik David and Yelsik B

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Nagybabi Maria V | -- | None Available | |

| Cuyahoga County Land Reutilization Corpo | -- | None Available | |

| C C M Renovations | $30,000 | Resource Title Agency | |

| Us Bank Na | $64,000 | Attorney | |

| Penner Brian | $85,000 | -- | |

| Woodburn David R | $61,000 | -- | |

| Yelsik Barbara J | -- | -- | |

| Yelsik David | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Penner Brian | $71,878 | |

| Closed | Penner Brian | $12,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,459 | $34,440 | $8,085 | $26,355 |

| 2023 | $2,012 | $18,170 | $4,380 | $13,790 |

| 2022 | $1,977 | $18,170 | $4,380 | $13,790 |

| 2021 | $2,093 | $18,170 | $4,380 | $13,790 |

| 2020 | $1,789 | $14,530 | $3,500 | $11,030 |

| 2019 | $1,773 | $41,500 | $10,000 | $31,500 |

| 2018 | $1,842 | $14,530 | $3,500 | $11,030 |

| 2017 | $427 | $0 | $0 | $0 |

| 2016 | $80 | $0 | $0 | $0 |

| 2015 | $225 | $0 | $0 | $0 |

| 2014 | $25,098 | $21,560 | $4,270 | $17,290 |

Source: Public Records

Map

Nearby Homes

- 10717 Park Heights Ave

- 10718 Vernon Ave

- 10916 Mccracken Rd

- 11006 Mccracken Rd

- 11016 Mccracken Rd

- 10925 Thornton Ave

- 11206 Park Heights Ave

- 10609 Mccracken Blvd

- 11105 Vernon Ave

- 10501 Park Heights Ave

- 4948 E 107th St

- 4953 E 106th St

- 4935 E 109th St

- 11100 Wallingford Ave

- 10408 S Highland Ave

- 10417 Grace Ave

- 5204 Turney Rd

- 11209 Langton Ave

- 11215 Langton Ave

- 10401 Grace Ave

- 10811 Park Heights Ave

- 10821 Park Heights Ave

- 10805 Park Heights Ave

- 10901 Park Heights Ave

- 10801 Park Heights Ave

- 10816 Plymouth Ave

- 10818 Plymouth Ave

- 10810 Plymouth Ave

- 10806 Plymouth Ave

- 10822 Plymouth Ave

- 10905 Park Heights Ave

- 10721 Park Heights Ave

- 10802 Plymouth Ave

- 10902 Plymouth Ave

- 10812 Park Heights Ave

- 10816 Park Heights Ave

- 10804 Park Heights Ave

- 10820 Park Heights Ave

- 10724 Plymouth Ave

- 10906 Plymouth Ave