109 Wild Flower Ln Pleasanton, CA 94566

Estimated Value: $1,405,000 - $1,612,000

4

Beds

3

Baths

1,986

Sq Ft

$767/Sq Ft

Est. Value

About This Home

This home is located at 109 Wild Flower Ln, Pleasanton, CA 94566 and is currently estimated at $1,523,909, approximately $767 per square foot. 109 Wild Flower Ln is a home located in Alameda County with nearby schools including Valley View Elementary School, Pleasanton Middle School, and Amador Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 9, 2015

Sold by

Corcoran Allison Mohr

Bought by

Adams James M and Becerra Natalia C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$720,000

Outstanding Balance

$555,476

Interest Rate

3.8%

Mortgage Type

New Conventional

Estimated Equity

$968,433

Purchase Details

Closed on

Dec 17, 2014

Sold by

Stroemer Gloria and Karin Mohr Revocable Inter Viv

Bought by

Corcoran Allison Mohr

Purchase Details

Closed on

Oct 2, 2002

Sold by

Mohr Karin

Bought by

Mohr Karin and Karin Mohr Revocable Inter Viv

Purchase Details

Closed on

Feb 5, 1999

Sold by

Mohr Karin

Bought by

Mohr Karin and Karin Mohr Revocable Inter Viv

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$203,600

Interest Rate

6.79%

Purchase Details

Closed on

Dec 3, 1993

Sold by

Mohr Karin Marcia

Bought by

Mohr Karin and Karin Mohr Revocable Inter Viv

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Adams James M | $900,000 | Chicago Title Company | |

| Corcoran Allison Mohr | -- | None Available | |

| Mohr Karin | -- | Fidelity National Title Co | |

| Mohr Karin | -- | Fidelity National Title Co | |

| Mohr Karin | -- | Fidelity National Title Co | |

| Mohr Karin | -- | Northwestern Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Adams James M | $720,000 | |

| Previous Owner | Mohr Karin | $203,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,412 | $1,074,628 | $324,488 | $757,140 |

| 2024 | $12,412 | $1,053,424 | $318,127 | $742,297 |

| 2023 | $12,269 | $1,039,634 | $311,890 | $727,744 |

| 2022 | $11,621 | $1,012,250 | $305,775 | $713,475 |

| 2021 | $11,322 | $992,270 | $299,781 | $699,489 |

| 2020 | $11,177 | $989,027 | $296,708 | $692,319 |

| 2019 | $11,313 | $969,641 | $290,892 | $678,749 |

| 2018 | $11,083 | $950,633 | $285,190 | $665,443 |

| 2017 | $10,798 | $931,994 | $279,598 | $652,396 |

| 2016 | $9,970 | $913,724 | $274,117 | $639,607 |

| 2015 | $4,907 | $451,580 | $266,968 | $184,612 |

| 2014 | $4,993 | $442,735 | $261,739 | $180,996 |

Source: Public Records

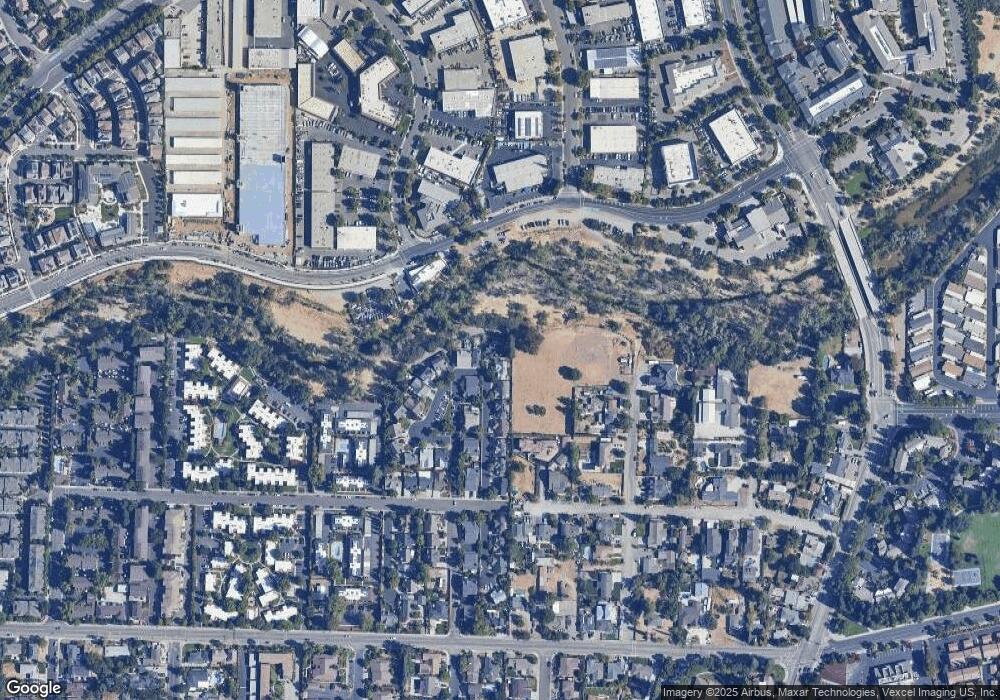

Map

Nearby Homes

- 215 Mavis Dr

- 373 Linden Way

- 3845 Vineyard Ave Unit F

- 3841 Vineyard Ave Unit 18

- 3839 Vineyard Ave Unit F

- 262 Birch Creek Dr

- 3937 Vine St

- 236 Birch Creek Terrace Unit 14

- 543 Tawny Dr

- 601 Palomino Dr Unit C

- 665 Palomino Dr Unit D

- 3375 Norton Way Unit 5

- 3399 Norton Way Unit 6

- 3263 Vineyard Ave Unit 44

- 3263 Vineyard Ave Unit 68

- 3263 Vineyard Ave Unit 174

- 3263 Vineyard Ave Unit 125

- 3263 Vineyard Ave Unit 132

- 3263 Vineyard Ave

- 3263 Vineyard Ave Unit 89

- 219 Mavis Dr

- 121 Wild Flower Ln

- 211 Mavis Dr

- 133 Wild Flower Ln

- 226 Mavis Dr

- 222 Mavis Dr

- 101 Sylvia Cir

- 145 Wild Flower Ln

- 238 Mavis Dr

- 109 Sylvia Cir

- 234 Mavis Dr

- 157 Wild Flower Ln

- 117 Sylvia Cir

- 3751 Mavis Dr

- 125 Sylvia Cir

- 169 Wild Flower Ln

- 246 Mavis Dr

- 242 Mavis Dr

- 327 Linden Way

- 133 Sylvia Cir