Estimated Value: $314,000 - $338,000

3

Beds

2

Baths

1,896

Sq Ft

$174/Sq Ft

Est. Value

About This Home

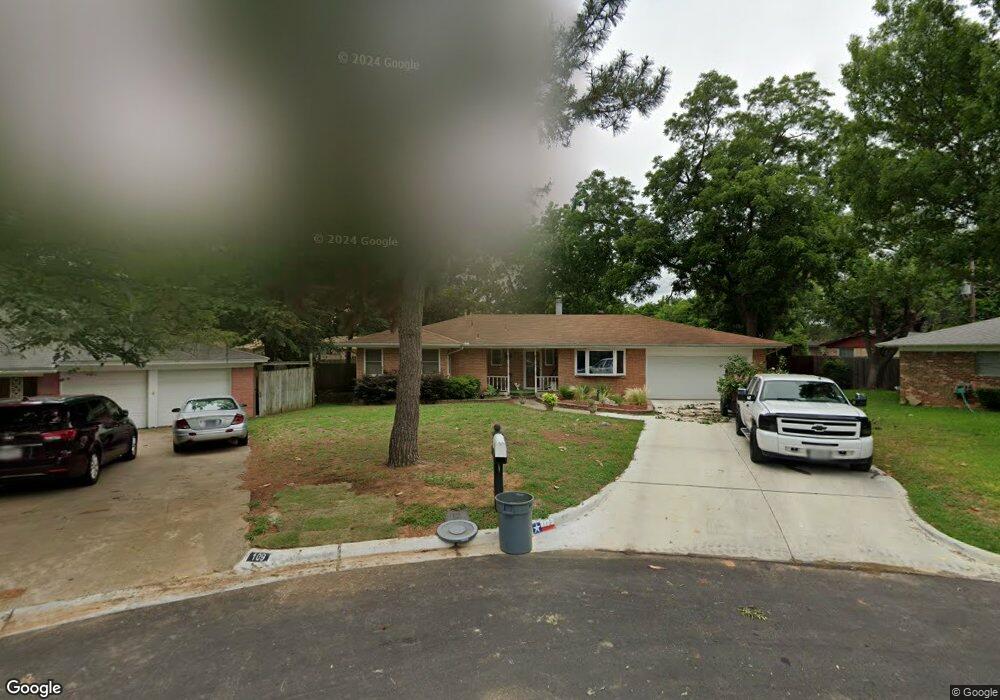

This home is located at 113 Crosstimber Ct, Hurst, TX 76053 and is currently estimated at $330,761, approximately $174 per square foot. 113 Crosstimber Ct is a home located in Tarrant County with nearby schools including West Hurst Elementary School, Hurst J High School, and L.D. Bell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 14, 2003

Sold by

Clark K G and Clark Grace S

Bought by

Lefler Troy and Zeringue Sheryl

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,400

Outstanding Balance

$47,982

Interest Rate

5.79%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$282,779

Purchase Details

Closed on

Aug 30, 1995

Sold by

Hubbell Bobby Wayne and Hubbell Emily Jane

Bought by

Clark K G and Clark Grace S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,640

Interest Rate

8.5%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lefler Troy | -- | Commonwealth Land Title | |

| Clark K G | -- | Commonwealth Land Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lefler Troy | $110,400 | |

| Previous Owner | Clark K G | $90,640 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,654 | $332,181 | $60,000 | $272,181 |

| 2024 | $4,654 | $332,181 | $60,000 | $272,181 |

| 2023 | $5,588 | $314,081 | $30,000 | $284,081 |

| 2022 | $5,838 | $287,060 | $30,000 | $257,060 |

| 2021 | $5,560 | $257,868 | $30,000 | $227,868 |

| 2020 | $5,042 | $209,566 | $30,000 | $179,566 |

| 2019 | $4,956 | $219,739 | $30,000 | $189,739 |

| 2018 | $3,910 | $184,077 | $18,000 | $166,077 |

| 2017 | $4,235 | $198,414 | $18,000 | $180,414 |

| 2016 | $3,850 | $176,149 | $18,000 | $158,149 |

| 2015 | $3,184 | $138,300 | $18,000 | $120,300 |

| 2014 | $3,184 | $138,300 | $18,000 | $120,300 |

Source: Public Records

Map

Nearby Homes

- 408 Simmons Dr

- 425 Ridgecrest Dr

- 637 Post Oak Dr

- 520 W Redbud Dr

- 741 Ponderosa Dr

- 744 Briarwood Ln

- 756 Briarwood Ln

- 758 Briarwood Ln

- 808 Betty Ct

- 628 Elm St

- 516 Hurstview Dr

- 612 Elm St

- 425 Moore Creek Rd

- 125 Souder Dr

- 708 Hurstview Dr

- 120 Charlene Dr

- 231 Elm St

- 205 Corinna Ct

- 405 Billy Creek Cir

- 120 Donald Dr

- 117 Crosstimber Ct

- 109 Crosstimber Ct

- 616 Cullum Ave

- 620 Cullum Ave

- 324 Ridgecrest Dr

- 320 Ridgecrest Dr

- 612 Cullum Ave

- 400 Ridgecrest Dr

- 105 Crosstimber Ct

- 112 Crosstimber Ct

- 316 Ridgecrest Dr

- 404 Ridgecrest Dr

- 608 Cullum Ave

- 108 Crosstimber Ct

- 325 Crosstimber Dr

- 104 Crosstimber Ct

- 408 Ridgecrest Dr

- 621 Cullum Ave

- 321 Crosstimber Dr

- 321 Ridgecrest Dr