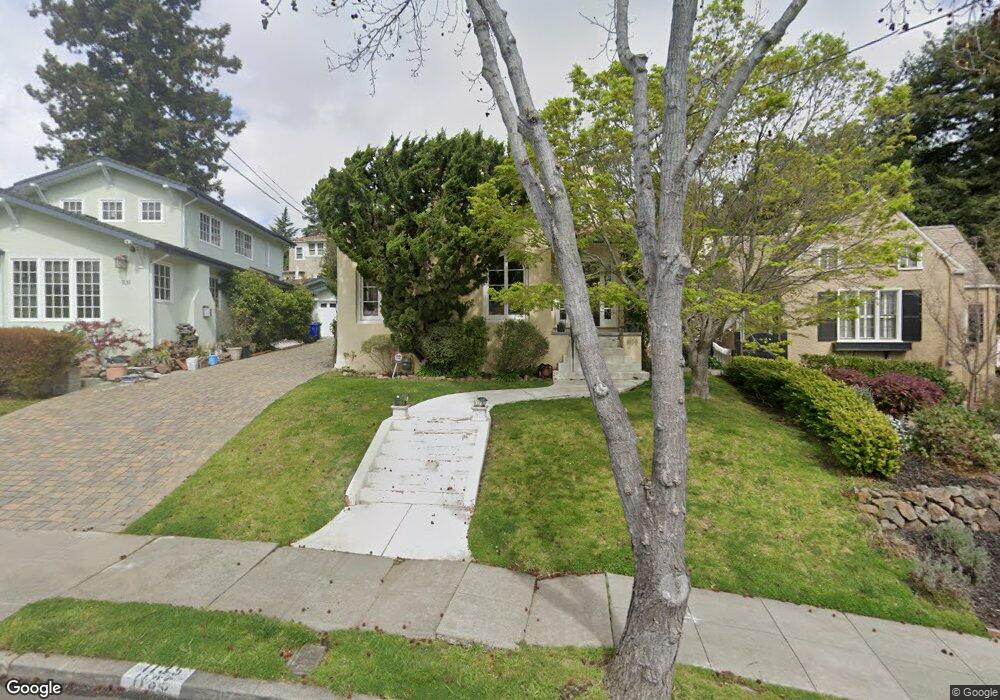

1135 Harvard Rd Piedmont, CA 94610

Central Piedmont NeighborhoodEstimated Value: $1,149,000 - $1,608,497

2

Beds

2

Baths

2,070

Sq Ft

$713/Sq Ft

Est. Value

About This Home

This home is located at 1135 Harvard Rd, Piedmont, CA 94610 and is currently estimated at $1,475,624, approximately $712 per square foot. 1135 Harvard Rd is a home located in Alameda County with nearby schools including Piedmont Middle School, Piedmont High School, and St. Leo the Great School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 17, 2025

Sold by

Jinich Samuel

Bought by

Jinich Elizabeth Murphy

Current Estimated Value

Purchase Details

Closed on

Mar 4, 2003

Sold by

Jinich Horcaio and Jinich Sonia

Bought by

Jinich Samuel and Jinich Elizabeth Murphy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$317,000

Interest Rate

5.83%

Purchase Details

Closed on

Jun 25, 1998

Sold by

Lim Dion M and Lin Amy J

Bought by

Jinich Samuel and Jinich Elizabeth Murphy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$227,150

Interest Rate

7.06%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jinich Elizabeth Murphy | -- | None Listed On Document | |

| Jinich Samuel | $89,000 | Placer Title Company | |

| Jinich Samuel | $345,000 | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jinich Samuel | $317,000 | |

| Previous Owner | Jinich Samuel | $227,150 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,523 | $709,326 | $162,248 | $554,078 |

| 2024 | $13,523 | $695,284 | $159,068 | $543,216 |

| 2023 | $13,303 | $688,516 | $155,949 | $532,567 |

| 2022 | $12,942 | $668,018 | $152,892 | $522,126 |

| 2021 | $12,420 | $654,784 | $149,894 | $511,890 |

| 2020 | $12,348 | $654,999 | $148,357 | $506,642 |

| 2019 | $11,986 | $642,159 | $145,449 | $496,710 |

| 2018 | $11,599 | $629,571 | $142,598 | $486,973 |

| 2017 | $11,566 | $617,229 | $139,802 | $477,427 |

| 2016 | $10,790 | $605,128 | $137,061 | $468,067 |

| 2015 | $10,757 | $596,041 | $135,003 | $461,038 |

| 2014 | $10,632 | $584,366 | $132,358 | $452,008 |

Source: Public Records

Map

Nearby Homes

- 1074 Annerley Rd

- 240 Wildwood Ave

- 1140 Winsor Ave

- 707 Arimo Ave

- 3925 Balfour Ave

- 25 Crocker Ave

- 801 Mandana Blvd

- 725 Carlston Ave

- 33 Richardson Way

- 44 Farragut Ave

- 61 Wildwood Ave

- 0 Fair Ave Unit 41113850

- 542 Midcrest Rd

- 907 York St

- 2026 Oakland Ave

- 62 Farragut Ave

- 2058 Oakland Ave

- 654 Mandana Blvd Unit 654

- 1131 Harvard Rd

- 1139 Harvard Rd

- 1129 Harvard Rd

- 78 Oakmont Ave

- 76 Oakmont Ave

- 80 Oakmont Ave

- 1143 Harvard Rd

- 72 Oakmont Ave

- 82 Oakmont Ave

- 1121 Harvard Rd

- 68 Oakmont Ave

- 1147 Harvard Rd

- 66 Oakmont Ave

- 1126 Harvard Rd

- 88 Oakmont Ave

- 84 Oakmont Ave

- 1130 Harvard Rd

- 1115 Harvard Rd

- 90 Oakmont Ave

- 1151 Harvard Rd