1175 Justin Ln Kalispell, MT 59901

Estimated Value: $827,000 - $1,129,000

4

Beds

3

Baths

2,462

Sq Ft

$386/Sq Ft

Est. Value

About This Home

This home is located at 1175 Justin Ln, Kalispell, MT 59901 and is currently estimated at $950,417, approximately $386 per square foot. 1175 Justin Ln is a home located in Flathead County with nearby schools including Helena Flats Elementary School, Helena Flats Junior High School, and Glacier High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 27, 2008

Sold by

Wiley Brian and Wiley Mikki

Bought by

Parson Christopher A and Parson Stephanie E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$404,000

Outstanding Balance

$268,459

Interest Rate

6.5%

Mortgage Type

VA

Estimated Equity

$681,958

Purchase Details

Closed on

Mar 6, 2007

Sold by

Wiley Brian

Bought by

Wiley Brian and Wiley Mikki

Purchase Details

Closed on

Oct 14, 2005

Sold by

Omyer Shane

Bought by

Wiley Brian and Wiley Mikki

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$366,000

Interest Rate

5.68%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Parson Christopher A | -- | First American Title Company | |

| Wiley Brian | -- | Flathead County Title Compan | |

| Wiley Brian | -- | Citizens Title & Escrow Co I |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Parson Christopher A | $404,000 | |

| Previous Owner | Wiley Brian | $366,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,609 | $920,500 | $0 | $0 |

| 2024 | $4,435 | $685,100 | $0 | $0 |

| 2023 | $4,421 | $685,100 | $0 | $0 |

| 2022 | $4,125 | $511,500 | $0 | $0 |

| 2021 | $4,491 | $511,500 | $0 | $0 |

| 2020 | $3,989 | $444,000 | $0 | $0 |

| 2019 | $3,942 | $444,000 | $0 | $0 |

| 2018 | $4,184 | $445,100 | $0 | $0 |

| 2017 | $3,773 | $445,100 | $0 | $0 |

| 2016 | $3,372 | $387,100 | $0 | $0 |

| 2015 | $3,538 | $387,100 | $0 | $0 |

| 2014 | $3,397 | $225,939 | $0 | $0 |

Source: Public Records

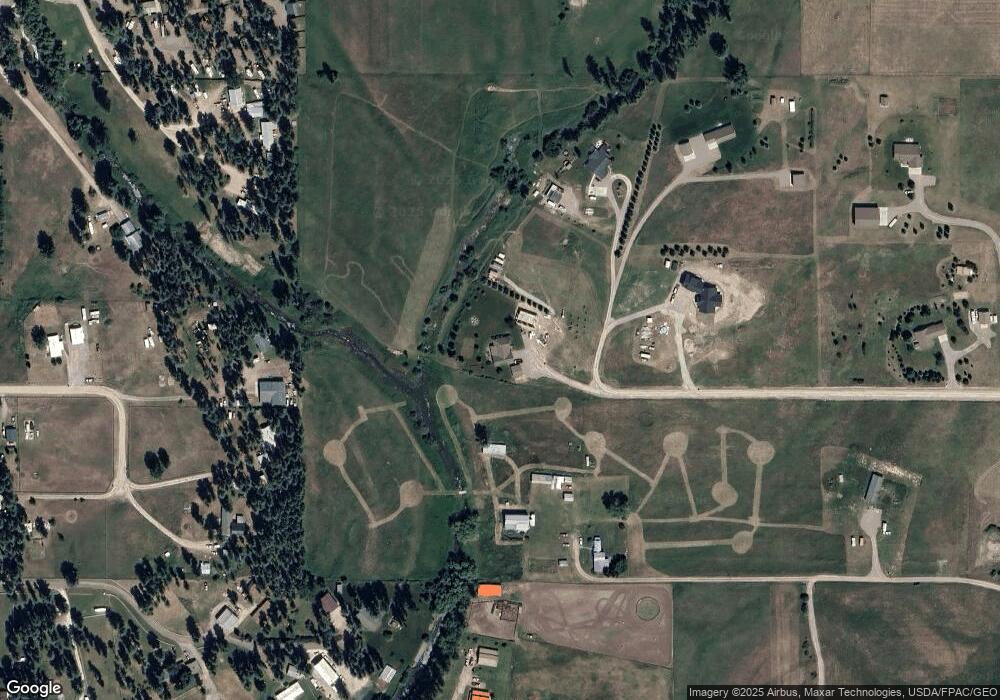

Map

Nearby Homes

- 791 Springwood Ln

- 701 Addison Square

- 457 Addison Square

- 580 Ezy Dr

- 654 Pebble Dr

- 1139 Aspen Ln

- 111 Freedom Way Unit BARNDOMINIUM

- 112 Freedom Way

- 650 Capistrano Dr Unit Parcel 4

- 650 Capistrano Dr Unit Parcels 1,2,3,4

- 650 Capistrano Dr Unit Parcel 3

- 650 Capistrano Dr Unit Parcel 2

- 650 Capistrano Dr Unit Parcel 1

- NHN Thompson Ln

- 1056 Clark Fork Dr

- 139 Shadow Mountain Trail

- 132 Shadow Mountain Trail

- 196 Shadow Mountain Trail

- 164 Shadow Mountain Trail

- 696 Mountain View Dr

- Nhn Justin Ln

- 1187 Justin Ln

- 120 N Springwood Rd

- 130 N Springwood Rd

- 1145 Justin Ln

- 803 Springwood Ln

- 1115 Justin Ln

- 827 Helena Flats Rd

- 803 Gazebo Ln

- 819 Helena Flats Rd

- 1075 Justin Ln

- 110 N Springwood Rd

- 1057 Justin Ln

- 0 Justin Ln

- 111 N Springwood Rd

- 121 N Springwood Rd

- 134 Helena Flats Trail

- 825 Helena Flats Rd

- 1035 Justin Ln

- 1099 Barn Owl Dr