Estimated Value: $272,666 - $300,000

2

Beds

1

Bath

936

Sq Ft

$307/Sq Ft

Est. Value

About This Home

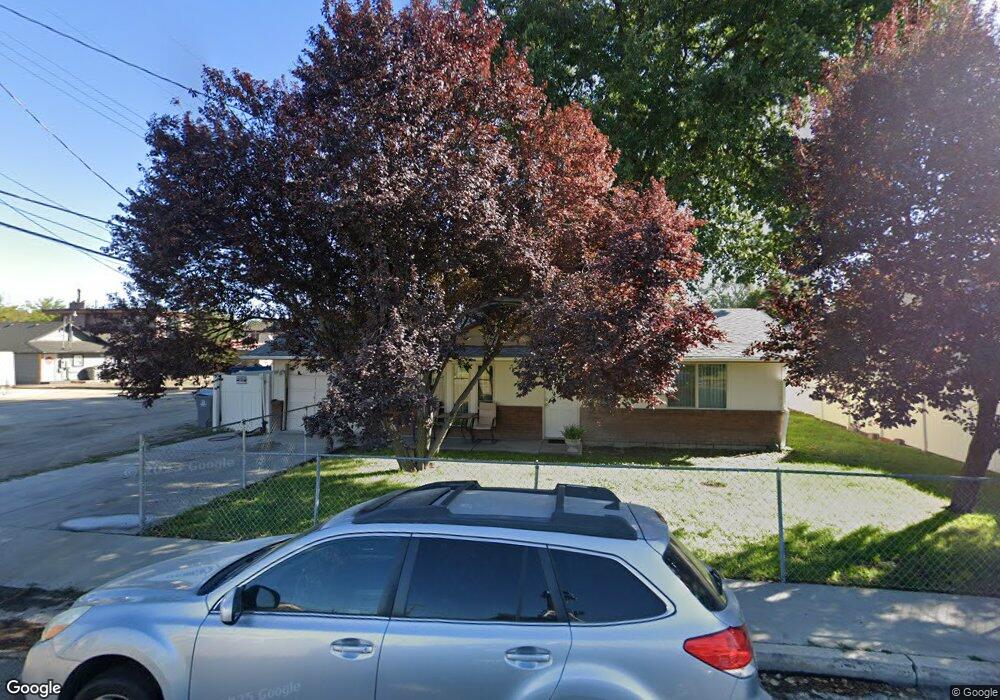

This home is located at 1216 10th St S, Nampa, ID 83651 and is currently estimated at $287,667, approximately $307 per square foot. 1216 10th St S is a home located in Canyon County with nearby schools including Central Elementary School, West Middle School, and Nampa Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 27, 2010

Sold by

Jones Sue Ellen

Bought by

Jones Sue Ellen

Current Estimated Value

Purchase Details

Closed on

Nov 5, 2009

Sold by

Jones Sue Ellen

Bought by

Puntenney Lloyd R

Purchase Details

Closed on

Feb 1, 2008

Sold by

Entrust Of Idaho

Bought by

Puntenney Lloyd R and Puntenney Verna E

Purchase Details

Closed on

Oct 23, 2007

Sold by

Molina Freddie and Massey Valerie

Bought by

Entrust Of Idaho and Richard W Budge Ira

Purchase Details

Closed on

Apr 10, 2006

Sold by

Alicea Jason T and Alicea Angela

Bought by

Molina Freddie and Massey Valerie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$21,850

Interest Rate

5.84%

Mortgage Type

Stand Alone Second

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jones Sue Ellen | -- | Pioneer Caldwell | |

| Puntenney Lloyd R | -- | None Available | |

| Puntenney Lloyd R | -- | Stewart Title Nampa | |

| Entrust Of Idaho | -- | Pioneer Title Company | |

| Molina Freddie | -- | Title One |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Molina Freddie | $21,850 | |

| Previous Owner | Molina Freddie | $87,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,712 | $256,500 | $96,400 | $160,100 |

| 2024 | $1,712 | $239,300 | $85,700 | $153,600 |

| 2023 | $1,764 | $234,100 | $85,700 | $148,400 |

| 2022 | $1,806 | $244,600 | $96,400 | $148,200 |

| 2021 | $2,197 | $186,500 | $53,500 | $133,000 |

| 2020 | $1,972 | $152,300 | $43,000 | $109,300 |

| 2019 | $2,216 | $138,100 | $40,200 | $97,900 |

| 2018 | $2,094 | $0 | $0 | $0 |

| 2017 | $1,938 | $0 | $0 | $0 |

| 2016 | $1,756 | $0 | $0 | $0 |

| 2015 | $1,502 | $0 | $0 | $0 |

| 2014 | $1,396 | $71,600 | $14,000 | $57,600 |

Source: Public Records

Map

Nearby Homes

- 1111 13th Ave S

- 1107 15th Ave S

- 1011 9th St S

- 1024 10th Ave S

- 1119 10th Ave S

- 911 7th St S

- 923 13th St S

- 219 S Locust St

- 1410 10th Ave S

- 218 W Roosevelt Ave

- 615 18th Ave S

- 219 Meffan Ave

- 212 Shoshone Ave

- 223 S Elder St

- 803 4th St S

- 219 16th Ave S

- 247 Elmore Ave

- 512 19th Ave S

- TBD Maple St

- 511 20th Ave S

- 919 13th Ave S

- 923 13th Ave S

- 915 13th Ave S

- 920 12th Ave S

- 1003 13th Ave S

- 924 12th Ave S

- 911 13th Ave S

- 1203 10th St S Unit Lots 2 & 4 Block 45

- 1007 13th Ave S

- 907 13th Ave S

- 912 12th Ave S

- 1215 9th St S

- 903 13th Ave S

- 924 13th Ave S

- 1011 13th Ave S

- 920 13th Ave S

- 916 13th Ave S

- 1004 13th Ave S

- 912 13th Ave S

- 1008 13th Ave S