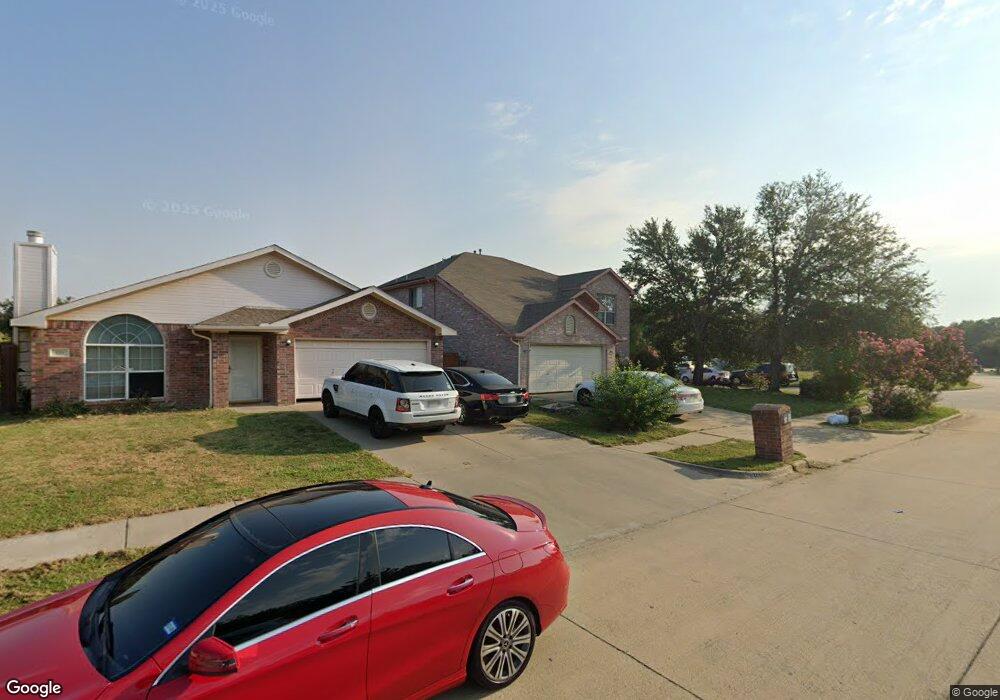

124 Enchanted Ct Grand Prairie, TX 75050

Estimated Value: $373,000 - $466,000

4

Beds

4

Baths

2,584

Sq Ft

$159/Sq Ft

Est. Value

About This Home

This home is located at 124 Enchanted Ct, Grand Prairie, TX 75050 and is currently estimated at $412,053, approximately $159 per square foot. 124 Enchanted Ct is a home located in Dallas County with nearby schools including John & Margie Stipes Elementary School, Lady Bird Johnson Middle School, and Nimitz High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 18, 2007

Sold by

Mac/Crescent #1 Llc

Bought by

Rahman Syed M and Rahman Najima

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$177,596

Outstanding Balance

$112,178

Interest Rate

6.26%

Mortgage Type

FHA

Estimated Equity

$299,875

Purchase Details

Closed on

Dec 4, 2007

Sold by

The Bank Of New York Trust Co Na

Bought by

Mac/Crescent #1 Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$177,596

Outstanding Balance

$112,178

Interest Rate

6.26%

Mortgage Type

FHA

Estimated Equity

$299,875

Purchase Details

Closed on

Jun 5, 2007

Sold by

Ngo Mai

Bought by

The Bank Of New York Trust Co Na and Jpmorgan Chase Bank

Purchase Details

Closed on

Jan 9, 2004

Sold by

Key Life Homes Inc

Bought by

Ngo Mai

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$187,650

Interest Rate

6.99%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rahman Syed M | -- | None Available | |

| Mac/Crescent #1 Llc | -- | None Available | |

| The Bank Of New York Trust Co Na | $196,249 | None Available | |

| Ngo Mai | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rahman Syed M | $177,596 | |

| Previous Owner | Ngo Mai | $187,650 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,058 | $398,190 | $66,000 | $332,190 |

| 2024 | $2,058 | $376,630 | $60,500 | $316,130 |

| 2023 | $2,058 | $376,630 | $60,500 | $316,130 |

| 2022 | $7,273 | $305,950 | $55,000 | $250,950 |

| 2021 | $7,616 | $305,950 | $55,000 | $250,950 |

| 2020 | $7,067 | $273,410 | $44,000 | $229,410 |

| 2019 | $6,927 | $253,970 | $38,500 | $215,470 |

| 2018 | $7,005 | $253,970 | $38,500 | $215,470 |

| 2017 | $6,566 | $237,060 | $33,000 | $204,060 |

| 2016 | $4,532 | $163,630 | $33,000 | $130,630 |

| 2015 | $4,065 | $163,630 | $33,000 | $130,630 |

| 2014 | $4,065 | $163,630 | $33,000 | $130,630 |

Source: Public Records

Map

Nearby Homes

- 406 Wright Blvd

- 3329 Shivers Dr

- 3327 Shivers Dr

- 3325 Shivers Dr

- 120 Homes Dr

- 3323 Shivers Dr

- 3321 Shivers Dr

- 3319 Shivers Dr

- 124 Homes Dr

- 3317 Shivers Dr

- 126 Homes Dr

- 3311 Shivers Dr

- 3307 Shivers Dr

- 3305 Shivers Dr

- 3303 Shivers Dr

- 3301 Shivers Dr

- 3309 Shivers Dr

- 506 Piccadilly Unit 166

- 3437 Sanjeev Dr

- 1119 Carrington Ct

- 120 Enchanted Ct

- 123 Lida Ct

- 116 Enchanted Ct

- 119 Lida Ct

- 3320 Autumn View Dr

- 3324 Autumn View Dr

- 115 Lida Ct

- 3328 Autumn View Dr

- 123 Enchanted Ct

- 203 Enchanted Ct

- 112 Enchanted Ct

- 111 Lida Ct

- 3332 Autumn View Dr

- 207 Enchanted Ct

- 212 Enchanted Ct

- 115 Enchanted Ct

- 119 Enchanted Ct

- 211 Enchanted Ct

- 3336 Autumn View Dr

- 124 Lida Ct