13020 Trails End Austin, TX 78737

Estimated Value: $814,000 - $1,035,000

--

Bed

--

Bath

2,584

Sq Ft

$350/Sq Ft

Est. Value

About This Home

This home is located at 13020 Trails End, Austin, TX 78737 and is currently estimated at $904,562, approximately $350 per square foot. 13020 Trails End is a home located in Hays County with nearby schools including Dripping Springs Middle School and Dripping Springs High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 11, 2024

Sold by

Clevenger Robert W and Clevenger Donna

Bought by

Clevenger Revocable Trust and Clevenger

Current Estimated Value

Purchase Details

Closed on

Mar 18, 2019

Sold by

Betts Christopher A and Betts Cathy A

Bought by

Clevenger Robert W and Clevenger Donna

Purchase Details

Closed on

Mar 7, 2005

Sold by

Monforte David J and Monforte Cathleen M

Bought by

Betts Christopher A and Betts Cathy A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,405

Interest Rate

5.62%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 26, 1996

Sold by

Concan Realty Co

Bought by

Betts Christopher and Betts Cathy

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Clevenger Revocable Trust | -- | None Listed On Document | |

| Clevenger Robert W | -- | None Available | |

| Betts Christopher A | -- | Gracy Title Co | |

| Betts Christopher | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Betts Christopher A | $85,405 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,291 | $658,714 | -- | -- |

| 2024 | $5,291 | $598,831 | $516,910 | $426,800 |

| 2023 | $8,220 | $544,392 | $516,910 | $585,800 |

| 2022 | $8,441 | $494,902 | $116,430 | $587,470 |

| 2021 | $8,417 | $449,911 | $116,430 | $351,480 |

| 2020 | $6,975 | $409,010 | $77,620 | $331,390 |

| 2019 | $7,949 | $385,480 | $64,120 | $321,360 |

| 2018 | $7,612 | $367,060 | $64,120 | $302,940 |

| 2017 | $7,495 | $358,700 | $64,120 | $294,580 |

| 2016 | $7,110 | $340,280 | $64,120 | $276,160 |

| 2015 | $6,575 | $341,240 | $80,150 | $261,090 |

Source: Public Records

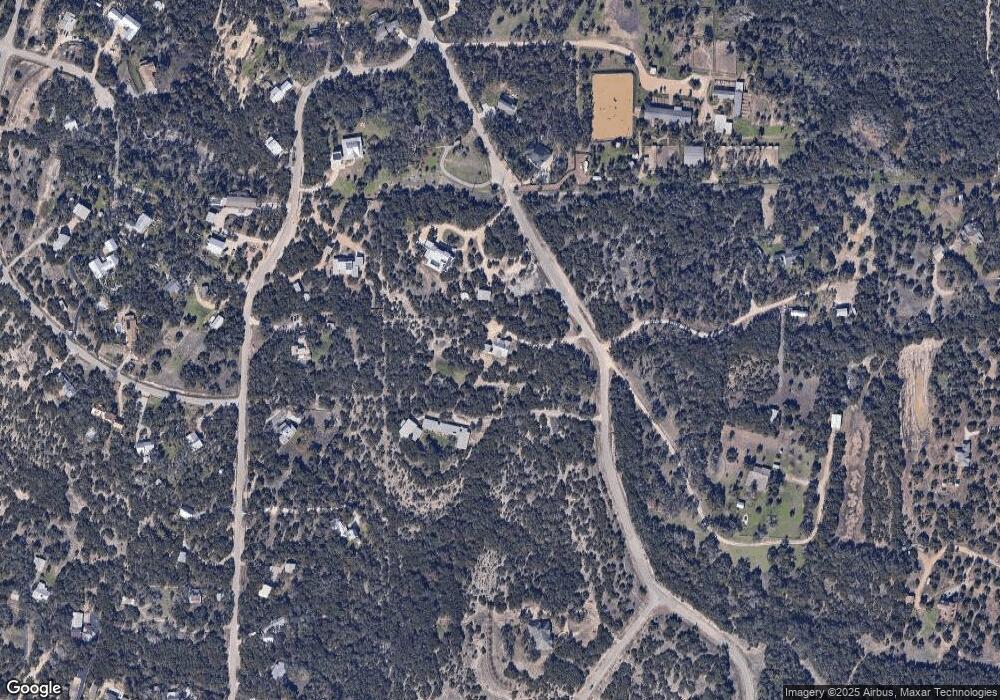

Map

Nearby Homes

- 12904 Wells Fargo St

- 400 Sundown Ridge

- 12600 Trail Driver St

- 13590 Paisano Trail

- 12621 Fitzhugh Rd

- 13601 Paisano Trail

- 13400 Paisano Trail

- 5 Midnight Sky Dr

- 4 Midnight Sky Dr

- 16 Tall Oaks Trail

- 190 Carol Ann Dr

- 13601 Paisano Cir

- 156 Sea Hero Place

- 301 Sea Hero Place

- 12609 Pauls Valley Rd

- 13005 D Fitzhugh Rd

- 14610 Fitzhugh Rd

- 12605 Fitzhugh Rd

- 11809 Oak Branch Dr

- TBD Fitzhugh Rd

- 13100 Trails End

- 13000 Trails End

- 13000 Trail End

- 13061 Trail Driver St

- 13001 Trail Driver St

- 13140 Trails End

- 13101 Trail Driver St

- 13111 Trail Driver St

- 12901 Trail Driver St

- 12909 Trails End

- 12961 Trail Driver

- 000 Trail Driver St

- 13400 Trail Driver

- 420 Sundown Ridge

- 13115 Trail Driver

- 13000 Trail Driver St

- 12999 Trails End

- 12922 Trail Driver St

- 13100 Trail Driver St

- 12975 Trails End