1393 Horseshoe Bend High Ridge, MO 63049

Estimated Value: $212,427 - $240,000

--

Bed

--

Bath

982

Sq Ft

$234/Sq Ft

Est. Value

About This Home

This home is located at 1393 Horseshoe Bend, High Ridge, MO 63049 and is currently estimated at $229,857, approximately $234 per square foot. 1393 Horseshoe Bend is a home located in Jefferson County with nearby schools including Northwest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 19, 2018

Sold by

Christophel Christopher and Christophel Sherri M

Bought by

Christophel Christopher and Christophel Sherri M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,731

Outstanding Balance

$110,737

Interest Rate

4.4%

Mortgage Type

FHA

Estimated Equity

$119,120

Purchase Details

Closed on

Nov 25, 2003

Sold by

Caughron Sherri Marie

Bought by

Christophel Christopher and Christophel Sherri Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$105,600

Interest Rate

5.94%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 17, 2001

Sold by

Caughron Edward Lee

Bought by

Caughron Sherri Marie

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Christophel Christopher | -- | None Available | |

| Christophel Christopher | -- | Capital Title | |

| Caughron Sherri Marie | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Christophel Christopher | $129,731 | |

| Closed | Christophel Christopher | $105,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,661 | $24,800 | $4,800 | $20,000 |

| 2024 | $1,661 | $23,000 | $4,800 | $18,200 |

| 2023 | $1,661 | $23,000 | $4,800 | $18,200 |

| 2022 | $1,643 | $23,000 | $4,800 | $18,200 |

| 2021 | $1,643 | $23,000 | $4,800 | $18,200 |

| 2020 | $1,500 | $20,500 | $4,200 | $16,300 |

| 2019 | $1,498 | $20,500 | $4,200 | $16,300 |

| 2018 | $1,518 | $20,500 | $4,200 | $16,300 |

| 2017 | $1,387 | $20,500 | $4,200 | $16,300 |

| 2016 | $1,290 | $18,900 | $4,000 | $14,900 |

| 2015 | $1,326 | $18,900 | $4,000 | $14,900 |

| 2013 | -- | $19,100 | $4,000 | $15,100 |

Source: Public Records

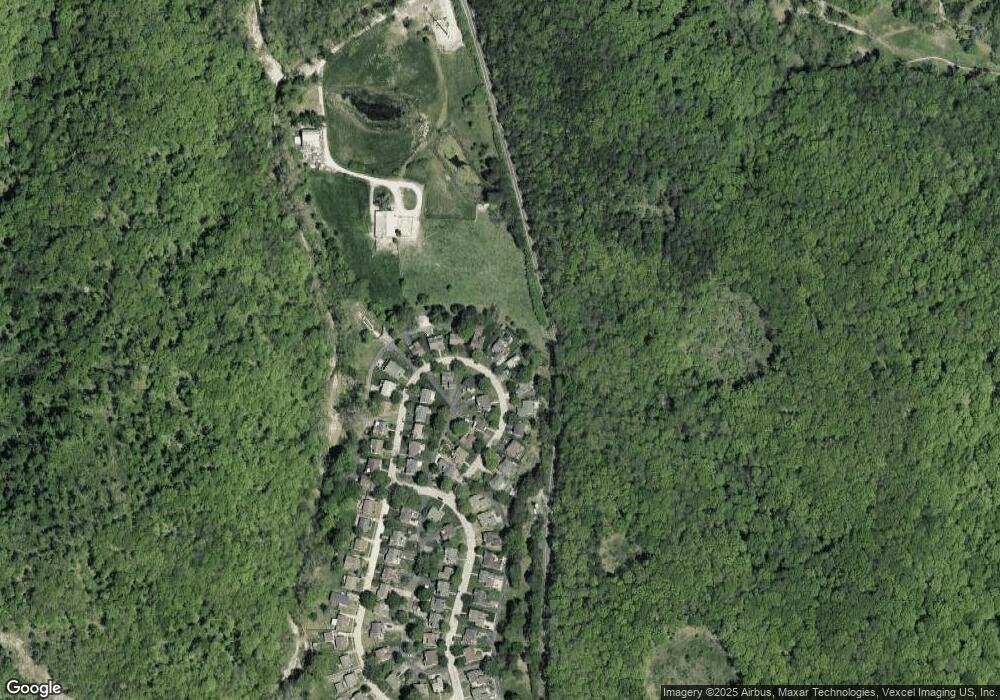

Map

Nearby Homes

- 1516 Redbriar Dr

- 907 Palomino Path

- 2300 Appaloosa Trail

- 709 Heatherstone Dr

- 2135 Linnus Dr

- 2149 Linnus Dr

- 60 the Bluffs Dr Unit 60

- 59 the Bluffs Dr Unit 59

- 54 the Bluffs Dr Unit 54

- 0 3 Lot Blk 2 High Ridge Manor Unit MAR24044893

- 2460 Huntress Hill Ln

- 2132 Ridgedale Dr

- 5012 Oak Bluff Dr

- 1524 Shalimar Ridge Ln

- 2436 Hillsboro Valley Park Rd

- 152 Brandy Mill Cir Unit 9G

- 168 Brandy Mill Cir Unit 5B

- 0 Mikel Ln

- 2715 Royal Oak Dr

- 1201 Diamond Valley Dr

- 1397 Horseshoe Bend

- 1389 Horseshoe Bend

- 1401 Horseshoe Bend

- 1394 Horseshoe Bend

- 1385 Horseshoe Bend

- 1384 Horseshoe Bend

- 1404 Horseshoe Bend

- 1405 Horseshoe Bend

- 1381 Horseshoe Bend

- 1376 Horseshoe Bend

- 1409 Horseshoe Bend

- 1414 Horseshoe Bend

- 1377 Horseshoe Bend

- 1370 Horseshoe Bend

- 1420 Horseshoe Bend

- 1413 Horseshoe Bend

- 1373 Horseshoe Bend

- 1366 Horseshoe Bend

- 1424 Horseshoe Bend

- 1417 Horseshoe Bend