14102 Wetmore Trail San Antonio, TX 78247

Thousand Oaks NeighborhoodEstimated Value: $264,000 - $306,000

3

Beds

3

Baths

2,050

Sq Ft

$142/Sq Ft

Est. Value

About This Home

This home is located at 14102 Wetmore Trail, San Antonio, TX 78247 and is currently estimated at $291,188, approximately $142 per square foot. 14102 Wetmore Trail is a home located in Bexar County with nearby schools including Stahl Elementary School, Driscoll Middle School, and Madison High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 3, 2005

Sold by

Hud

Bought by

Halle Kristin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$15,000

Outstanding Balance

$7,824

Interest Rate

5.55%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$283,364

Purchase Details

Closed on

Dec 7, 2004

Sold by

Washington Mutual Bank Fa

Bought by

Hud

Purchase Details

Closed on

Nov 17, 1997

Sold by

Calsouth Corp

Bought by

Ramos Juan F and Ramos Martha P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,735

Interest Rate

7.3%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Halle Kristin | -- | -- | |

| Hud | -- | -- | |

| Ramos Juan F | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Halle Kristin | $15,000 | |

| Previous Owner | Ramos Juan F | $92,735 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,784 | $310,310 | $71,640 | $238,670 |

| 2024 | $4,784 | $284,035 | $71,640 | $240,190 |

| 2023 | $4,784 | $258,214 | $71,640 | $218,910 |

| 2022 | $5,792 | $234,740 | $59,070 | $205,320 |

| 2021 | $5,452 | $213,400 | $49,500 | $178,140 |

| 2020 | $5,569 | $214,731 | $45,840 | $171,350 |

| 2019 | $5,199 | $195,210 | $26,240 | $168,970 |

| 2018 | $4,754 | $178,049 | $26,240 | $162,280 |

| 2017 | $4,362 | $161,863 | $26,240 | $158,520 |

| 2016 | $3,965 | $147,148 | $26,240 | $140,730 |

| 2015 | $3,143 | $133,771 | $22,450 | $141,230 |

| 2014 | $3,143 | $121,610 | $0 | $0 |

Source: Public Records

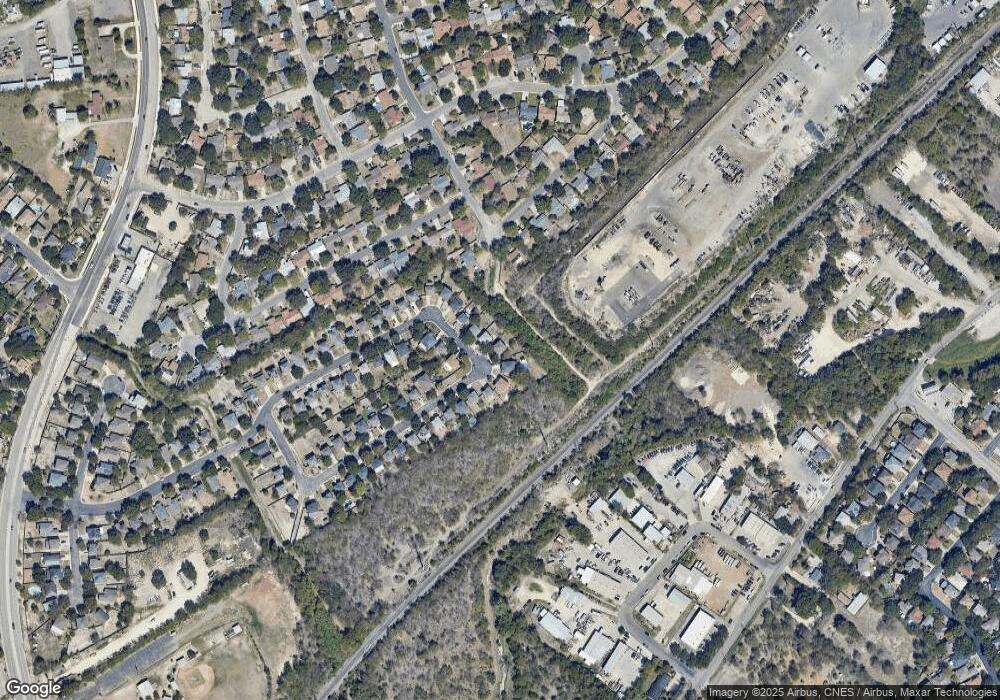

Map

Nearby Homes

- 3862 Briarhaven St

- 3818 Wetmore Ridge

- 3807 Wetmore Knoll

- 14423 Briarlake St

- Kendal Plan at Park Hill Commons

- Inverness Plan at Park Hill Commons

- Kingsbury Plan at Park Hill Commons

- Upton Plan at Park Hill Commons

- Quinley Plan at Park Hill Commons

- Pembrook Plan at Park Hill Commons

- Lanport Plan at Park Hill Commons

- Norwich Plan at Park Hill Commons

- Natalia Plan at Park Hill Commons

- Travis Plan at Park Hill Commons

- Montrose Plan at Park Hill Commons

- Martindale Plan at Park Hill Commons

- Redland Plan at Park Hill Commons

- Oxford Plan at Park Hill Commons

- 14227 Wetmore Bend

- 13802 Fairway Crest

- 14106 Wetmore Trail

- 3866 Wetmore Knoll

- 14110 Wetmore Trail

- 3862 Wetmore Knoll

- 14114 Wetmore Trail

- 3858 Wetmore Knoll

- 14107 Wetmore Trail

- 3854 Wetmore Knoll

- 14118 Wetmore Trail

- 14111 Wetmore Trail

- 3850 Wetmore Knoll

- 14115 Wetmore Trail

- 14122 Wetmore Trail

- 3902 Briarvalley St

- 3843 Wetmore Knoll

- 3846 Wetmore Knoll

- 14301 Briarlake St

- 3838 Wetmore Ridge

- 3855 Wetmore Ridge

- 3842 Wetmore Knoll