14133 Yorkshire Woods Dr Silver Spring, MD 20906

Estimated Value: $355,197 - $369,000

3

Beds

3

Baths

1,336

Sq Ft

$270/Sq Ft

Est. Value

About This Home

This home is located at 14133 Yorkshire Woods Dr, Silver Spring, MD 20906 and is currently estimated at $360,299, approximately $269 per square foot. 14133 Yorkshire Woods Dr is a home located in Montgomery County with nearby schools including Bel Pre Elementary School, Strathmore Elementary School, and Lawton Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 19, 2013

Sold by

Yoo Taek S and Yoo Jay

Bought by

Yoo Taek S

Current Estimated Value

Purchase Details

Closed on

Dec 14, 2012

Sold by

Kitzes Daniel S

Bought by

Baltimore Home Alliance Llc

Purchase Details

Closed on

Apr 20, 2006

Sold by

Ridgewood I Townhomes Llc

Bought by

Kitzes Daniel S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$283,920

Interest Rate

5.25%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 28, 2006

Sold by

Ridgewood I Townhomes Llc

Bought by

Kitzes Daniel S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$283,920

Interest Rate

5.25%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yoo Taek S | -- | First American Title Ins Co | |

| Baltimore Home Alliance Llc | $128,000 | -- | |

| Kitzes Daniel S | $354,900 | -- | |

| Kitzes Daniel S | $354,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kitzes Daniel S | $283,920 | |

| Previous Owner | Kitzes Daniel S | $283,920 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,188 | $290,000 | -- | -- |

| 2024 | $3,188 | $270,000 | $81,000 | $189,000 |

| 2023 | $0 | $263,333 | $0 | $0 |

| 2022 | $2,069 | $256,667 | $0 | $0 |

| 2021 | $0 | $250,000 | $75,000 | $175,000 |

| 2020 | $9,889 | $241,667 | $0 | $0 |

| 2019 | $2,636 | $233,333 | $0 | $0 |

| 2018 | $2,548 | $225,000 | $67,500 | $157,500 |

| 2017 | $2,460 | $213,333 | $0 | $0 |

| 2016 | -- | $201,667 | $0 | $0 |

| 2015 | $1,582 | $190,000 | $0 | $0 |

| 2014 | $1,582 | $190,000 | $0 | $0 |

Source: Public Records

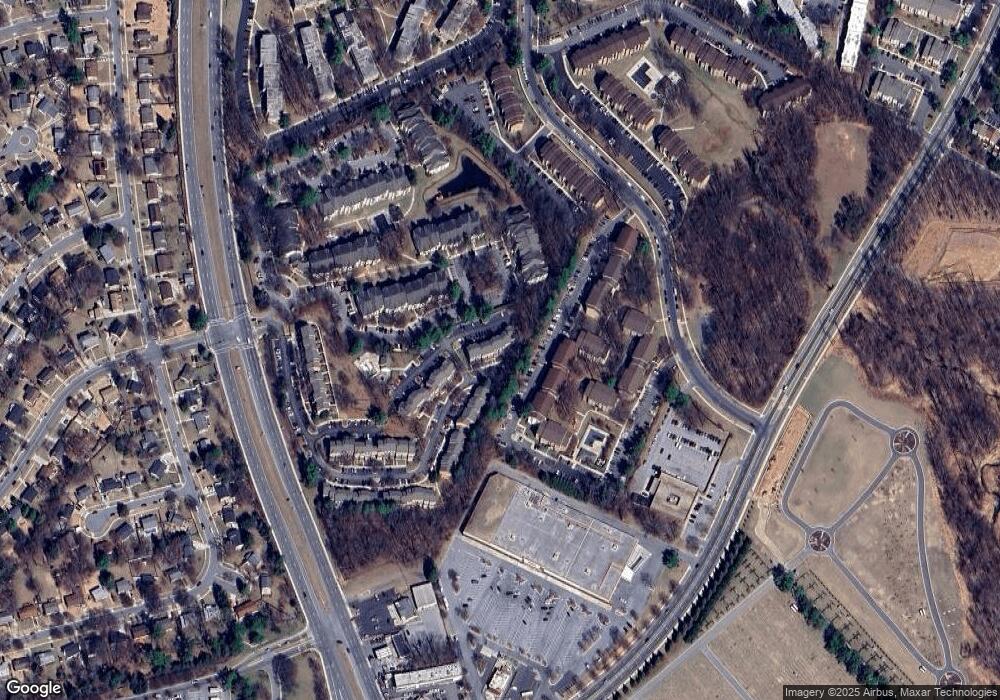

Map

Nearby Homes

- 3772 Bel Pre Rd Unit 10

- 3964 Bel Pre Rd Unit 8

- 3960 Bel Pre Rd Unit 4

- 3974 Bel Pre Rd Unit 6

- 3970 Bel Pre Rd Unit 4

- 3800 3800 Bel Pro Unit 5

- 3946 Bel Pre Rd Unit 4

- 3946 Bel Pre Rd Unit 6

- 4106 Southend Rd

- 3722 Bel Pre Rd Unit 12

- 3904 Bel Pre Rd Unit 6

- 3914 Bel Pre Rd Unit 4

- 3714 Capulet Terrace Unit 4

- 14613 Tynewick Terrace Unit 6-1461

- 3613 Edelmar Terrace

- 3638 Edelmar Terrace Unit 123-B

- 14603 Edelmar Dr Unit 132-A

- 14507 Elmhan Ct

- 3301 Hewitt Ave Unit 204

- 3912 Palmira Ln

- 14133 Yorkshire Woods Dr

- 14131 Yorkshire Woods Dr

- 3805 Chesterwood Dr

- 14137 Yorkshire Woods Dr

- 14129 Yorkshire Woods Dr

- 3811 Chesterwood Dr

- 14135 Yorkshire Woods Dr

- 3801 Chesterwood Dr

- 14127 Yorkshire Woods Dr

- 3813 Chesterwood Dr

- 14139 Yorkshire Woods Dr

- 14141 Yorkshire Woods Dr

- 14141 Yorkshire Woods Dr Unit 1

- 3803 Chesterwood Dr

- 3807 Chesterwood Dr Unit 1

- 3807 Chesterwood Dr

- 3809 Chesterwood Dr

- 14143 Yorkshire Woods Dr

- 3802 Chesterwood Dr

- 3804 Chesterwood Dr