1500 NW 193rd St Edmond, OK 73012

Deer Creek NeighborhoodEstimated Value: $391,712 - $423,000

4

Beds

3

Baths

2,900

Sq Ft

$141/Sq Ft

Est. Value

About This Home

This home is located at 1500 NW 193rd St, Edmond, OK 73012 and is currently estimated at $408,928, approximately $141 per square foot. 1500 NW 193rd St is a home located in Oklahoma County with nearby schools including Frontier Elementary, Heartland Middle School, and Santa Fe High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 25, 2006

Sold by

Case Win and Crowe Ronda

Bought by

Deaton Robert D and Deaton Danna

Current Estimated Value

Purchase Details

Closed on

Jun 17, 2005

Sold by

Case Win and Crowe Ronda

Bought by

Deaton Robert D and Deaton Danna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$177,500

Interest Rate

5.67%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jun 11, 2003

Sold by

Danforth Farms West Community Homeowners

Bought by

Hodges Harold L

Purchase Details

Closed on

Nov 8, 2002

Sold by

Case Win

Bought by

Case Win and Crowe Ronda M

Purchase Details

Closed on

Oct 28, 2002

Sold by

Smith Weldon E and Smith Toni L

Bought by

Case Win

Purchase Details

Closed on

Jun 26, 1998

Sold by

Brand Homes L C

Bought by

Smith Weldon E and Smith Toni L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Deaton Robert D | -- | Lawyers Title Of Ok City Inc | |

| Deaton Robert D | $205,000 | Lawyers Title Of Ok City Inc | |

| Hodges Harold L | -- | -- | |

| Case Win | -- | -- | |

| Kurtz Gary L | -- | -- | |

| Case Win | -- | American Guaranty Title Co | |

| Case Win | $185,000 | American Guaranty Title Co | |

| Smith Weldon E | $163,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Deaton Robert D | $177,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,712 | $33,154 | $4,937 | $28,217 |

| 2023 | $3,712 | $32,188 | $5,084 | $27,104 |

| 2022 | $3,633 | $31,251 | $5,581 | $25,670 |

| 2021 | $3,488 | $30,341 | $6,257 | $24,084 |

| 2020 | $3,433 | $29,458 | $6,177 | $23,281 |

| 2019 | $3,348 | $28,600 | $6,297 | $22,303 |

| 2018 | $3,302 | $28,051 | $0 | $0 |

| 2017 | $3,270 | $27,955 | $6,191 | $21,764 |

| 2016 | $3,154 | $27,141 | $6,374 | $20,767 |

| 2015 | $3,076 | $26,350 | $6,032 | $20,318 |

| 2014 | $2,975 | $25,582 | $6,162 | $19,420 |

Source: Public Records

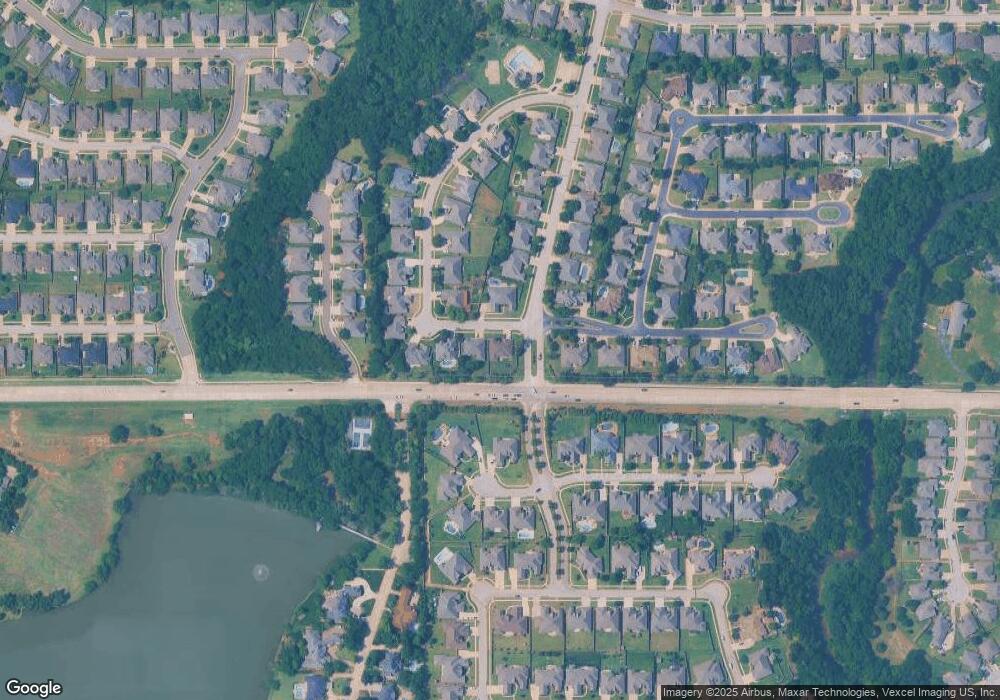

Map

Nearby Homes

- 19408 Yearling Way

- 19425 Stubblefield Ln

- 19213 Canyon Creek Place

- 1716 NW 196th St

- 1808 NW 195th Cir

- 19204 Canyon Creek Place

- 18909 Saddle River Dr

- 1404 NW 189th St

- 0 NW 192nd St Unit 1167400

- 1500 NW 188th St

- 1204 NW 190th Place

- 1225 NW 198th St

- 1800 NW 198th St

- 19912 Coverton Way

- 19608 Harness Ct

- 18804 Shilstone Way

- 1405 NW 187th St

- 19640 Stratmore Way

- 2008 Bretton Cir

- 1117 NW 198th St

- 1504 NW 193rd St

- 1501 NW 193rd St

- 1328 NW 193rd St

- 19400 Yearling Way

- 1329 NW 193rd St

- 19405 Danforth Farms Blvd

- 1512 NW 193rd St

- 19404 Yearling Way

- 1505 NW 192nd Terrace Unit 8305156483

- 1505 NW 192nd Terrace

- 1501 NW 192nd Terrace

- 1324 NW 193rd St

- 1417 NW 192nd Terrace

- 19404 Danforth Farms Blvd

- 19401 Yearling Way

- 19401 Stubblefield Ln

- 19405 Yearling Way

- 19409 Danforth Farms Blvd

- 1409 NW 192nd Terrace

- 19409 Yearling Way