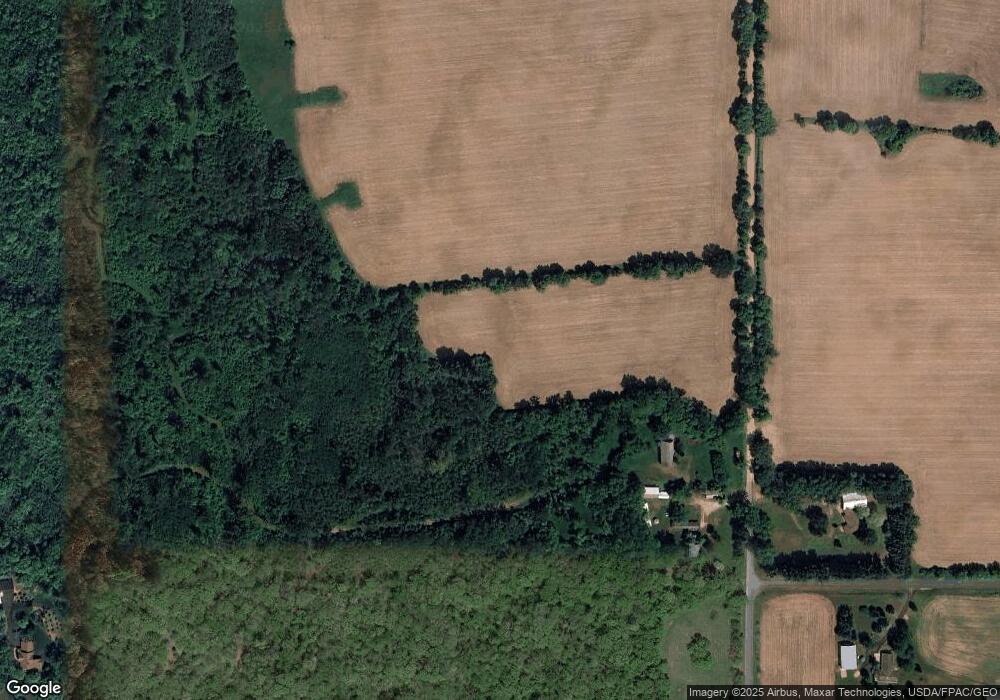

1553 42nd St Somerset, WI 54025

Estimated Value: $452,218 - $841,000

--

Bed

--

Bath

--

Sq Ft

5

Acres

About This Home

This home is located at 1553 42nd St, Somerset, WI 54025 and is currently estimated at $603,305. 1553 42nd St is a home located in St. Croix County with nearby schools including Somerset Elementary School, Somerset Middle School, and Somerset High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 10, 2021

Sold by

Streng Deanna J and Streng Jonathan D

Bought by

Streng Jonathan D and Streng Deanna J

Current Estimated Value

Purchase Details

Closed on

Jul 19, 2013

Sold by

Streng Deanna J and Streng Deanna Strese

Bought by

Streng Deanna J and Streng Jonathan D

Purchase Details

Closed on

Oct 18, 2010

Sold by

Strese John E and Streng Deanna Strese

Bought by

Streng Deanna Strese

Purchase Details

Closed on

Aug 20, 2010

Sold by

The John A Strese & Evelyn C Strese Fami

Bought by

The John A Strese & Evelyn C Strese Surv

Purchase Details

Closed on

Feb 22, 2010

Sold by

The John A Strese Jr & Evelyn C Strese R

Bought by

The John A Strese & Evelyn C Strese Fami

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Streng Jonathan D | -- | None Available | |

| Streng Deanna J | -- | None Available | |

| Streng Deanna Strese | -- | None Available | |

| Streng Deanna Strese | -- | None Available | |

| The John A Strese & Evelyn C Strese Surv | -- | None Available | |

| The John A Strese & Evelyn C Strese Fami | -- | None Available |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $37 | $374,500 | $126,000 | $248,500 |

| 2023 | $3,709 | $374,500 | $126,000 | $248,500 |

| 2022 | $3,147 | $374,500 | $126,000 | $248,500 |

| 2021 | $3,155 | $216,000 | $85,000 | $131,000 |

| 2020 | $3,165 | $216,000 | $85,000 | $131,000 |

| 2019 | $2,903 | $216,000 | $85,000 | $131,000 |

| 2018 | $2,864 | $216,000 | $85,000 | $131,000 |

| 2017 | $2,484 | $216,000 | $85,000 | $131,000 |

| 2016 | $2,484 | $151,100 | $33,000 | $118,100 |

| 2015 | $2,378 | $151,100 | $33,000 | $118,100 |

| 2014 | $2,375 | $151,100 | $33,000 | $118,100 |

| 2013 | $2,385 | $151,100 | $33,000 | $118,100 |

Source: Public Records

Map

Nearby Homes

- TBD 47th St

- 496 149th Ave

- 487 146th Ave

- 339 144th Ave

- 342 144th Ave

- 1397 Fox Ridge Trail

- 1393 Fox Ridge Trail

- 375 Lot #10 172nd Ave

- 372 Lot #9 172nd Ave

- 371 Lot #11 172nd Ave

- 1730 42nd St

- 543 Homestead Trail

- xxx Lot 2 38th St

- 329 138th Ave

- 317 138th Ave

- 1432 25th St

- 415 Bruce Larson Way

- 406 134th Ave

- 1395 25th St

- 10 Acres Highland View