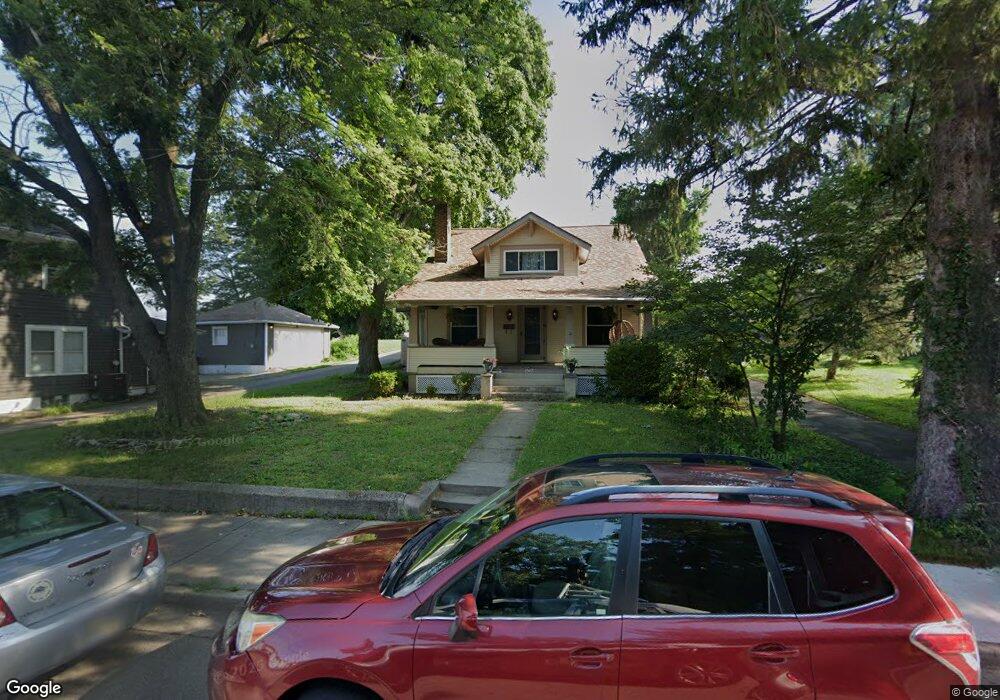

1597 Oakland Ave Dayton, OH 45409

Estimated Value: $210,000 - $241,000

3

Beds

2

Baths

1,493

Sq Ft

$149/Sq Ft

Est. Value

About This Home

This home is located at 1597 Oakland Ave, Dayton, OH 45409 and is currently estimated at $222,608, approximately $149 per square foot. 1597 Oakland Ave is a home located in Montgomery County with nearby schools including Southdale Elementary School, Van Buren Middle School, and Kettering Fairmont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 16, 2021

Sold by

Edwards Todd P

Bought by

Ingram Capital Llc

Current Estimated Value

Purchase Details

Closed on

Aug 28, 2020

Sold by

Ashgard Group Llc

Bought by

Sogard Ashlea

Purchase Details

Closed on

Aug 14, 2008

Sold by

Millard Michelle R

Bought by

Edwards Todd P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,479

Interest Rate

6.31%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 16, 2001

Sold by

Wade Murray L

Bought by

Millard Michelle R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,850

Interest Rate

7.16%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ingram Capital Llc | $122,500 | Pctitle Pros | |

| Sogard Ashlea | -- | None Available | |

| Edwards Todd P | $141,000 | Springdale Title Agency Llc | |

| Millard Michelle R | $130,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Edwards Todd P | $138,479 | |

| Previous Owner | Millard Michelle R | $127,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,067 | $59,940 | $14,960 | $44,980 |

| 2023 | $4,067 | $59,940 | $14,960 | $44,980 |

| 2022 | $3,470 | $39,780 | $9,910 | $29,870 |

| 2021 | $3,236 | $39,780 | $9,910 | $29,870 |

| 2020 | $3,180 | $39,780 | $9,910 | $29,870 |

| 2019 | $3,572 | $39,970 | $9,910 | $30,060 |

| 2018 | $3,590 | $39,970 | $9,910 | $30,060 |

| 2017 | $3,329 | $39,970 | $9,910 | $30,060 |

| 2016 | $3,470 | $39,320 | $9,910 | $29,410 |

| 2015 | $3,327 | $39,320 | $9,910 | $29,410 |

| 2014 | $3,327 | $39,320 | $9,910 | $29,410 |

| 2012 | -- | $42,890 | $9,820 | $33,070 |

Source: Public Records

Map

Nearby Homes

- 1545 Cardington Rd

- 1554 Crescent Blvd

- 1536 Old Lane Ave

- 1597 Old Lane Ave

- 1424 Elmdale Dr

- 1364 Elmdale Dr

- 1129 W Dorothy Ln

- 3225 Southdale Dr Unit 1

- 1473 Constance Ave Unit 1481

- 3060 Regent St

- 2467 S Dixie Dr

- 1314 Ridgeview Ave

- 1151 Brookview Ave

- 1420 Adirondack Trail

- 1125 Laurelwood Rd

- 1615 Carrollton Ave

- 2230 S Patterson Blvd

- 1349 Tamerlane Rd

- 3464 Southern Blvd

- 1211 Runnymede Rd

- 1599 Oakland Ave

- 1581 Oakland Ave

- 2810 S Dixie Dr

- 1573 Oakland Ave

- 1556 Cardington Rd

- 2850 S Dixie Dr

- 1596 Oakland Ave

- 2850 S Dixie Dr

- 1588 Oakland Ave

- 1552 Cardington Rd

- 1569 Oakland Ave

- 1556 Oakland Ave

- 1560 Cardington Rd

- 1548 Cardington Rd

- 1565 Oakland Ave

- 1548 Oakland Ave

- 1544 Cardington Rd

- 1540 Cardington Rd

- 1549 Oakland Ave

- 1543 Crescent Blvd