1863 Angeles Glen Escondido, CA 92029

Vineyard NeighborhoodEstimated Value: $857,000 - $927,000

4

Beds

3

Baths

1,669

Sq Ft

$536/Sq Ft

Est. Value

About This Home

This home is located at 1863 Angeles Glen, Escondido, CA 92029 and is currently estimated at $894,645, approximately $536 per square foot. 1863 Angeles Glen is a home located in San Diego County with nearby schools including Bernardo Elementary School, Bear Valley Middle School, and San Pasqual High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 22, 2001

Sold by

Atkins Kymberley

Bought by

Atkins Mark Williams

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$273,000

Outstanding Balance

$104,644

Interest Rate

6.91%

Estimated Equity

$790,001

Purchase Details

Closed on

Dec 16, 1996

Sold by

Peterson Kevin J

Bought by

Figueroa Victor Amed and Figueroa Mayda Ivette

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,755

Interest Rate

7.46%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 13, 1995

Sold by

Shannon Karen W

Bought by

Ryder Thomas Brendan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$178,398

Interest Rate

7.8%

Mortgage Type

Assumption

Purchase Details

Closed on

Sep 11, 1995

Sold by

Ryder Thomas Brendan

Bought by

Peterson Kevin J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$178,398

Interest Rate

7.8%

Mortgage Type

Assumption

Purchase Details

Closed on

Apr 20, 1989

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Atkins Mark Williams | -- | Old Republic Title Company | |

| Atkins Mark Williams | $273,000 | Old Republic Title Company | |

| Figueroa Victor Amed | -- | First American Title | |

| Ryder Thomas Brendan | -- | Fidelity National Title | |

| Peterson Kevin J | $175,000 | Fidelity National Title | |

| -- | $184,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Atkins Mark Williams | $273,000 | |

| Previous Owner | Figueroa Victor Amed | $154,755 | |

| Previous Owner | Peterson Kevin J | $178,398 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,460 | $403,283 | $147,720 | $255,563 |

| 2024 | $4,460 | $395,376 | $144,824 | $250,552 |

| 2023 | $4,357 | $387,625 | $141,985 | $245,640 |

| 2022 | $4,309 | $380,025 | $139,201 | $240,824 |

| 2021 | $4,238 | $372,574 | $136,472 | $236,102 |

| 2020 | $4,213 | $368,755 | $135,073 | $233,682 |

| 2019 | $4,110 | $361,525 | $132,425 | $229,100 |

| 2018 | $3,995 | $354,437 | $129,829 | $224,608 |

| 2017 | $41 | $347,488 | $127,284 | $220,204 |

| 2016 | $3,852 | $340,676 | $124,789 | $215,887 |

| 2015 | $3,818 | $335,560 | $122,915 | $212,645 |

| 2014 | $3,659 | $328,988 | $120,508 | $208,480 |

Source: Public Records

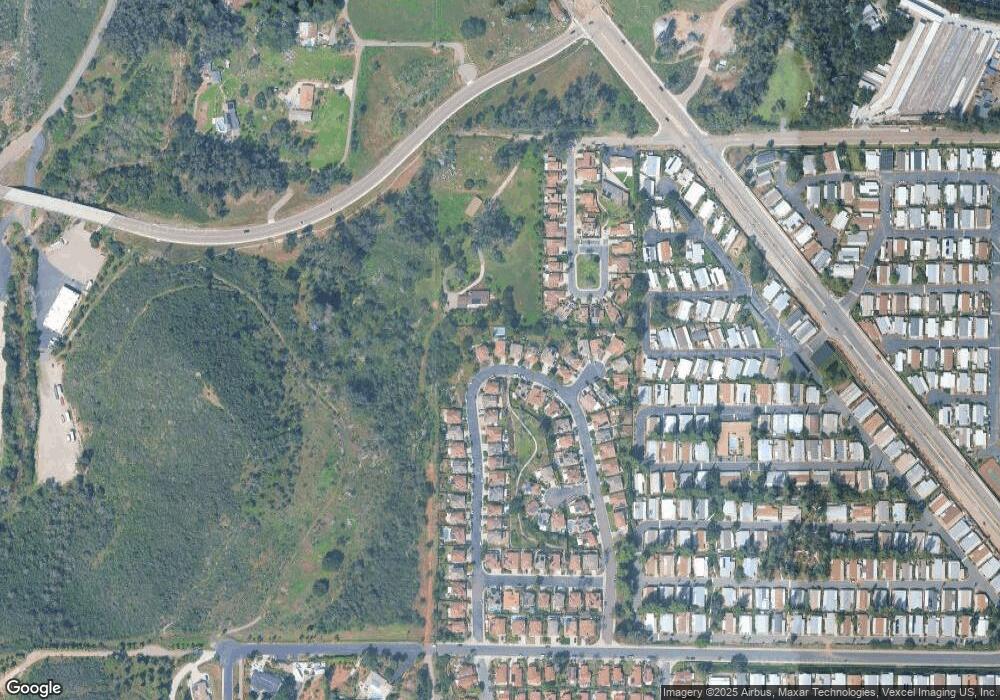

Map

Nearby Homes

- 2247 Johnston Rd

- 1751 Citracado Pkwy Unit SPC 288

- 1750 W Citracado Pkwy Unit 157

- 2400 W Valley Pkwy Unit 36

- 2243 Avenida Del Diablo

- 2133 Emberwood Way

- 1729 Mesa Grande Rd

- 0 Hill Valley Dr Unit NDP2410667

- 1225 Lancer Glen

- 1461 Autumn Woods Place

- 1045 Howard Ave

- 2831 Fishers Place

- 21547 Trail Blazer Ln

- 21639 Trail Blazer Ln

- 1110 Gaucho Place

- 21505 Trail Blazer Ln

- 21578 Saddle Bred Ln

- 21622 Saddle Bred Ln

- 1007 Howard Ave Unit 42

- 1001 S Hale Ave Unit 13

- 1867 Angeles Glen

- 1857 Angeles Glen

- 1871 Angeles Glen

- 1901 Tecate Glen

- 1870 Angeles Glen

- 1875 Angeles Glen

- 2347 Avenida Del Diablo

- 1907 Tecate Glen

- 1821 Shadow Glen

- 1876 Angeles Glen

- 1817 Shadow Glen

- 2256 Nevada Glen

- 2252 Nevada Glen

- 1917 Tecate Glen

- 2248 Nevada Glen

- 1813 Shadow Glen

- 1825 Shadow Glen

- 1880 Angeles Glen

- 1918 Tecate Glen

- 1923 Tecate Glen