18832 Vista Del Canon Unit A Newhall, CA 91321

Estimated Value: $525,000 - $533,000

3

Beds

3

Baths

1,176

Sq Ft

$449/Sq Ft

Est. Value

About This Home

This home is located at 18832 Vista Del Canon Unit A, Newhall, CA 91321 and is currently estimated at $528,324, approximately $449 per square foot. 18832 Vista Del Canon Unit A is a home located in Los Angeles County with nearby schools including Golden Oak Community School, La Mesa Junior High School, and Golden Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 21, 2004

Sold by

Garcia Steve and Garcia Kristen

Bought by

Gazarian Aramaeys and Gazarian Silvana

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$255,960

Outstanding Balance

$103,576

Interest Rate

3.67%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$424,748

Purchase Details

Closed on

Mar 17, 2001

Sold by

Brooks Monte and Brooks Carole

Bought by

Garcia Steve and Garcia Kristen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Interest Rate

7.09%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gazarian Aramaeys | $320,000 | Chicago Title Co | |

| Garcia Steve | $166,000 | Investors Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gazarian Aramaeys | $255,960 | |

| Previous Owner | Garcia Steve | $125,000 | |

| Closed | Gazarian Aramaeys | $31,995 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,222 | $454,808 | $315,487 | $139,321 |

| 2024 | $5,987 | $445,891 | $309,301 | $136,590 |

| 2023 | $5,829 | $437,149 | $303,237 | $133,912 |

| 2022 | $5,726 | $428,579 | $297,292 | $131,287 |

| 2021 | $5,505 | $410,000 | $285,000 | $125,000 |

| 2020 | $5,133 | $379,000 | $263,000 | $116,000 |

| 2019 | $5,072 | $379,000 | $263,000 | $116,000 |

| 2018 | $4,512 | $330,000 | $229,000 | $101,000 |

| 2016 | $3,845 | $290,000 | $201,300 | $88,700 |

| 2015 | $3,993 | $290,000 | $201,300 | $88,700 |

| 2014 | $3,305 | $234,000 | $162,400 | $71,600 |

Source: Public Records

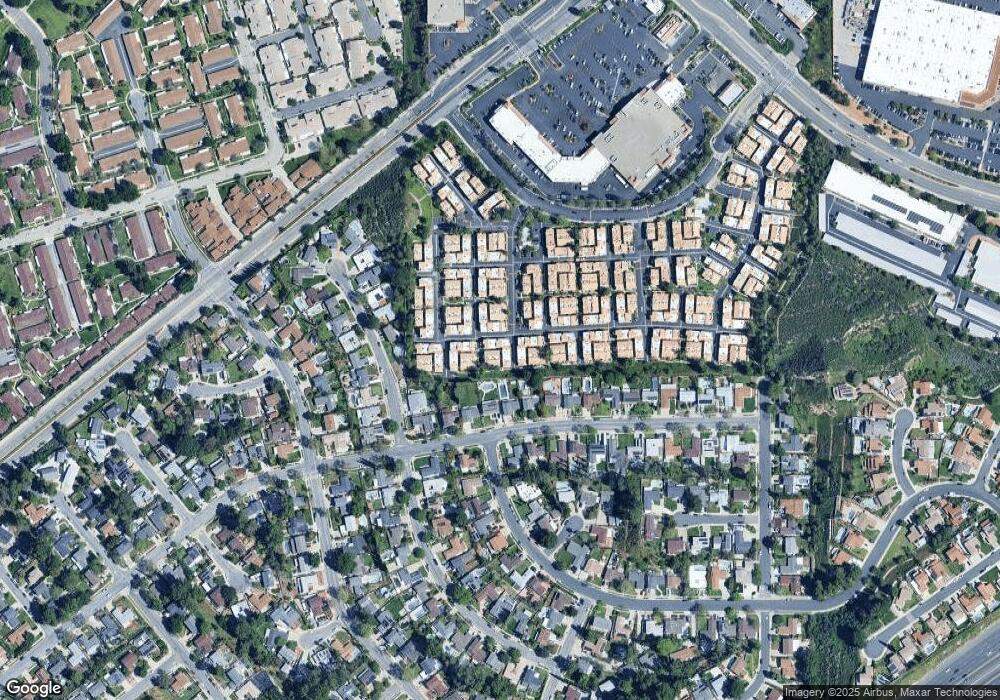

Map

Nearby Homes

- 18836 Vista Del Canon

- 18850 Vista Del Canon Unit B

- 18844 Vista Del Canon Unit B

- 18738 Vista Del Canon Unit F

- 18923 Circle of Friends

- 26822 Avenue of The Oaks

- 26834 Avenue of The Oaks Unit A

- 19124 Avenue of The Oaks Unit A

- 19118 Avenue of The Oaks Unit B

- 19235 Avenue of The Oaks Unit C

- 26745 Oak Crossing Rd Unit D

- 19318 Flowers Ct

- 19324 Flowers Ct Unit 59

- 26701 Oak Branch Cir

- 19380 Anzel Cir

- 26847 Oak Branch Cir

- 26751 Winsome Cir

- 26116 Friendly Valley Pkwy

- 19427 Oak Crossing Rd

- 26360 Oakspur Dr Unit A

- 18832 Vista Del Canon

- 18840 Vista Del Canon

- 18838 Vista Del Canon Unit G

- 18838 Vista Del Canon

- 18832 Vista Del Canon Unit B

- 18834 Vista Del Canon Unit A

- 18832 Vista Del Canon Unit F

- 18836 Vista Del Canon Unit H

- 18836 Vista Del Canon Unit A

- 18832 Vista Del Canon Unit E

- 18836 Vista Del Canon Unit C

- 18850 Vista Del Canon Unit E

- 18834 Vista Del Canon Unit H

- 18840 Vista Del Canon Unit H

- 18836 Vista Del Canon Unit F

- 18848 Vista Del Canon Unit B

- 18834 Vista Del Canon Unit G

- 18842 Vista Del Canon Unit H

- 18840 Vista Del Canon Unit G

- 18832 Vista Del Canon Unit D