206 Honors Dr Shorewood, IL 60404

Estimated Value: $501,887 - $556,000

--

Bed

--

Bath

2,633

Sq Ft

$198/Sq Ft

Est. Value

About This Home

This home is located at 206 Honors Dr, Shorewood, IL 60404 and is currently estimated at $522,222, approximately $198 per square foot. 206 Honors Dr is a home located in Will County with nearby schools including Walnut Trails Elementary School, Minooka Junior High School, and Minooka Intermediate School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 21, 2024

Sold by

Suellen K Cordano Living Trust and Cordano Suellen K

Bought by

Cordano Suellen K

Current Estimated Value

Purchase Details

Closed on

Feb 18, 2019

Sold by

Cordano Suellen K

Bought by

The Suellen K Cordano Living Trust

Purchase Details

Closed on

Jun 1, 2017

Sold by

Orenic Raymond G and Orenic Colleen L

Bought by

Cordano Suellen K

Purchase Details

Closed on

Nov 30, 2005

Sold by

Pulte Home Corp

Bought by

Orenic Raymond G and Orenic Colleen L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$43,829

Interest Rate

6.36%

Mortgage Type

Stand Alone Second

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cordano Suellen K | -- | None Listed On Document | |

| The Suellen K Cordano Living Trust | -- | Attorney | |

| Cordano Suellen K | $445,000 | First American Title | |

| Orenic Raymond G | $438,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Orenic Raymond G | $43,829 | |

| Previous Owner | Orenic Raymond G | $350,632 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $12,040 | $174,157 | $31,999 | $142,158 |

| 2023 | $12,040 | $156,475 | $28,750 | $127,725 |

| 2022 | $10,549 | $148,065 | $27,205 | $120,860 |

| 2021 | $10,296 | $139,290 | $25,593 | $113,697 |

| 2020 | $10,458 | $137,309 | $25,593 | $111,716 |

| 2019 | $9,850 | $131,712 | $24,550 | $107,162 |

| 2018 | $9,905 | $130,812 | $24,550 | $106,262 |

| 2017 | $9,287 | $121,812 | $24,550 | $97,262 |

| 2016 | $8,990 | $116,550 | $24,550 | $92,000 |

| 2015 | $7,914 | $111,360 | $22,610 | $88,750 |

| 2014 | $7,914 | $106,010 | $22,610 | $83,400 |

| 2013 | $7,914 | $101,270 | $22,610 | $78,660 |

Source: Public Records

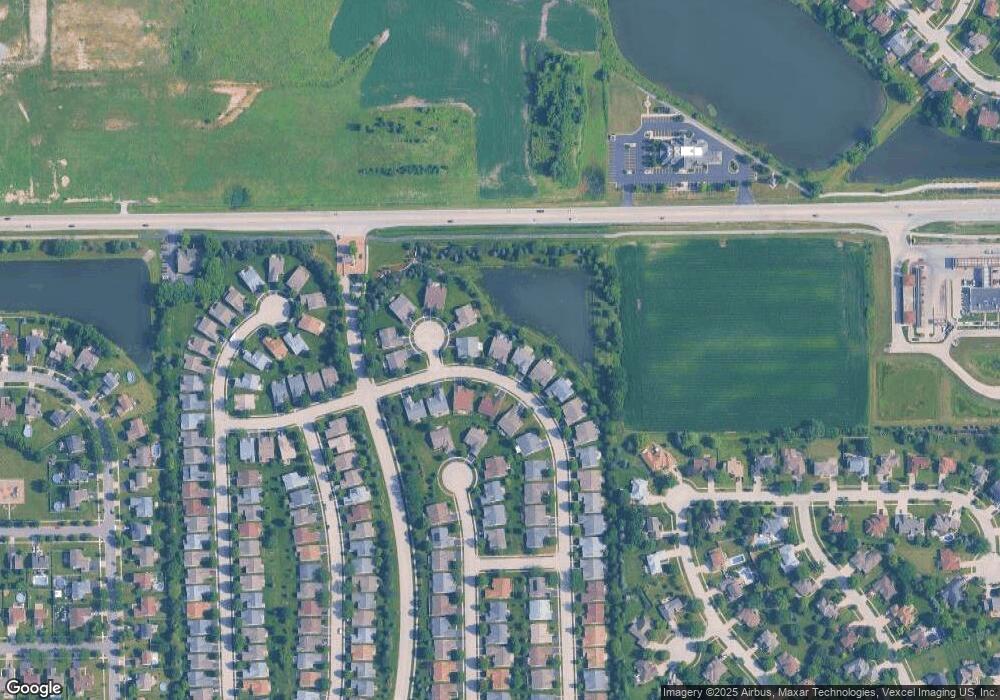

Map

Nearby Homes

- 110 National Ct

- 1228 Conquest Ct

- 312 Honors Dr

- 1204 Glen Mor Dr Unit B

- 1728 Parkside Dr Unit 2

- 1808 Wintercrest Ct

- 228 Parkside Dr

- 1111 Country Dr

- 621 Pleasant Dr

- 1719 Moran Dr

- 704 Flag Dr

- 00002 Jefferson St

- 1 AC Jefferson St

- 00001 Jefferson St

- 0000 W Seil Rd

- 7507 Honeysuckle Ln

- 7513 Honeysuckle Ln

- 7510 Honeysuckle Ln

- 1007 Windsor Dr

- 0 W Seil Rd