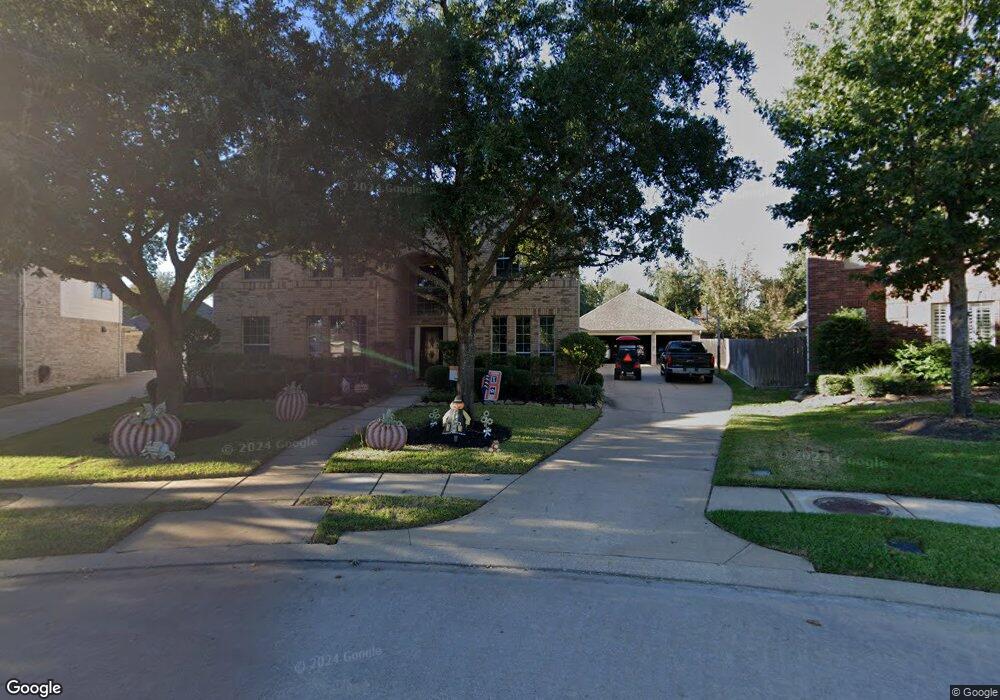

20918 Heartwood Oak Trail Cypress, TX 77433

Fairfield Village NeighborhoodEstimated Value: $614,912 - $720,000

5

Beds

4

Baths

4,092

Sq Ft

$159/Sq Ft

Est. Value

About This Home

This home is located at 20918 Heartwood Oak Trail, Cypress, TX 77433 and is currently estimated at $649,728, approximately $158 per square foot. 20918 Heartwood Oak Trail is a home located in Harris County with nearby schools including Keith Elementary School, Salyards Middle, and Bridgeland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 21, 2012

Sold by

Jensen Julia R

Bought by

Jensen Family Trust

Current Estimated Value

Purchase Details

Closed on

Dec 28, 2011

Sold by

Hemphill Edward R and Hemphill Diane R

Bought by

Jensen Julia R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,800

Interest Rate

4.03%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 9, 2003

Sold by

Newmark Homes Lp

Bought by

Hemphill Edward R and Hemphill Diane R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$202,600

Interest Rate

5.94%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jensen Family Trust | -- | None Available | |

| Jensen Julia R | -- | Stewart Title | |

| Hemphill Edward R | -- | Universal Land Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jensen Julia R | $280,800 | |

| Previous Owner | Hemphill Edward R | $202,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,402 | $604,628 | $89,459 | $515,169 |

| 2024 | $8,402 | $585,553 | $89,459 | $496,094 |

| 2023 | $8,402 | $502,080 | $89,459 | $412,621 |

| 2022 | $10,482 | $454,254 | $74,719 | $379,535 |

| 2021 | $10,060 | $384,554 | $74,719 | $309,835 |

| 2020 | $10,897 | $405,942 | $50,829 | $355,113 |

| 2019 | $10,277 | $365,645 | $50,829 | $314,816 |

| 2018 | $3,714 | $353,687 | $50,829 | $302,858 |

| 2017 | $10,067 | $353,687 | $50,829 | $302,858 |

| 2016 | $10,067 | $353,687 | $50,829 | $302,858 |

| 2015 | $6,450 | $349,654 | $50,829 | $298,825 |

| 2014 | $6,450 | $331,412 | $50,829 | $280,583 |

Source: Public Records

Map

Nearby Homes

- 16018 Lower Lake Dr

- 11018 White Caterpillar Dr

- 20806 Autumn Redwood Way

- 20822 Chappell Knoll Dr

- 20807 Twisted Leaf Dr

- 15503 Fairfield Falls Way

- 20803 Twisted Leaf Dr

- 15318 Redbud Berry Way

- 15403 Court Green Trail

- 15326 Wild Timber Trail

- 15311 Redbud Berry Way

- 15434 Redbud Leaf Ln

- 15003 Big Spring Park Dr

- 20815 Golden Sycamore Trail

- 20315 Lakeland Falls Dr

- 15403 Redbud Leaf Ln

- 15611 Garden Bend Cir

- 20207 Fairfield Trace Dr

- 15334 Sienna Oak Dr

- 15918 Lake Loop Dr

- 20922 Heartwood Oak Trail

- 20914 Heartwood Oak Trail

- 15922 Crooked Lake Way S

- 15918 Crooked Lake Way S

- 20926 Heartwood Oak Trail

- 20707 Turning Leaf Lake Ct

- 15914 Crooked Lake Way S

- 20911 Heartwood Oak Trail

- 20910 Heartwood Oak Trail

- 20711 Turning Leaf Lake Ct

- 20930 Heartwood Oak Trail

- 20703 Turning Leaf Lake Ct

- 15910 Crooked Lake Way S

- 20906 Heartwood Oak Trail

- 20907 Heartwood Oak Trail

- 15910 Cumberland Oak Ct

- 21002 Heartwood Oak Trail

- 15919 Crooked Lake Way S

- 15906 Crooked Lake Way S

- 15915 Crooked Lake Way S