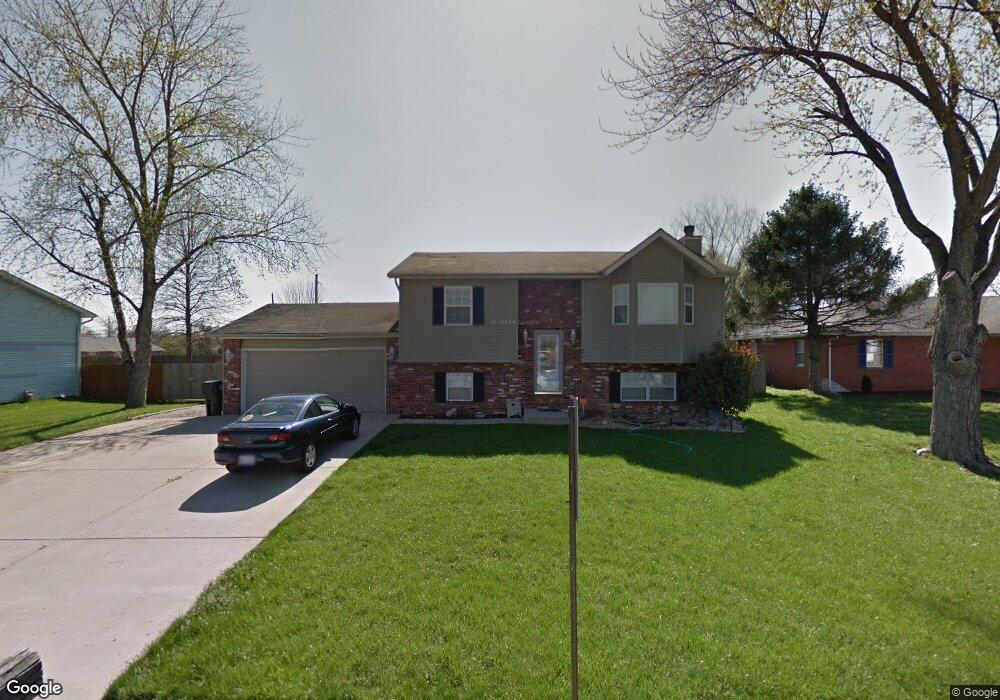

21 Paul Dr Granite City, IL 62040

Estimated Value: $204,000 - $225,045

3

Beds

2

Baths

816

Sq Ft

$261/Sq Ft

Est. Value

About This Home

This home is located at 21 Paul Dr, Granite City, IL 62040 and is currently estimated at $213,011, approximately $261 per square foot. 21 Paul Dr is a home located in Madison County with nearby schools including Granite City High School, St. Elizabeth Elementary School, and Metro East Montessori School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 9, 2014

Sold by

Buckingham Mark and Smith Barbara C

Bought by

Hunter Ryan M and Hunter Kellie M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,100

Outstanding Balance

$100,986

Interest Rate

4.62%

Mortgage Type

New Conventional

Estimated Equity

$112,025

Purchase Details

Closed on

Nov 27, 2007

Sold by

Buckingham Mark

Bought by

Buckingham Mark and Smith Barbara C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,000

Interest Rate

6.47%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 9, 2007

Sold by

Fannie Mae

Bought by

Buckingham Mark B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,000

Interest Rate

6.47%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 4, 2007

Sold by

Rice Eric J and Regions Bank

Bought by

Federal National Mortgage Association

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hunter Ryan M | $138,000 | Pontoon Title Company | |

| Buckingham Mark | -- | First American Title Ins Co | |

| Buckingham Mark B | $130,000 | Fatic | |

| Federal National Mortgage Association | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hunter Ryan M | $131,100 | |

| Previous Owner | Buckingham Mark B | $130,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,850 | $70,060 | $9,370 | $60,690 |

| 2023 | $3,850 | $64,560 | $8,400 | $56,160 |

| 2022 | $3,956 | $56,270 | $7,320 | $48,950 |

| 2021 | $3,403 | $53,160 | $6,920 | $46,240 |

| 2020 | $3,196 | $50,190 | $6,530 | $43,660 |

| 2019 | $3,243 | $50,190 | $6,530 | $43,660 |

| 2018 | $3,161 | $47,070 | $6,120 | $40,950 |

| 2017 | $3,050 | $47,070 | $6,120 | $40,950 |

| 2016 | $3,283 | $47,070 | $6,120 | $40,950 |

| 2015 | $3,160 | $47,910 | $6,230 | $41,680 |

| 2014 | $3,160 | $47,910 | $6,230 | $41,680 |

| 2013 | $3,160 | $49,470 | $6,430 | $43,040 |

Source: Public Records

Map

Nearby Homes

- 3120 W Chain of Rocks Rd Unit 252

- 3120 W Chain of Rocks Rd Unit 199

- 3120 W Chain of Rocks Rd Unit 161

- 3120 W Chain of Rocks Rd Unit 249

- 3120 W Chain of Rocks Rd Unit 171

- 1048 Cote Brillante

- 5104 Stephanie Dr

- 5121 Stacey Dr

- 5120 Buena St

- 5129 Stacey Dr

- 5147 Old Alton Rd

- 1608 Union Ave

- 2507 Morrison Rd

- 1633 Sycamore St

- 2305 Clinton Dr

- 2152 Bern Ave

- 1732 Sycamore St

- 1728 Ferguson Ave

- 2132 Orville Ave

- 1612 Venice Ave