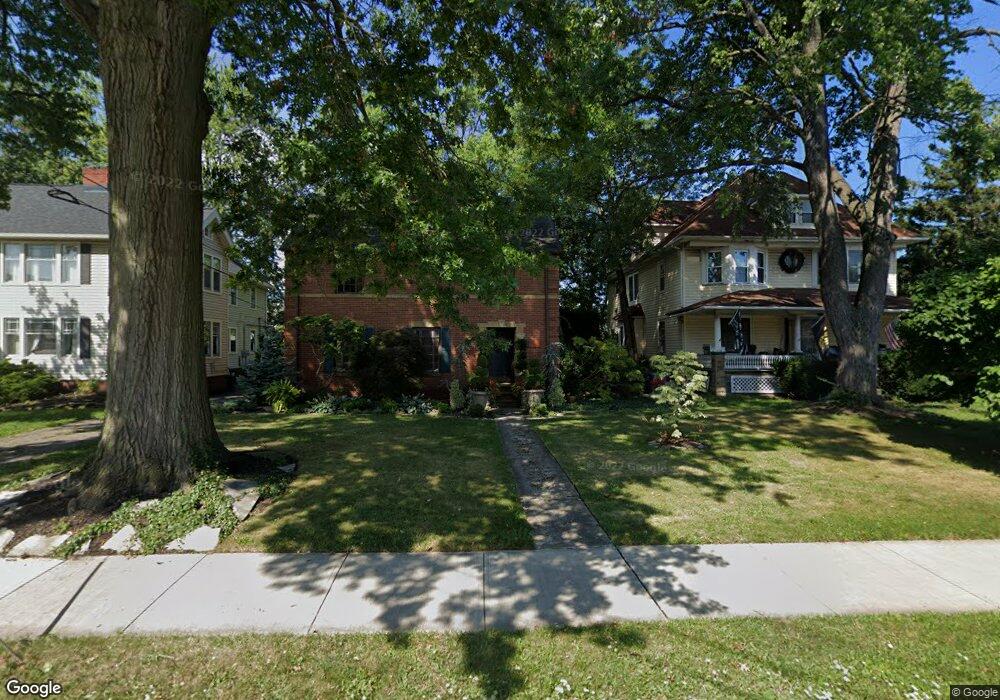

2122 Warren Rd Lakewood, OH 44107

Estimated Value: $312,000 - $338,000

3

Beds

2

Baths

1,518

Sq Ft

$213/Sq Ft

Est. Value

About This Home

This home is located at 2122 Warren Rd, Lakewood, OH 44107 and is currently estimated at $324,034, approximately $213 per square foot. 2122 Warren Rd is a home located in Cuyahoga County with nearby schools including Hayes Elementary School, Harding Middle School, and Lakewood High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 22, 2003

Sold by

Dibble Matthew J and Maniscalco Michelle

Bought by

Hartzell Scott Kenneth

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,400

Outstanding Balance

$53,817

Interest Rate

5.95%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$270,217

Purchase Details

Closed on

Oct 20, 1989

Sold by

Dibble Matthew J

Bought by

Dibble Matthew J

Purchase Details

Closed on

Sep 21, 1989

Sold by

Dibble Matthew J

Bought by

Dibble Matthew J

Purchase Details

Closed on

Jan 1, 1975

Bought by

Schwenk Robert H

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hartzell Scott Kenneth | $153,000 | Blvd Title | |

| Dibble Matthew J | -- | -- | |

| Dibble Matthew J | -- | -- | |

| Dibble Matthew J | -- | -- | |

| Dibble Matthew J | -- | -- | |

| Dibble Matthew J | -- | -- | |

| Dibble Matthew J | -- | -- | |

| Dibble Matthew J | -- | -- | |

| Dibble Matthew J | $89,000 | -- | |

| Schwenk Robert H | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hartzell Scott Kenneth | $122,400 | |

| Closed | Hartzell Scott Kenneth | $30,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,396 | $84,000 | $22,365 | $61,635 |

| 2023 | $5,543 | $73,850 | $17,640 | $56,210 |

| 2022 | $5,578 | $73,850 | $17,640 | $56,210 |

| 2021 | $7,002 | $73,850 | $17,640 | $56,210 |

| 2020 | $4,898 | $57,260 | $13,690 | $43,580 |

| 2019 | $4,801 | $163,600 | $39,100 | $124,500 |

| 2018 | $4,538 | $57,260 | $13,690 | $43,580 |

| 2017 | $4,312 | $46,800 | $10,400 | $36,400 |

| 2016 | $6,050 | $46,800 | $10,400 | $36,400 |

| 2015 | $4,286 | $46,800 | $10,400 | $36,400 |

| 2014 | $4,286 | $45,010 | $10,010 | $35,000 |

Source: Public Records

Map

Nearby Homes

- 14924 Arden Ave

- 14909 Arden Ave

- 14926 Esther Ave

- 2165 Arthur Ave

- 14924 Delaware Ave

- 2209 Alger Rd

- 2230 Alger Rd

- 2263 Warren Rd

- 14428 Delaware Ave

- 14404 Bayes Ave

- 2078 Baxterly Ave

- 15555 Hilliard Rd Unit 401A

- 15615 Fernway Ave

- 2099 Olive Ave

- 2234 Olive Ave

- 1578 Mars Ave

- 1594 Victoria Ave

- 1617 Westwood Ave

- 1590 Lakeland Ave

- 2209 Woodward Ave

- 2116 Warren Rd

- 2126 Alger Rd

- 14912 Arden Ave

- 14819 Athens Ave

- 2130 Alger Rd

- 14914 Arden Ave

- 14923 Athens Ave

- 2106 Warren Rd

- 14916 Arden Ave

- 2105 Reveley Ave

- 14920 Arden Ave

- 2100 Warren Rd

- 2140 Alger Rd

- 15003 Athens Ave

- 2119 Warren Rd

- 2123 Warren Rd

- 2113 Warren Rd

- 2144 Alger Rd

- 2096 Warren Rd

- 15007 Athens Ave