2217 W Jordan Dr Edinburg, TX 78539

Estimated Value: $486,000 - $755,000

6

Beds

3

Baths

3,956

Sq Ft

$148/Sq Ft

Est. Value

About This Home

This home is located at 2217 W Jordan Dr, Edinburg, TX 78539 and is currently estimated at $586,440, approximately $148 per square foot. 2217 W Jordan Dr is a home located in Hidalgo County with nearby schools including Canterbury Elementary School, South Middle School, and Robert Vela High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 26, 2015

Sold by

Sierra Madre Ltd

Bought by

Patel Rakesh N and Patel Jagruti

Current Estimated Value

Purchase Details

Closed on

Nov 1, 2011

Sold by

Alva Brick Eduardo and Chang Elsa

Bought by

Delizardi De La Rosa Antonio Enrique

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

4.14%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 12, 2006

Sold by

Berit Ltd

Bought by

Sierra Madre Ltd

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$38,250

Interest Rate

6.37%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Patel Rakesh N | -- | Edwards Abstract & Title Co | |

| Delizardi De La Rosa Antonio Enrique | -- | Edwards Abstract & Title Co | |

| Sierra Madre Ltd | -- | Southern Star Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Delizardi De La Rosa Antonio Enrique | $200,000 | |

| Previous Owner | Sierra Madre Ltd | $38,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,457 | $428,971 | -- | -- |

| 2024 | $8,457 | $389,974 | -- | -- |

| 2023 | $8,506 | $354,522 | $0 | $0 |

| 2022 | $8,393 | $322,293 | $56,738 | $265,555 |

| 2021 | $8,473 | $312,906 | $56,738 | $256,168 |

| 2020 | $8,514 | $312,906 | $56,738 | $256,168 |

| 2019 | $8,690 | $312,906 | $51,000 | $261,906 |

| 2018 | $9,665 | $347,135 | $51,000 | $296,135 |

| 2017 | $9,400 | $336,423 | $56,738 | $279,685 |

| 2016 | $9,492 | $339,713 | $56,738 | $282,975 |

| 2015 | $9,101 | $343,004 | $56,738 | $286,266 |

Source: Public Records

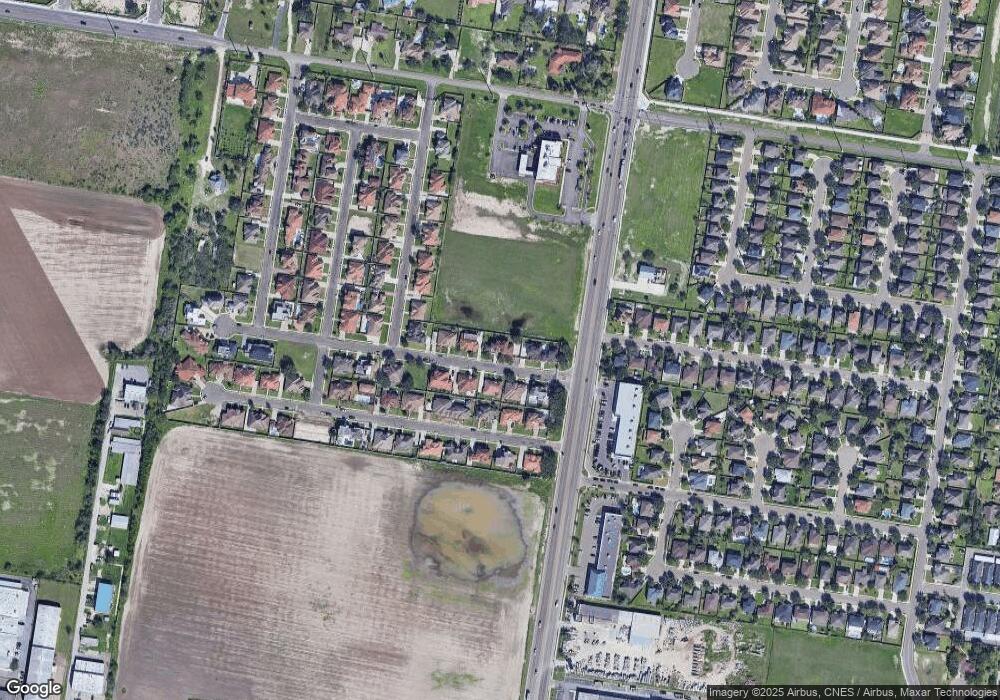

Map

Nearby Homes

- 2201 W Rhin Dr

- 2117 Andrea Ave

- 3807 Bridget St

- 2405 W Rhin Dr

- 2008 Beatrice Ave

- 3408 Madison Ave

- 1910 Linsay Blvd

- 1920 Katherine Ave

- 3305 Crystal Falls Ave

- 3204 S Wharton Ave

- 3200 S Wharton Ave

- 3216 S Wharton Ave

- 3400 S Colt Ln

- 0 W Trenton Rd Unit 380151

- 0 W Trenton Rd Unit 400542

- 0 W Trenton Rd Unit 455681

- 2009 Rochester Ave

- 1209 S Waterfall Ave

- 1708 Rio de Janeiro St

- 2455 W Brown St

- 2217 W Jordan Dr Unit 54&1/2 of 55

- 2301 W Jordan Dr

- 2205 W Jordan Dr

- 2218 W Jordan Dr

- 2218 W Jordan Dr Unit 32

- 2212 W Jordan Dr

- 2302 W Jordan Dr

- 2307 W Jordan Dr

- 2206 W Jordan Dr

- 2213 W Rhin Dr

- 2207 W Rhin Dr

- 2308 W Jordan Dr

- 2219 W Rhin Dr

- 3716 Ebro Dr

- 3710 Ebro Dr

- 2309 W Rhin Dr

- 3704 Ebro Dr

- 2406 W Jordan Dr

- lot 45 W Jordan Dr

- lote 35 W Jordan Dr