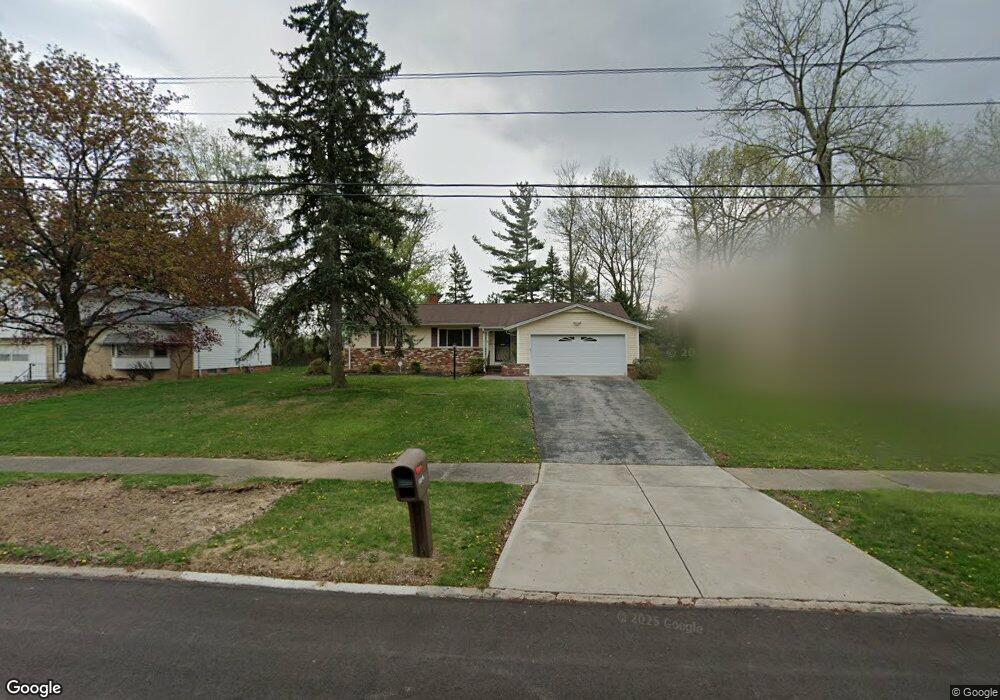

22170 Sandalwood Rd Bedford, OH 44146

Estimated Value: $162,000 - $228,000

3

Beds

2

Baths

1,428

Sq Ft

$130/Sq Ft

Est. Value

About This Home

This home is located at 22170 Sandalwood Rd, Bedford, OH 44146 and is currently estimated at $185,398, approximately $129 per square foot. 22170 Sandalwood Rd is a home located in Cuyahoga County with nearby schools including Heskett Middle School, Bedford High School, and Ohio College Preparatory School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 17, 2018

Sold by

Hunter Dianna C

Bought by

Hunter Norman

Current Estimated Value

Purchase Details

Closed on

May 25, 2004

Sold by

Wilson Maurice

Bought by

Wilson Dianna C

Purchase Details

Closed on

Jun 22, 1998

Sold by

Forster Patricia Lvg Trust

Bought by

Wilson Maurice and Wilson Dianna C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$116,350

Interest Rate

7.02%

Mortgage Type

VA

Purchase Details

Closed on

Aug 20, 1992

Sold by

Forster Helen M

Bought by

Forster Patricia H

Purchase Details

Closed on

Nov 8, 1979

Sold by

Forster George E and Forster Helen M

Bought by

Forster Helen M

Purchase Details

Closed on

Jan 1, 1975

Bought by

Forster George E and Forster Helen M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hunter Norman | -- | None Available | |

| Wilson Dianna C | -- | -- | |

| Wilson Maurice | $114,950 | -- | |

| Forster Patricia H | -- | -- | |

| Forster Helen M | -- | -- | |

| Forster George E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wilson Maurice | $116,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,692 | $51,800 | $11,235 | $40,565 |

| 2023 | $3,947 | $47,920 | $8,470 | $39,450 |

| 2022 | $3,450 | $47,915 | $8,470 | $39,445 |

| 2021 | $3,413 | $47,920 | $8,470 | $39,450 |

| 2020 | $3,110 | $39,270 | $6,930 | $32,340 |

| 2019 | $3,019 | $112,200 | $19,800 | $92,400 |

| 2018 | $3,149 | $39,270 | $6,930 | $32,340 |

| 2017 | $3,325 | $41,090 | $8,750 | $32,340 |

| 2016 | $3,298 | $41,090 | $8,750 | $32,340 |

| 2015 | $3,292 | $41,090 | $8,750 | $32,340 |

| 2014 | $3,292 | $41,090 | $8,750 | $32,340 |

Source: Public Records

Map

Nearby Homes

- 5301 Mardale Ave

- 20750 Bowling Green Rd

- 5285 Mardale Ave

- 20739 Donny Brook Rd

- 20732 Applegate Rd

- 5385 Bartlett Rd

- 21416 Gardenview Dr

- 179 Willard Ave

- 20625 Centuryway Rd

- 20814 Kenyon Dr

- 20701 Kenyon Dr

- 63 Willard Ave

- 54 Willard Ave

- 21207 Franklin Rd

- 61 Hubbell Way

- 66 Hubbell Way

- 58 Hubbell Way

- 62 Hubbell Way

- 54 Hubbell Way

- 57 Hubbell Way

- 22140 Sandalwood Rd

- 22200 Sandalwood Rd

- 22110 Sandalwood Rd

- 22230 Sandalwood Rd

- 5427 Holly Rd

- 22080 Sandalwood Rd

- 22260 Sandalwood Rd

- 5428 Mardale Ave

- 5419 Holly Rd

- 5420 Mardale Ave

- 22290 Sandalwood Rd

- 22050 Sandalwood Rd

- 5411 Holly Rd

- 5412 Mardale Ave

- 5428 Holly Rd

- 22020 Sandalwood Rd

- 22320 Sandalwood Rd

- 5420 Holly Rd

- 5403 Holly Rd

- 5404 Mardale Ave