241 Governors Way Brentwood, TN 37027

Estimated Value: $1,988,161 - $2,761,000

--

Bed

7

Baths

5,290

Sq Ft

$467/Sq Ft

Est. Value

About This Home

This home is located at 241 Governors Way, Brentwood, TN 37027 and is currently estimated at $2,470,387, approximately $466 per square foot. 241 Governors Way is a home located in Williamson County with nearby schools including Crockett Elementary School, Woodland Middle School, and Ravenwood High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 21, 2025

Sold by

Siebert Harold L and Siebert Sandra L

Bought by

Siebert Family Revocable Trust and Siebert

Current Estimated Value

Purchase Details

Closed on

May 8, 2001

Sold by

Miele Linda S

Bought by

Siebert Harold L and Siebert Sandra L

Purchase Details

Closed on

May 7, 1999

Sold by

Miele Homes In Governors Club Llc

Bought by

Miele Linda S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Interest Rate

6.62%

Purchase Details

Closed on

Sep 28, 1998

Sold by

Miele Timothy J

Bought by

Miele Homes In Governors Club Llc

Purchase Details

Closed on

Aug 5, 1998

Sold by

The Governors Club Llc

Bought by

Miele Timothy J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Siebert Family Revocable Trust | -- | None Listed On Document | |

| Siebert Family Revocable Trust | -- | None Listed On Document | |

| Siebert Harold L | $1,290,000 | -- | |

| Miele Linda S | -- | -- | |

| Miele Homes In Governors Club Llc | -- | -- | |

| Miele Timothy J | $185,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Miele Linda S | $250,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,768 | $577,525 | $175,000 | $402,525 |

| 2024 | $8,768 | $404,050 | $87,500 | $316,550 |

| 2023 | $8,768 | $404,050 | $87,500 | $316,550 |

| 2022 | $8,768 | $404,050 | $87,500 | $316,550 |

| 2021 | $8,768 | $404,050 | $87,500 | $316,550 |

| 2020 | $9,250 | $358,500 | $68,750 | $289,750 |

| 2019 | $9,250 | $358,500 | $68,750 | $289,750 |

| 2018 | $8,999 | $358,500 | $68,750 | $289,750 |

| 2017 | $8,927 | $358,500 | $68,750 | $289,750 |

| 2016 | $0 | $358,500 | $68,750 | $289,750 |

| 2015 | -- | $317,575 | $62,500 | $255,075 |

| 2014 | $1,397 | $317,575 | $62,500 | $255,075 |

Source: Public Records

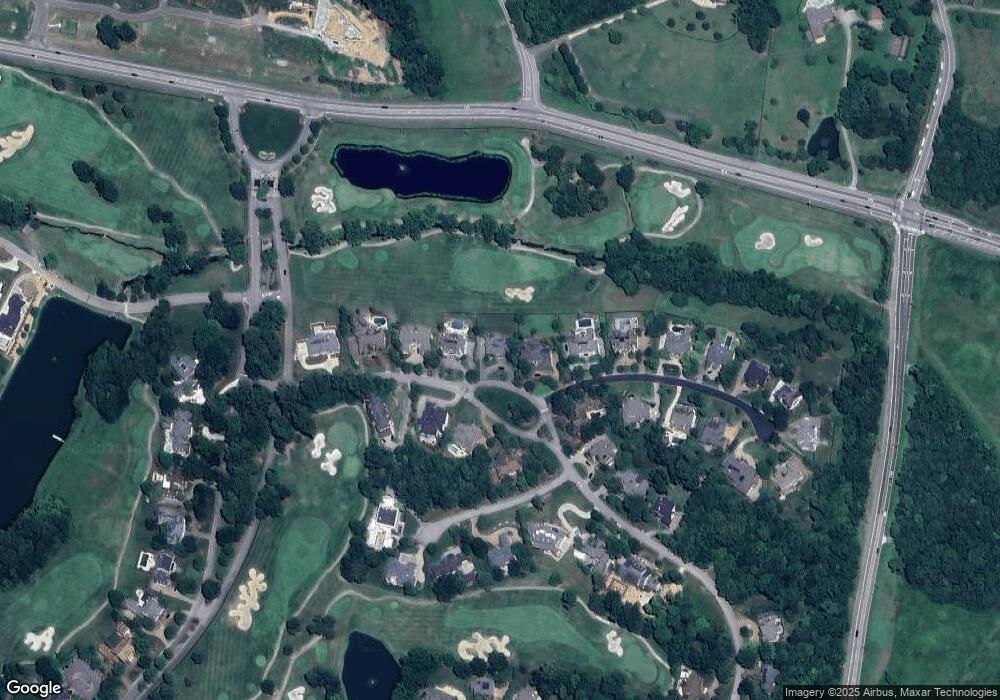

Map

Nearby Homes

- 1 Wentworth Place

- 9636 Concord Rd

- 1 Tradition Ln

- 8 Carmel Ln

- 9626 Concord Rd

- 9619 Deer Track Ct

- 10 Tradition Ln

- 9580 Crockett Rd

- 9634 Brunswick Dr

- 9722 Concord Rd

- 1000 Lower Stow Ct

- 3 Prestwick Place

- 1081 Sunset Rd

- 5 Camel Back Ct

- 14 Angel Trace

- 9572 Hampton Reserve Dr

- 9727 Concord Rd

- 6 Portrush Ct

- 9711 Turner Ln

- 9704 Turnbridge Ct

- 243 Governors Way

- 239 Governors Way

- 245 Governors Way

- 4 Crooked Stick Ln

- 242 Governors Way

- 244 Governors Way

- 237 Governors Way

- 1 Crooked Stick Ln

- 247 Governors Way

- 6 Crooked Stick Ln

- 246 Governors Way

- 3 Crooked Stick Ln

- 235 Governors Way

- 8 Crooked Stick Ln

- 249 Governors Way

- 2 Wentworth Place

- 233 Governors Way

- 5 Crooked Stick Ln

- 4 Wentworth Place

- 7 Wentworth Place