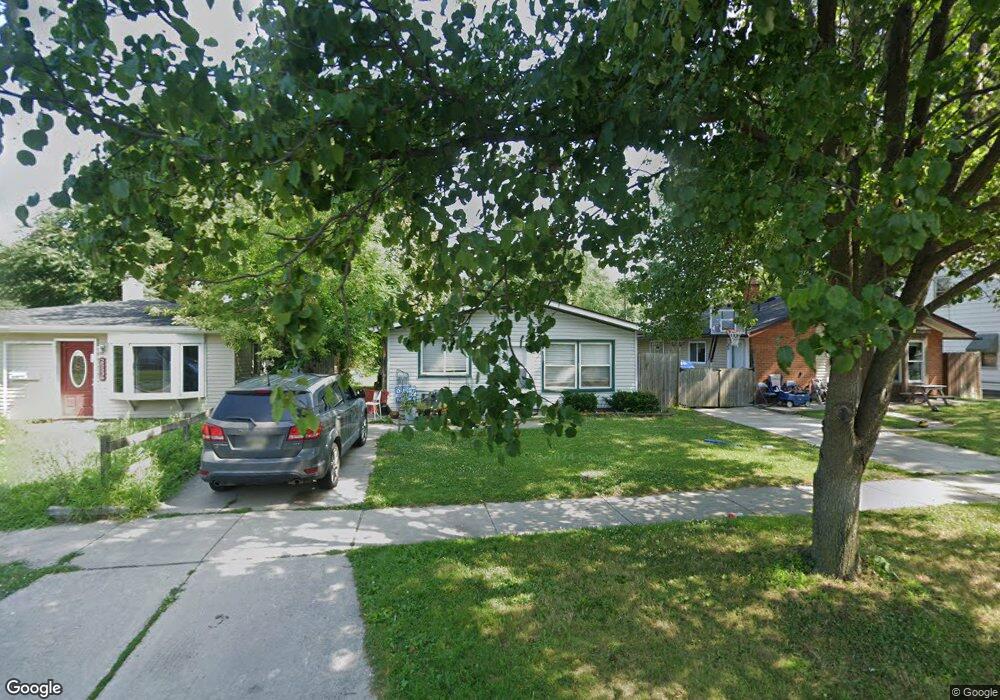

25526 Powers Ave Dearborn Heights, MI 48125

Estimated Value: $123,000 - $165,547

3

Beds

1

Bath

936

Sq Ft

$155/Sq Ft

Est. Value

About This Home

This home is located at 25526 Powers Ave, Dearborn Heights, MI 48125 and is currently estimated at $144,637, approximately $154 per square foot. 25526 Powers Ave is a home located in Wayne County with nearby schools including Quest Charter Academy, West Village Academy, and Peterson-Warren Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 13, 2024

Sold by

Declaration Of Trust For Laurel A Steven and Stevens Laurel A

Bought by

Ksj-Llc

Current Estimated Value

Purchase Details

Closed on

Jul 18, 2018

Sold by

Hussein Samart G

Bought by

Trust For Laurel A Stevens

Purchase Details

Closed on

Aug 16, 2012

Sold by

Hussein Bilal G

Bought by

Hussein Samar G

Purchase Details

Closed on

Nov 12, 2008

Sold by

The Bank Of New York Mellon Trust Compan

Bought by

Hussein Bilal G

Purchase Details

Closed on

Feb 7, 2008

Sold by

Shippey Tiffany N

Bought by

The Bank Of New York Trust Co Na and Jp Morgan Chase Bank Na

Purchase Details

Closed on

May 13, 2003

Sold by

Patterson Ronald W and Patterson Betty

Bought by

Shippey Tiffany N

Purchase Details

Closed on

May 2, 2003

Sold by

Moss David L and Moss Debbie A

Bought by

Patterson Ronald W

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ksj-Llc | $675,000 | Title One | |

| Ksj-Llc | $675,000 | Title One | |

| Trust For Laurel A Stevens | $60,000 | None Available | |

| Hussein Samar G | $200 | None Available | |

| Hussein Bilal G | $20,000 | Attorneys Title Agency Llc | |

| The Bank Of New York Trust Co Na | $39,600 | None Available | |

| Shippey Tiffany N | $83,000 | Great Lakes Title Of Michiga | |

| Patterson Ronald W | $32,000 | Great Lakes Title Of Michiga |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,318 | $58,300 | $0 | $0 |

| 2024 | $1,318 | $48,200 | $0 | $0 |

| 2023 | $1,198 | $41,500 | $0 | $0 |

| 2022 | $1,761 | $35,100 | $0 | $0 |

| 2021 | $1,748 | $31,000 | $0 | $0 |

| 2019 | $1,619 | $24,400 | $0 | $0 |

| 2018 | $914 | $22,400 | $0 | $0 |

| 2017 | $944 | $21,500 | $0 | $0 |

| 2016 | $1,355 | $21,800 | $0 | $0 |

| 2015 | $2,030 | $20,300 | $0 | $0 |

| 2013 | $2,190 | $23,100 | $0 | $0 |

| 2010 | -- | $27,400 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 25628 Powers Ave

- 5118 Michael St

- 25474 McDonald St

- 25926 Powers Ave

- 25965 Currier St

- 25895 Annapolis St

- 5842 Janet St

- 26106 Powers Ave

- 5845 Beech Daly Rd

- 4856 Carolee Ln

- 5904 Janet St

- 25243 Lehigh St

- 5961 Beech Daly Rd

- 25212 Lehigh St

- 25118 Lehigh St

- 26225 McDonald St

- 5963 Vivian St

- 24754 Annapolis St

- 5961 Marvin St

- 6020 Vivian St

- 25536 Powers Ave

- 25518 Powers Ave

- 25510 Powers Ave

- 25548 Powers Ave

- 25543 Pennie St

- 25527 Pennie St

- 25519 Pennie St

- 25549 Pennie St

- 25525 Powers Ave

- 25515 Powers Ave

- 25535 Powers Ave

- 25468 Powers Ave

- 25469 Pennie St

- 25547 Powers Ave

- 25493 Powers Ave

- 25458 Powers Ave

- 25459 Pennie St

- 25481 Powers Ave

- 25612 Powers Ave

- 25605 Powers Ave