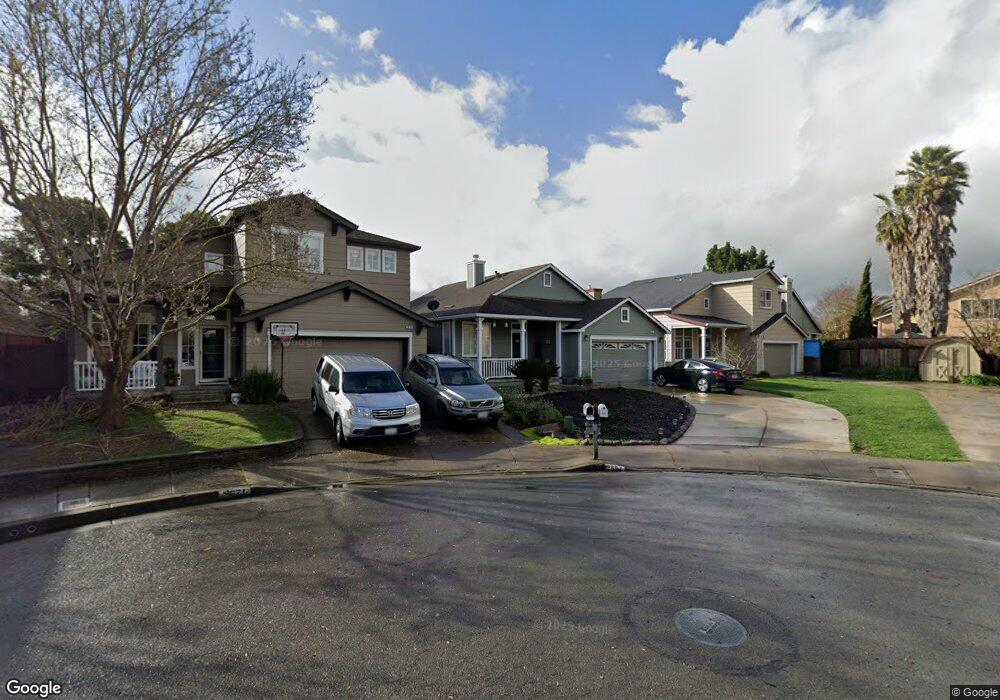

2667 Wild Bill Cir Santa Rosa, CA 95407

Estimated Value: $589,631 - $701,000

3

Beds

2

Baths

1,157

Sq Ft

$555/Sq Ft

Est. Value

About This Home

This home is located at 2667 Wild Bill Cir, Santa Rosa, CA 95407 and is currently estimated at $641,658, approximately $554 per square foot. 2667 Wild Bill Cir is a home located in Sonoma County with nearby schools including Elsie Allen High School and St. Michael's Orthodox School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 27, 2003

Sold by

Mora Norberto

Bought by

Gomez Miriam M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$297,600

Outstanding Balance

$139,259

Interest Rate

6.25%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$502,399

Purchase Details

Closed on

Oct 16, 2003

Sold by

Bowling Ron

Bought by

Gomez Miriam

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$297,600

Outstanding Balance

$139,259

Interest Rate

6.25%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$502,399

Purchase Details

Closed on

Jan 21, 2000

Sold by

Bellevue Ranch Associates Llc

Bought by

Bowling Ron

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,100

Interest Rate

7.87%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gomez Miriam M | -- | Fidelity Natl Title Co | |

| Gomez Miriam | $372,000 | Fidelity Natl Title Co | |

| Bowling Ron | $193,000 | North American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gomez Miriam | $297,600 | |

| Previous Owner | Bowling Ron | $154,100 | |

| Closed | Gomez Miriam | $74,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,014 | $528,886 | $213,261 | $315,625 |

| 2024 | $6,014 | $518,517 | $209,080 | $309,437 |

| 2023 | $6,014 | $508,351 | $204,981 | $303,370 |

| 2022 | $5,869 | $498,384 | $200,962 | $297,422 |

| 2021 | $5,805 | $488,613 | $197,022 | $291,591 |

| 2020 | $5,638 | $483,604 | $195,002 | $288,602 |

| 2019 | $5,568 | $474,123 | $191,179 | $282,944 |

| 2018 | $5,522 | $464,828 | $187,431 | $277,397 |

| 2017 | $5,152 | $436,000 | $176,000 | $260,000 |

| 2016 | $4,805 | $404,000 | $163,000 | $241,000 |

| 2015 | $4,181 | $358,000 | $144,000 | $214,000 |

| 2014 | $3,917 | $341,000 | $138,000 | $203,000 |

Source: Public Records

Map

Nearby Homes

- 2630 Arrowhead Dr

- 2632 Wild Bill Way

- 2599 Silver Spur Dr

- 2863 Liscum St

- 2912 Liscum St

- Plan 2 at Grove Village

- Plan 4 at Grove Village

- Plan 5 at Grove Village

- Plan 1 at Grove Village

- Plan 6 at Grove Village

- 2716 Amora Cir

- 2931 Liscum St

- 2928 Liscum St

- 2766 Sassy St

- 2778 Sassy St

- 1461 Trombetta St

- 2786 Sassy St

- 2790 Sassy St

- 2771 Sassy St

- 2779 Sassy St

- 2665 Wild Bill Cir

- 2671 Wild Bill Cir

- 2673 Wild Bill Cir

- 2021 Blacksmith Way

- 2663 Wild Bill Cir

- 2017 Blacksmith Way

- 2025 Blacksmith Way

- 2642 Arrowhead Dr

- 2011 Blacksmith Way

- 2640 Arrowhead Dr

- 2029 Blacksmith Way

- 2657 Wild Bill Cir

- 2651 Wild Bill Way

- 2638 Arrowhead Dr

- 2666 Wild Bill Cir

- 2653 Wild Bill Cir

- 2636 Arrowhead Dr

- 2670 Wild Bill Cir

- 2662 Wild Bill Cir