2903 E Summer Heights San Juan, TX 78589

Estimated Value: $260,475 - $286,000

4

Beds

2

Baths

1,643

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 2903 E Summer Heights, San Juan, TX 78589 and is currently estimated at $272,869, approximately $166 per square foot. 2903 E Summer Heights is a home with nearby schools including Alfred Sorensen Elementary, Stephen F. Austin Middle School, and PSJA Early College High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 29, 2023

Sold by

El Piloto Enterprises Llc

Bought by

Summer Heights Lot 16 Series and El Piloto Holdings Llc

Current Estimated Value

Purchase Details

Closed on

Oct 29, 2021

Sold by

Isasi Raquel

Bought by

Sanchez Joel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$235,653

Interest Rate

2.88%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 10, 2018

Sold by

Lagarda Angel

Bought by

Isasi Raquel

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Summer Heights Lot 16 Series | -- | None Listed On Document | |

| Summer Heights Lot 46 Series | -- | None Listed On Document | |

| Summer Heights Lot 5 Series | -- | None Listed On Document | |

| Summer Heights Lot 22 Series | -- | None Listed On Document | |

| Summer Heights Lot 8 Series | -- | None Listed On Document | |

| Summer Heights Lot 17 Series | -- | None Listed On Document | |

| Sanchez Joel | -- | Capital Title | |

| Isasi Raquel | -- | Valley Land Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sanchez Joel | $235,653 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,366 | $259,539 | $58,310 | $201,229 |

| 2024 | $6,366 | $245,689 | $58,310 | $187,379 |

| 2023 | $6,361 | $245,689 | $58,310 | $187,379 |

| 2022 | $5,857 | $211,913 | $53,410 | $158,503 |

| 2021 | $1,371 | $48,510 | $48,510 | $0 |

| 2020 | $986 | $34,300 | $34,300 | $0 |

| 2019 | $876 | $29,400 | $29,400 | $0 |

| 2018 | $881 | $29,400 | $29,400 | $0 |

| 2017 | $1,774 | $58,800 | $58,800 | $0 |

| 2016 | $1,774 | $58,800 | $58,800 | $0 |

| 2015 | $569 | $20,580 | $20,580 | $0 |

Source: Public Records

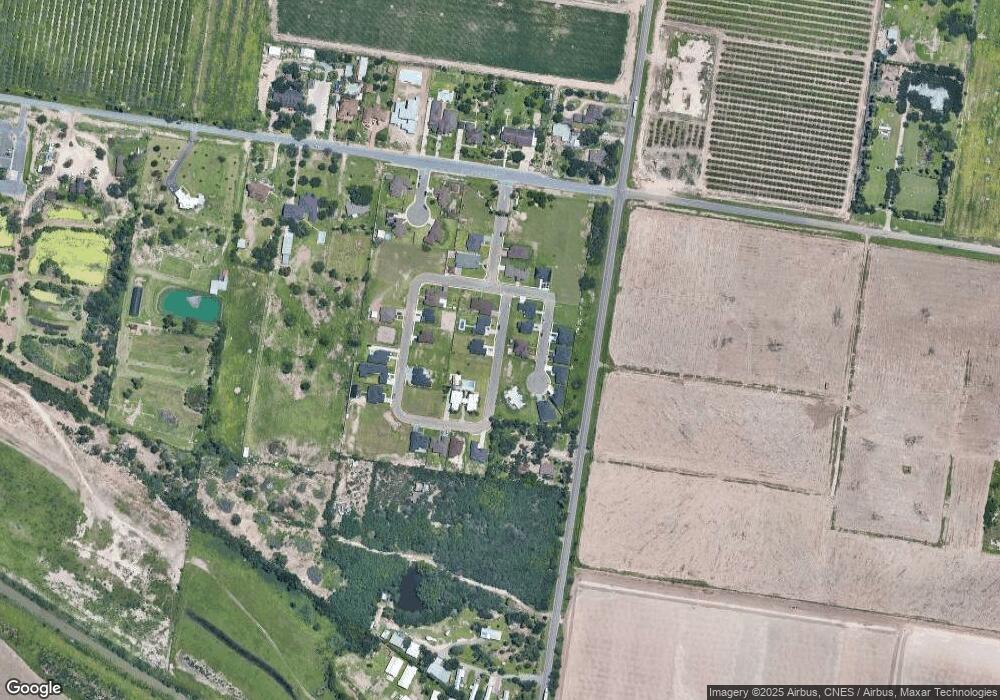

Map

Nearby Homes

- 2903 W Summer Heights

- 2907 Summer Village Cir

- 2801 Summer Heights Dr

- 3001 Lot#16 Summer Heights Dr

- 409 Lot #8 Summer Heights Dr

- 509 N Lot#46 Summer Heights Dr

- 409 Lot #17 Summer Heights Dr

- 321 Hall Acres Rd

- 200 S Stewart Rd

- 419 Melo Gold St

- 421 Melo Gold St

- 413 Melo Gold St

- 501 Melo Gold St

- 503 Melo Gold St

- 100 Lauryn Dr

- 505 St

- 414 Rio Red St

- 2408 San Pascual St

- 412 Rio Red St

- 509 Rio Red St

- 2901 E Summer Heights

- 2902 W Summer Heights

- 2811 E Summer Heights

- 2900 Lot #26 W Summer Heights Dr

- 2904 W Summer Heights

- 2904 W Summer Heights

- 2900 W Summer Heights

- 2903 Summer Village Cir

- 2900 W Summer Heights

- 2905 Summer Village Cir

- 2901 Summer Village Cir

- 2907 E Summer Heights

- 2906 W Summer Heights

- 2906 W Summer Heights

- 2811 Summer Village Cir

- 2909 Summer Village Cir

- 2909 Summer Village Cir

- 2807 Summer Heights Dr

- 2810 Lot#45 Summer Village Cir

- 2902 Lot 43 Summer Village Cir