301 S Grant St Earlville, IL 60518

Estimated Value: $205,000 - $286,000

5

Beds

3

Baths

1,500

Sq Ft

$160/Sq Ft

Est. Value

About This Home

This home is located at 301 S Grant St, Earlville, IL 60518 and is currently estimated at $239,934, approximately $159 per square foot. 301 S Grant St is a home located in LaSalle County with nearby schools including Earlville Elementary School and Earlville Junior/Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 17, 2020

Sold by

Eva Apartments & Storfront Inc

Bought by

Fox Thomas E and Fox Kevin P

Current Estimated Value

Purchase Details

Closed on

Oct 31, 2018

Sold by

Pfaff Gregg L and Pfaff Rhiannon C

Bought by

Sampson Shaun Christopher and Sampson Kristen A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,283

Interest Rate

5.25%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 17, 2007

Sold by

Rodriguez Roel Scott and Rodriguez Cynthia L

Bought by

Pfaff Gregg and Pfaff Rhiannon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,000

Interest Rate

6.75%

Mortgage Type

Assumption

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fox Thomas E | $130,000 | Chicago Title | |

| Sampson Shaun Christopher | $150,000 | None Available | |

| Pfaff Gregg | $160,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sampson Shaun Christopher | $147,283 | |

| Previous Owner | Pfaff Gregg | $152,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,625 | $61,174 | $4,489 | $56,685 |

| 2023 | $4,176 | $54,036 | $3,965 | $50,071 |

| 2022 | $3,856 | $48,450 | $6,475 | $41,975 |

| 2021 | $3,928 | $47,621 | $6,364 | $41,257 |

| 2020 | $3,795 | $46,193 | $6,173 | $40,020 |

| 2019 | $3,696 | $44,195 | $5,906 | $38,289 |

| 2018 | $3,217 | $38,580 | $5,679 | $32,901 |

| 2017 | $2,959 | $35,210 | $5,183 | $30,027 |

| 2016 | $2,794 | $32,907 | $4,844 | $28,063 |

| 2015 | $2,675 | $31,529 | $4,641 | $26,888 |

| 2012 | -- | $37,042 | $5,452 | $31,590 |

Source: Public Records

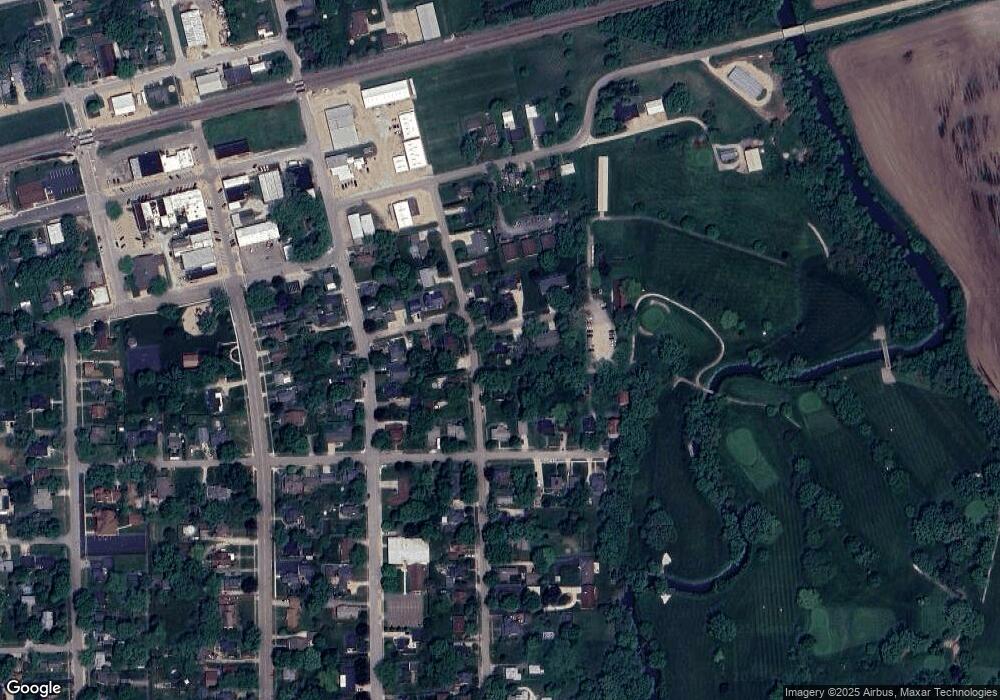

Map

Nearby Homes