3172 Kimber Ct Unit 83 San Jose, CA 95124

Doerr-Steindorf NeighborhoodEstimated Value: $644,009 - $862,000

2

Beds

1

Bath

886

Sq Ft

$818/Sq Ft

Est. Value

About This Home

This home is located at 3172 Kimber Ct Unit 83, San Jose, CA 95124 and is currently estimated at $724,752, approximately $818 per square foot. 3172 Kimber Ct Unit 83 is a home located in Santa Clara County with nearby schools including Branham High School, Fammatre Elementary School, and Sartorette Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 15, 2006

Sold by

Owen Jeffrey G and Christison Terri T

Bought by

Owen Jeffrey G and Christison Terri T

Current Estimated Value

Purchase Details

Closed on

Apr 29, 2002

Sold by

Owen Jeffrey Gordon

Bought by

Owen Jeffrey Gordon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$216,000

Outstanding Balance

$92,811

Interest Rate

7.18%

Estimated Equity

$631,941

Purchase Details

Closed on

Oct 23, 1997

Sold by

Calvetti Alfredo

Bought by

Owen Jeffrey Gordon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,400

Interest Rate

7.36%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Owen Jeffrey G | -- | None Available | |

| Owen Jeffrey G | -- | None Available | |

| Owen Jeffrey Gordon | -- | American Title Co | |

| Owen Jeffrey Gordon | $152,000 | Golden California Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Owen Jeffrey Gordon | $216,000 | |

| Closed | Owen Jeffrey Gordon | $144,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,727 | $242,679 | $109,203 | $133,476 |

| 2024 | $3,727 | $237,921 | $107,062 | $130,859 |

| 2023 | $3,684 | $233,257 | $104,963 | $128,294 |

| 2022 | $3,638 | $228,684 | $102,905 | $125,779 |

| 2021 | $3,556 | $224,201 | $100,888 | $123,313 |

| 2020 | $3,428 | $221,903 | $99,854 | $122,049 |

| 2019 | $3,393 | $217,553 | $97,897 | $119,656 |

| 2018 | $3,307 | $213,288 | $95,978 | $117,310 |

| 2017 | $3,185 | $209,107 | $94,097 | $115,010 |

| 2016 | $3,030 | $205,007 | $92,252 | $112,755 |

| 2015 | $2,986 | $201,929 | $90,867 | $111,062 |

| 2014 | $2,877 | $197,975 | $89,088 | $108,887 |

Source: Public Records

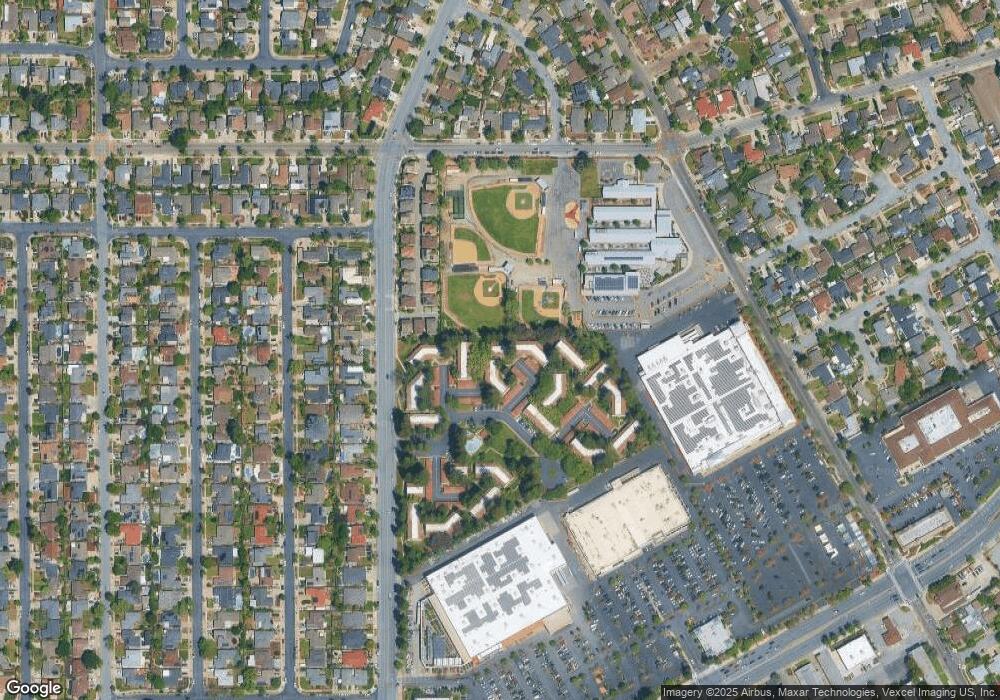

Map

Nearby Homes

- 3328 Kimber Ct Unit 21

- 1828 Nestorita Way

- 2925 Newark Way

- 3429 New Jersey Ave

- 1795 Foxworthy Ave

- 1921 Camden Ave

- 1800 Donna Ln

- 2917 Quinto Way

- 3231 Lanelle Place

- 14361 Lenray Ln

- 3771 Justine Dr

- 2772 Quinto Way

- 1503 Love Ct

- 3335 Jennifer Way

- 1756 Hallmark Ln

- 3825 Woodford Dr

- 14570 Wyrick Ave

- 1507 Love Ct

- 1500 Paradise Ct

- 1502 Love Ct

- 3172 Kimber Ct Unit 82

- 3172 Kimber Ct Unit 81

- 3164 Kimber Ct Unit 66

- 3164 Kimber Ct Unit 65

- 3164 Kimber Ct Unit 72

- 3164 Kimber Ct Unit 71

- 3164 Kimber Ct Unit 70

- 3164 Kimber Ct Unit 69

- 3164 Kimber Ct Unit 68

- 3164 Kimber Ct Unit 67

- 3186 Kimber Ct Unit 92

- 3186 Kimber Ct Unit 91

- 3186 Kimber Ct Unit 90

- 3186 Kimber Ct Unit 89

- 3186 Kimber Ct Unit 88

- 3186 Kimber Ct Unit 87

- 3186 Kimber Ct Unit 86

- 3186 Kimber Ct Unit 85

- 3212 Kimber Ct Unit 80

- 3212 Kimber Ct Unit 80