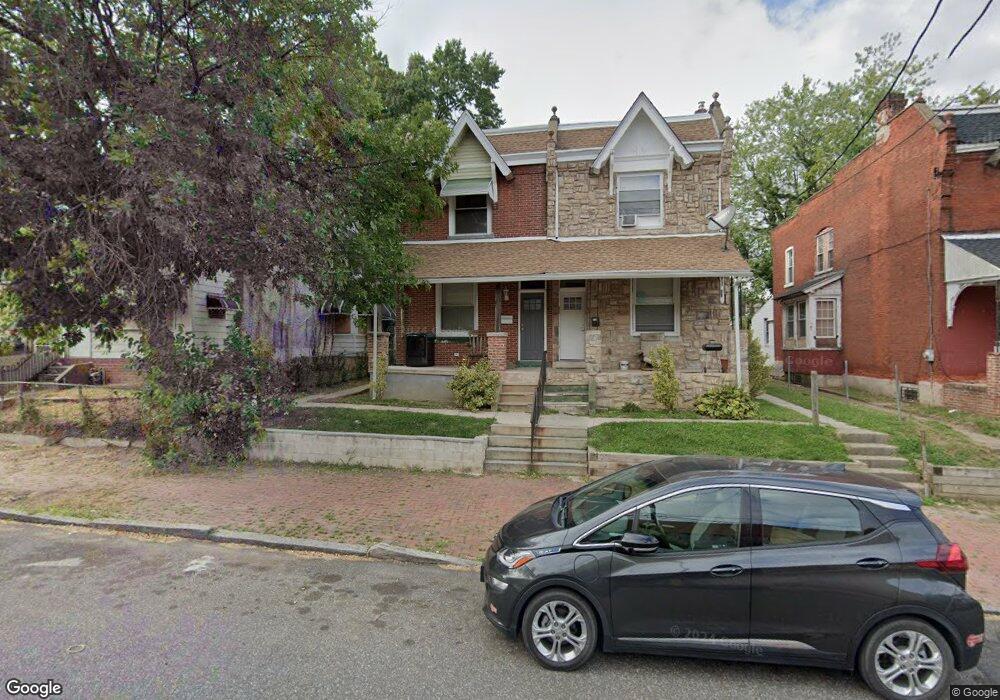

318 W 8th St Chester, PA 19013

Estimated Value: $68,000 - $146,000

3

Beds

1

Bath

1,659

Sq Ft

$60/Sq Ft

Est. Value

About This Home

This home is located at 318 W 8th St, Chester, PA 19013 and is currently estimated at $99,495, approximately $59 per square foot. 318 W 8th St is a home located in Delaware County with nearby schools including Chester Community Charter School, Institute of Islamic Studies, and Faith Temple Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 29, 2017

Sold by

Herring Jamar A

Bought by

Gene Mack Properties Llc

Current Estimated Value

Purchase Details

Closed on

Jul 4, 2015

Sold by

Tax Claim Bureau

Bought by

Herring Jamar A

Purchase Details

Closed on

Jul 26, 2004

Sold by

Trico Properties Llc

Bought by

Dragon Realty Lp

Purchase Details

Closed on

Oct 10, 2002

Sold by

Mason Philip G

Bought by

Trico Properties Llc

Purchase Details

Closed on

Sep 11, 2001

Sold by

Hud

Bought by

Mason Phillip G

Purchase Details

Closed on

May 14, 2001

Sold by

Midfirst Bank

Bought by

Hud

Purchase Details

Closed on

Jan 17, 2001

Sold by

Daniels Patricia and Brown Annette

Bought by

Midfirst Bank

Purchase Details

Closed on

Jan 6, 1999

Sold by

Brown Calvin and Brown Annette

Bought by

Daniels George and Daniels Patrice

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gene Mack Properties Llc | $80,000 | None Available | |

| Herring Jamar A | $650 | None Available | |

| Dragon Realty Lp | $42,000 | -- | |

| Trico Properties Llc | $28,469 | -- | |

| Mason Phillip G | $18,010 | -- | |

| Hud | -- | -- | |

| Midfirst Bank | -- | -- | |

| Daniels George | $25,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $18 | $650 | $650 | -- |

| 2024 | $18 | $650 | $650 | -- |

| 2023 | $18 | $650 | $650 | $0 |

| 2022 | $19 | $650 | $650 | $0 |

| 2021 | $8 | $650 | $650 | $0 |

| 2020 | $4 | $650 | $650 | $0 |

| 2019 | $4 | $650 | $650 | $0 |

| 2018 | $4 | $650 | $0 | $0 |

| 2017 | $4 | $650 | $0 | $0 |

| 2016 | $4 | $650 | $0 | $0 |

| 2015 | $4 | $26,360 | $0 | $0 |

| 2014 | $148 | $26,360 | $0 | $0 |

Source: Public Records

Map

Nearby Homes