3304 Fm 2280 Cleburne, TX 76031

Estimated Value: $500,000 - $670,392

3

Beds

2

Baths

2,492

Sq Ft

$235/Sq Ft

Est. Value

About This Home

This home is located at 3304 Fm 2280, Cleburne, TX 76031 and is currently estimated at $585,598, approximately $234 per square foot. 3304 Fm 2280 is a home located in Johnson County with nearby schools including Plum Creek Elementary School, Joshua High School - 9th Grade Campus, and Joshua High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 22, 2020

Sold by

Pettit Jarrod

Bought by

Dji Unlimited Llc

Current Estimated Value

Purchase Details

Closed on

Oct 1, 2019

Sold by

Fox Al and Fox Helen

Bought by

Ranch Oaks Mhp Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$174,435

Interest Rate

3.5%

Mortgage Type

Construction

Estimated Equity

$411,163

Purchase Details

Closed on

Jul 1, 2013

Sold by

Wells Fargo Bank Na

Bought by

Ricardos Trailer Park Llc

Purchase Details

Closed on

Apr 2, 2013

Sold by

Dueboay Steve

Bought by

Wells Fargo Bank Na and Abfc 2005-Opt1 Trust

Purchase Details

Closed on

Jun 15, 2005

Sold by

Ricardo Trailer Park Llc

Bought by

Dueboay Steve

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,000

Interest Rate

7.9%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dji Unlimited Llc | $2,400,000 | None Listed On Document | |

| Ranch Oaks Mhp Llc | -- | Capital Title | |

| Ricardos Trailer Park Llc | -- | None Available | |

| Wells Fargo Bank Na | $98,000 | None Available | |

| Dueboay Steve | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ranch Oaks Mhp Llc | $200,000 | |

| Previous Owner | Dueboay Steve | $144,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,181 | $660,666 | $366,000 | $294,666 |

| 2024 | $9,181 | $526,354 | $0 | $0 |

| 2023 | $6,906 | $541,543 | $232,800 | $308,743 |

| 2022 | $7,885 | $438,628 | $232,800 | $205,828 |

| 2021 | $4,258 | $233,976 | $109,600 | $124,376 |

| 2020 | $4,615 | $233,976 | $109,600 | $124,376 |

| 2019 | $4,346 | $206,776 | $109,600 | $97,176 |

| 2018 | $4,511 | $206,776 | $109,600 | $97,176 |

| 2017 | $4,507 | $206,776 | $109,600 | $97,176 |

| 2016 | $4,507 | $206,776 | $109,600 | $97,176 |

| 2015 | -- | $232,296 | $135,120 | $97,176 |

Source: Public Records

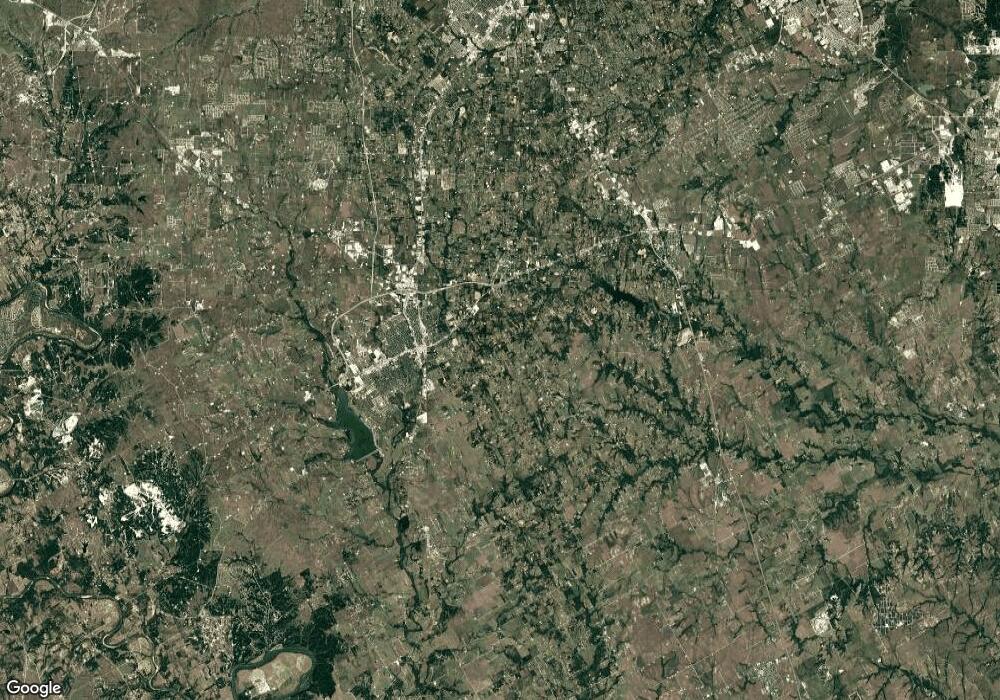

Map

Nearby Homes

- 3920 County Road 805b

- 2720 Hill Ln

- 4200 Fm 2280

- 529 Neely Ln

- 2820 County Road 805b

- 2812 County Road 805b

- 5405 County Road 704d

- 4032 Highland Oaks Ln

- 2001 Beauty Berry Ct

- 4105 Highland Oaks Ln

- 2517 County Road 805b

- 2341 Oak Leaf Trail

- 1105 Snowberry St

- 3813 Ponderosa Cir

- TBD County Road 703a

- 407 E Oakdale St

- 1311 County Road 702

- 5227 County Road 703

- 406 N Eastern St

- 503 N Fairview St Unit LOT 46