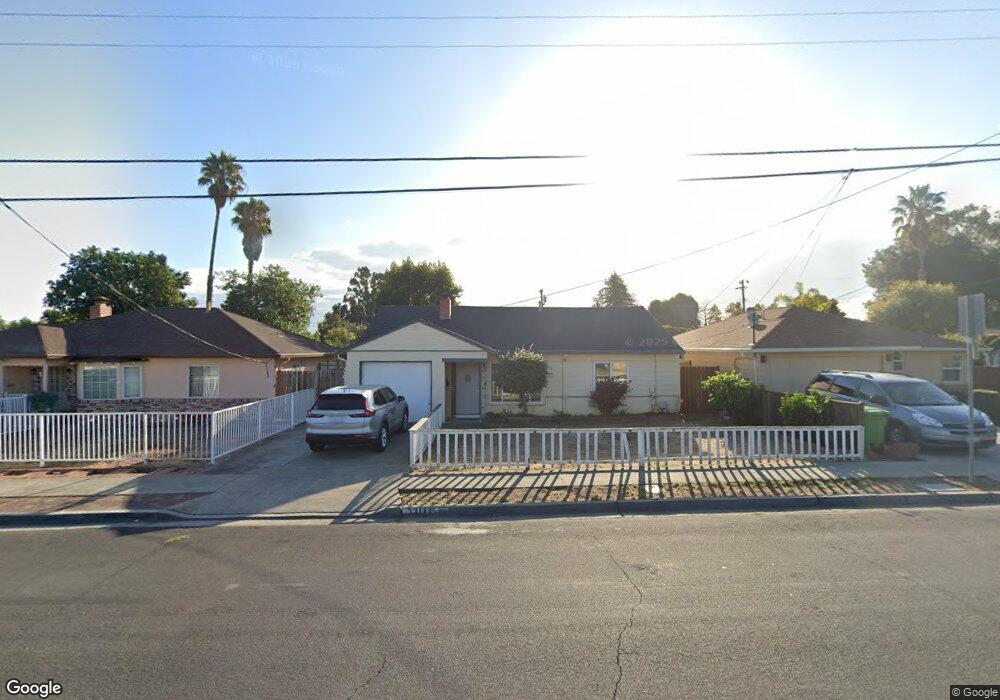

33111 8th St Union City, CA 94587

Downtown Union City NeighborhoodEstimated Value: $698,611 - $1,039,000

3

Beds

1

Bath

1,024

Sq Ft

$810/Sq Ft

Est. Value

About This Home

This home is located at 33111 8th St, Union City, CA 94587 and is currently estimated at $829,403, approximately $809 per square foot. 33111 8th St is a home located in Alameda County with nearby schools including Hillview Crest Elementary School, Cesar Chavez Middle School, and James Logan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 20, 2017

Sold by

Vachher Rohit K

Bought by

Vachher Rohit K and The Rohit Vachher Living Trust

Current Estimated Value

Purchase Details

Closed on

Jan 18, 2012

Sold by

Ramirez Rita Elizabeth and Ramirez Rita

Bought by

Vachher Rohit K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$159,600

Outstanding Balance

$108,892

Interest Rate

3.88%

Mortgage Type

New Conventional

Estimated Equity

$720,511

Purchase Details

Closed on

Jan 24, 2006

Sold by

Ramirez Carlos

Bought by

Ramirez Rita Elizabeth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$435,200

Interest Rate

6.62%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 17, 2006

Sold by

Sarmento Harry and Sarmento Dorothy

Bought by

Ramirez Rita

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$435,200

Interest Rate

6.62%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vachher Rohit K | -- | None Available | |

| Vachher Rohit K | $199,500 | Old Republic Title Company | |

| Ramirez Rita Elizabeth | -- | Chicago Title Company | |

| Ramirez Rita | $544,000 | Chicago Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vachher Rohit K | $159,600 | |

| Previous Owner | Ramirez Rita Elizabeth | $435,200 | |

| Previous Owner | Ramirez Rita | $108,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,652 | $250,569 | $75,108 | $175,461 |

| 2024 | $4,652 | $245,657 | $73,635 | $172,022 |

| 2023 | $4,454 | $240,842 | $72,192 | $168,650 |

| 2022 | $4,349 | $236,119 | $70,776 | $165,343 |

| 2021 | $4,252 | $231,491 | $69,389 | $162,102 |

| 2020 | $4,190 | $229,119 | $68,678 | $160,441 |

| 2019 | $4,213 | $224,628 | $67,332 | $157,296 |

| 2018 | $4,112 | $220,225 | $66,012 | $154,213 |

| 2017 | $4,012 | $215,908 | $64,718 | $151,190 |

| 2016 | $3,870 | $211,674 | $63,449 | $148,225 |

| 2015 | $3,790 | $208,496 | $62,496 | $146,000 |

| 2014 | $3,648 | $204,412 | $61,272 | $143,140 |

Source: Public Records

Map

Nearby Homes

- 1028 Montoya Terrace Unit 2

- 136 Tamarack Dr

- 33548 4th St

- 32306 Ithaca St

- 33359 University Dr

- 33603 3rd St

- 33528 13th St

- 902 G St

- 33718 3rd St

- 33721 12th St

- 54 Lafayette Ave

- 33840 10th St

- 31953 Potsdam St

- 31959 Carroll Ave

- 33848 10th St

- 33853 10th St

- 33846 14th St

- 32072 Chicoine Ave

- 31865 Chicoine Ave

- 33852 11th St