344 N Ridge Heights Dr Howard, OH 43028

Apple Valley NeighborhoodEstimated Value: $339,000 - $410,000

4

Beds

6

Baths

1,044

Sq Ft

$351/Sq Ft

Est. Value

About This Home

This home is located at 344 N Ridge Heights Dr, Howard, OH 43028 and is currently estimated at $366,735, approximately $351 per square foot. 344 N Ridge Heights Dr is a home located in Knox County with nearby schools including East Knox Elementary School and East Knox High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 10, 2010

Sold by

Eckman David W and Eckman Sandra L

Bought by

Parris Thomas S and Parris Donna M

Current Estimated Value

Purchase Details

Closed on

Jul 6, 2006

Sold by

Boerner Kenneth A and Ferre Lorraine A

Bought by

Eckman David W and Eckman Sandra L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,100

Outstanding Balance

$85,283

Interest Rate

6.72%

Mortgage Type

New Conventional

Estimated Equity

$281,452

Purchase Details

Closed on

Sep 2, 1999

Sold by

Ferre Lorraine A

Bought by

Ferre Lorraine A and Ferre Boerne

Purchase Details

Closed on

Jun 16, 1998

Sold by

Perrine Anthony J and Perrine Sylvi

Bought by

Ferre Lorraine A

Purchase Details

Closed on

Jun 19, 1997

Sold by

Curl Harrold T and Curl Louise G

Bought by

Perrine Anthony J and Perrine Sylvi

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Parris Thomas S | $108,000 | None Available | |

| Eckman David W | $159,000 | None Available | |

| Ferre Lorraine A | -- | -- | |

| Ferre Lorraine A | $97,000 | -- | |

| Perrine Anthony J | $90,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Eckman David W | $143,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,094 | $75,470 | $17,220 | $58,250 |

| 2023 | $3,094 | $75,470 | $17,220 | $58,250 |

| 2022 | $2,483 | $52,050 | $11,880 | $40,170 |

| 2021 | $2,483 | $52,050 | $11,880 | $40,170 |

| 2020 | $2,370 | $52,050 | $11,880 | $40,170 |

| 2019 | $2,299 | $46,350 | $11,250 | $35,100 |

| 2018 | $2,156 | $46,350 | $11,250 | $35,100 |

| 2017 | $2,140 | $46,350 | $11,250 | $35,100 |

| 2016 | $2,012 | $42,910 | $10,410 | $32,500 |

| 2015 | $1,836 | $42,910 | $10,410 | $32,500 |

| 2014 | $1,839 | $42,910 | $10,410 | $32,500 |

| 2013 | $2,021 | $44,800 | $10,880 | $33,920 |

Source: Public Records

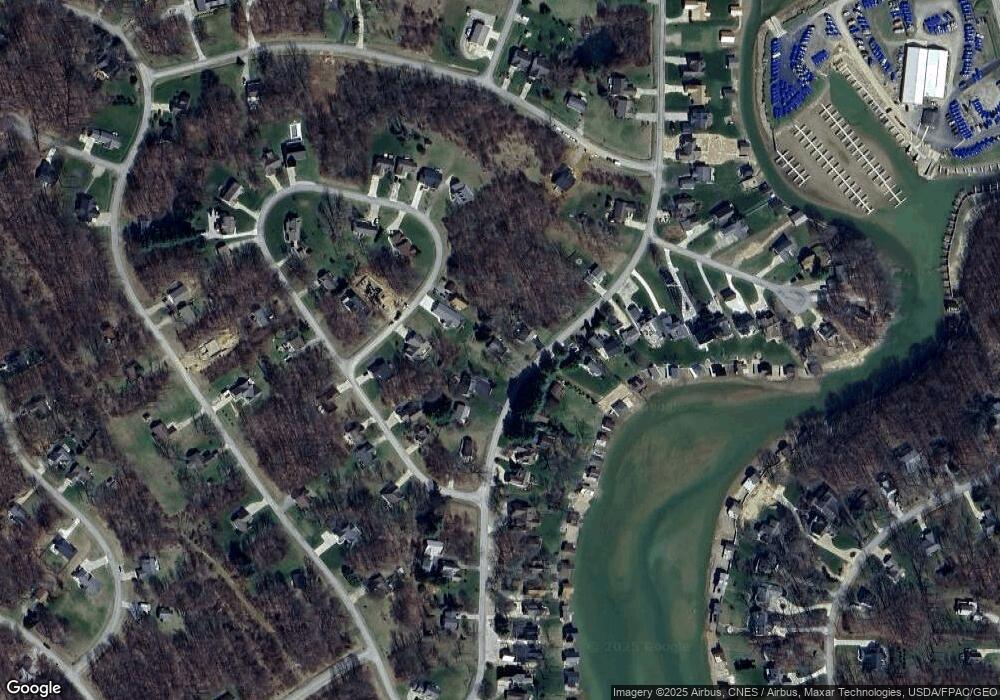

Map

Nearby Homes

- 202 Glenridge Cir

- 392 N Ridge Heights Dr

- 381 N Ridge Heights Dr

- 381 Northridge Heights Dr

- 665 Highland Hills Dr

- 741 Floral Valley Dr E

- 561 Glenmonte Dr

- 2863 Apple Valley Dr

- 42 N Highland Ct

- 0 Northridge Heights Dr Unit 481 225013751

- 2599 Apple Valley Dr

- 2543 Apple Valley Dr

- 577 Floral Valley Dr W

- 431 Highland Hills Cir

- 783 Crestrose Dr

- 2527 Apple Valley Dr

- 0 Crestrose Dr Unit 20250705

- 353 Valleybrook Cir

- 419 Highland Hills Cir

- 553 Floral Valley Dr W

- 348 N Ridge Heights Dr

- 348 N Ridge Heights Dr

- 336 N Ridge Heights Dr

- 336 Northridge Heights Dr

- 327 Glenridge Cir

- 323 Glenridge Cir

- 332 Northridge Heights Dr

- 332 N Ridge Heights Dr

- 332 N Ridge Heights Dr

- 335 Glenridge Cir

- 345 N Ridge Heights Dr

- 353 N Ridge Heights Dr

- 337 N Ridge Heights Dr

- 333 N Ridge Heights Dr

- 218 Glenridge Cir

- 357 N Ridge Heights Dr

- 214 Glenridge Cir

- 0 N Glenridge Cir Unit Lt547 2657189

- 0 N Glenridge Cir Unit 2534770

- 0 N Glenridge Cir Unit 2130131