37553 Summer Holly Common Fremont, CA 94536

Centerville District NeighborhoodEstimated Value: $1,507,747 - $1,759,000

4

Beds

3

Baths

1,866

Sq Ft

$860/Sq Ft

Est. Value

About This Home

This home is located at 37553 Summer Holly Common, Fremont, CA 94536 and is currently estimated at $1,605,687, approximately $860 per square foot. 37553 Summer Holly Common is a home located in Alameda County with nearby schools including John G. Mattos Elementary School, G.M. Walters Middle School, and John F. Kennedy High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2022

Sold by

Harris-Agodi Sylaine

Bought by

Sylaine Harris-Agodi Living Trust and Harris-Agodi

Current Estimated Value

Purchase Details

Closed on

Jan 20, 2021

Sold by

Harris Agodi Sylaine

Bought by

Harris Agodi Sylaine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$667,500

Interest Rate

2.67%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 23, 1998

Sold by

Braddock & Logan Group Lp

Bought by

Agodi Frank I and Harris Agodi Sylaine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$294,930

Interest Rate

7.05%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sylaine Harris-Agodi Living Trust | -- | None Listed On Document | |

| Harris Agodi Sylaine | -- | Old Republic Title Company | |

| Harris Agodi Sylaine | -- | Old Republic Title Company | |

| Agodi Frank I | $328,000 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Harris Agodi Sylaine | $667,500 | |

| Previous Owner | Agodi Frank I | $294,930 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,553 | $516,228 | $157,591 | $365,637 |

| 2024 | $6,553 | $505,971 | $154,502 | $358,469 |

| 2023 | $6,368 | $502,913 | $151,472 | $351,441 |

| 2022 | $6,272 | $486,054 | $148,503 | $344,551 |

| 2021 | $6,121 | $476,386 | $145,591 | $337,795 |

| 2020 | $6,097 | $478,432 | $144,099 | $334,333 |

| 2019 | $6,028 | $469,053 | $141,274 | $327,779 |

| 2018 | $5,908 | $459,857 | $138,504 | $321,353 |

| 2017 | $5,760 | $450,842 | $135,789 | $315,053 |

| 2016 | $5,655 | $442,004 | $133,127 | $308,877 |

| 2015 | $5,573 | $435,364 | $131,127 | $304,237 |

| 2014 | $5,472 | $426,838 | $128,559 | $298,279 |

Source: Public Records

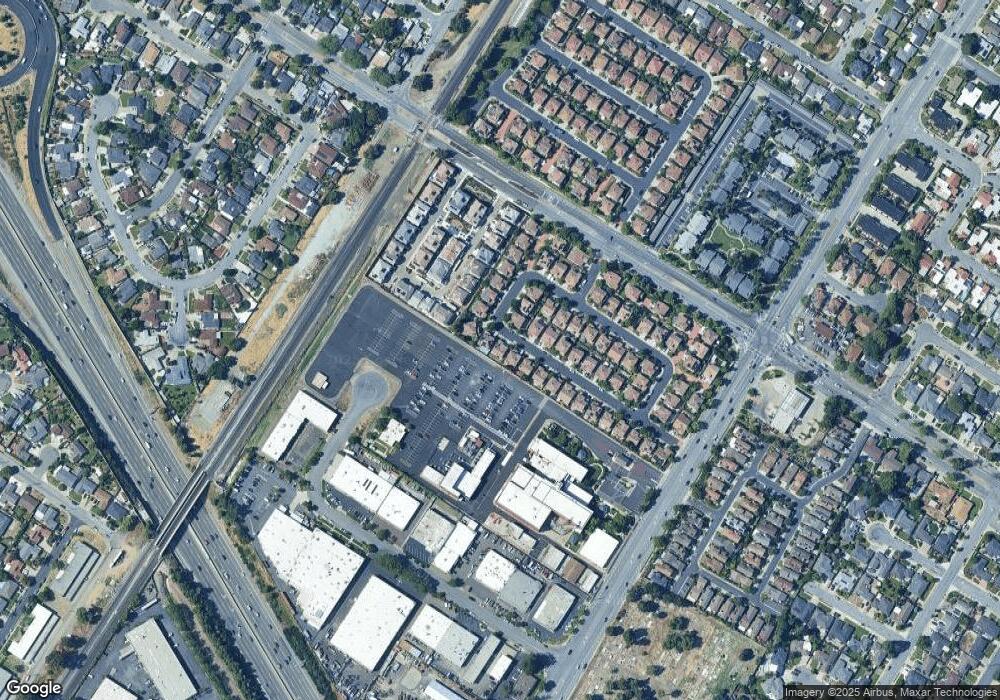

Map

Nearby Homes

- 5268 Keeler Ct

- 37792 Colfax Ct

- 37721 Madera Ct

- 4737 Deadwood Dr

- 37114 Dondero Way

- 37659 Granville Dr

- 5169 Lawler Ave

- 37987 Alta Dr

- 36720 Charles St

- 36686 Charles St

- 4637 Rothbury Common

- 5669 Civic Terrace Ave

- 38324 Blacow Rd

- 4586 Norris Rd

- 5113 Dupont Ave

- 5859 Central Ave

- 4632 Balboa Way

- 37001 Contra Costa Ave

- 4715 Eggers Dr

- 36521 Cabrillo Dr

- 37557 Summer Holly Common

- 37549 Summer Holly Common

- 37561 Summer Holly Common

- 37560 Summer Holly Common

- 37545 Summer Holly Common

- 37564 Summer Holly Common

- 37541 Summer Holly Common

- 37565 Summer Holly Common

- 37556 Summer Holly Common

- 37568 Summer Holly Common

- 37537 Summer Holly Common

- 37572 Summer Holly Common

- 37548 Summer Holly Common

- 37569 Summer Holly Common

- 37552 Summer Holly Common

- 37533 Summer Holly Common

- 37544 Summer Holly Common

- 37576 Summer Holly Common

- 37540 Summer Holly Common

- 37529 Summer Holly Common