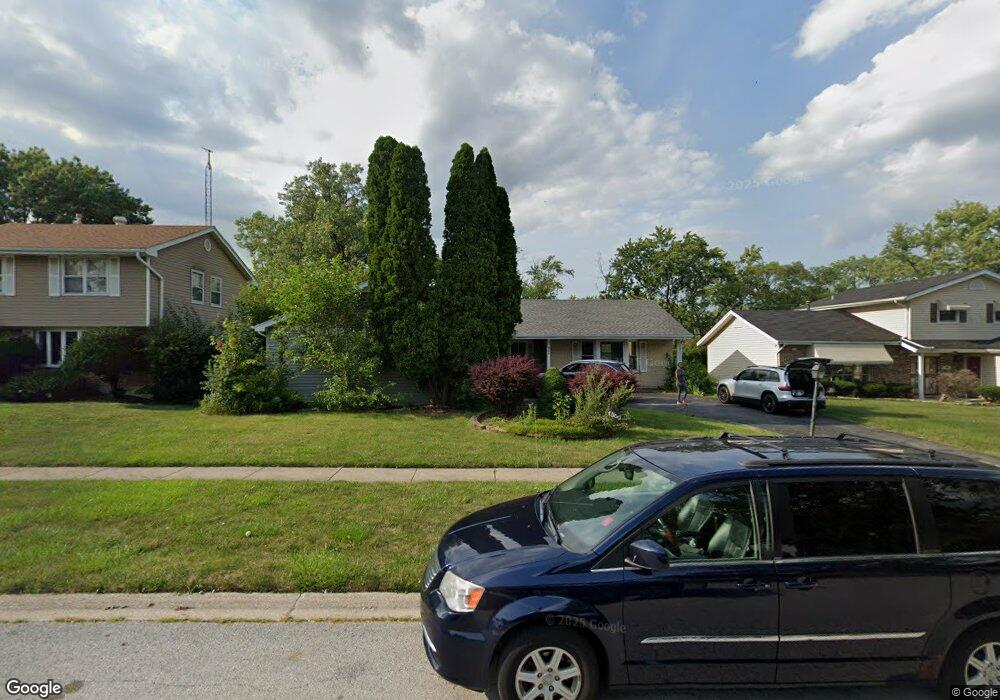

4300 176th St Country Club Hills, IL 60478

Estimated Value: $204,000 - $252,000

3

Beds

2

Baths

1,640

Sq Ft

$144/Sq Ft

Est. Value

About This Home

This home is located at 4300 176th St, Country Club Hills, IL 60478 and is currently estimated at $236,871, approximately $144 per square foot. 4300 176th St is a home located in Cook County with nearby schools including Zenon J Sykuta School, Meadowview Intermediate School, and Southwood Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 24, 2017

Sold by

The Secretary Of Veterans Affairs

Bought by

Stokes Brittney

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,140

Interest Rate

5.5%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 16, 2017

Sold by

Sales Judicial

Bought by

Midfirst Bank

Purchase Details

Closed on

May 12, 2000

Sold by

Washington Henry I and Washington Margaret

Bought by

Parker Allen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,540

Interest Rate

8.14%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stokes Brittney | -- | Landtrust National Title | |

| Midfirst Bank | -- | Attorney | |

| Parker Allen | $127,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Stokes Brittney | $97,140 | |

| Previous Owner | Parker Allen | $129,540 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,812 | $19,000 | $4,239 | $14,761 |

| 2023 | $7,424 | $19,000 | $4,239 | $14,761 |

| 2022 | $7,424 | $13,968 | $3,741 | $10,227 |

| 2021 | $7,544 | $13,967 | $3,740 | $10,227 |

| 2020 | $7,835 | $13,967 | $3,740 | $10,227 |

| 2019 | $5,795 | $11,282 | $3,491 | $7,791 |

| 2018 | $7,958 | $11,282 | $3,491 | $7,791 |

| 2017 | $5,478 | $11,282 | $3,491 | $7,791 |

| 2016 | $5,113 | $10,044 | $2,992 | $7,052 |

| 2015 | $4,889 | $10,044 | $2,992 | $7,052 |

| 2014 | $5,316 | $10,784 | $2,992 | $7,792 |

| 2013 | $5,760 | $12,493 | $2,992 | $9,501 |

Source: Public Records

Map

Nearby Homes

- 4240 176th St

- 4207 176th Place

- 4200 W 176th Place

- 4411 177th Place

- 4101 176th Place

- 4061 177th St

- 4101 Park Ln Unit 1

- 17700 Oakwood Ave

- 4421 179th St

- 4656 176th Place

- 17700 Springfield Ave

- 17942 Edwards Ave

- 17511 Winston Dr Unit 1

- 17963 Huntleigh Ct Unit 302

- 17975 Huntleigh Ct Unit 301

- 17963 Amherst Ct Unit 102

- 17975 Amherst Ct Unit 301

- 18038 Juneway Ct

- 18010 Olympia Dr

- 3740 Highland Place

- 4248 176th St

- 4308 176th St

- 4301 175th Place

- 4316 176th St Unit 11

- 4309 175th Place

- 4249 175th Place

- 4301 176th St

- 4241 175th Place

- 4249 176th St

- 4309 176th St

- 4324 176th St

- 17532 Willow Ave

- 4317 176th St

- 4325 175th Place

- 17520 Willow Ave

- 4332 176th St

- 17600 Willow Ave

- 4325 176th St

- 4333 175th Place

- 4300 176th Place