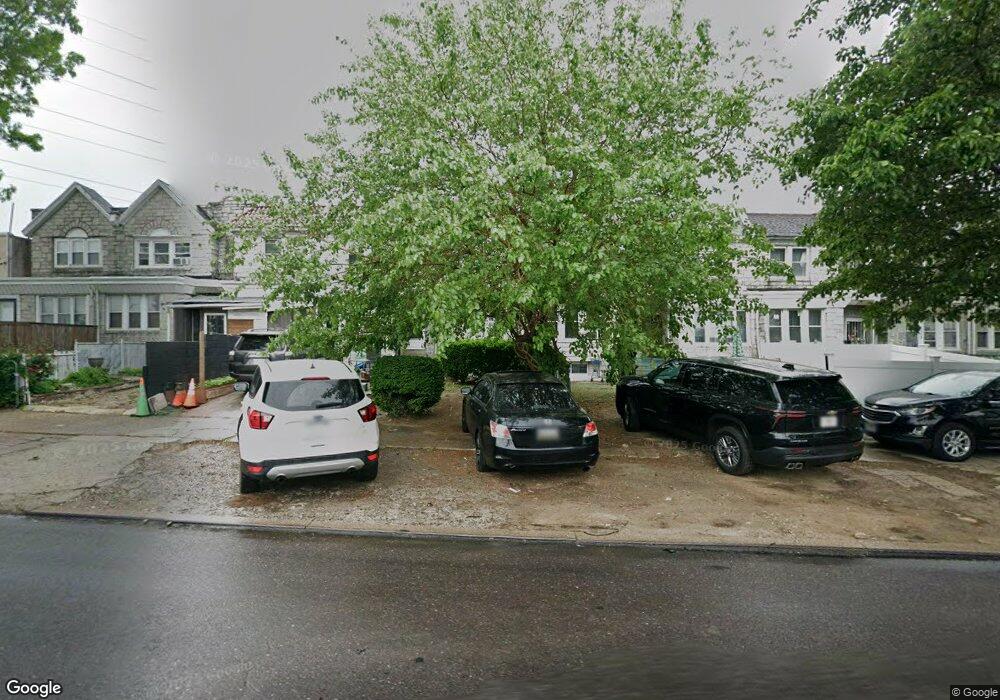

4321 Roosevelt Blvd Philadelphia, PA 19124

Lawncrest NeighborhoodEstimated Value: $200,000 - $282,000

4

Beds

3

Baths

1,563

Sq Ft

$150/Sq Ft

Est. Value

About This Home

This home is located at 4321 Roosevelt Blvd, Philadelphia, PA 19124 and is currently estimated at $235,012, approximately $150 per square foot. 4321 Roosevelt Blvd is a home located in Philadelphia County with nearby schools including Samuel Fels High School, University Creighton Charter School, and Olney Charter High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 13, 2016

Sold by

Leon Hod Win R

Bought by

Morales Yennaira Burgos

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,373

Outstanding Balance

$100,372

Interest Rate

3.59%

Mortgage Type

FHA

Estimated Equity

$134,640

Purchase Details

Closed on

Aug 7, 2013

Sold by

Donovan Shaun and Secretary Of Hud Of Washington

Bought by

Leon Rodwin R

Purchase Details

Closed on

Feb 10, 2012

Sold by

Us Bank Na

Bought by

Secretary Of Hud

Purchase Details

Closed on

Nov 7, 2011

Sold by

Morin Gabriel and Morin Yves

Bought by

Us Bank National Association and The Pennsylvania Housing Finance Agency

Purchase Details

Closed on

Jul 13, 2004

Sold by

Morin Yves

Bought by

Morin Gabriel

Purchase Details

Closed on

Jan 14, 1999

Sold by

Konert Stella D

Bought by

Morin Yves

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Morales Yennaira Burgos | $130,000 | Title Insurance Company | |

| Leon Rodwin R | $46,555 | None Available | |

| Secretary Of Hud | -- | None Available | |

| Us Bank National Association | $13,100 | None Available | |

| Morin Gabriel | -- | None Available | |

| Morin Yves | $62,700 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Morales Yennaira Burgos | $126,373 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,954 | $189,900 | $37,980 | $151,920 |

| 2024 | $1,954 | $189,900 | $37,980 | $151,920 |

| 2023 | $1,954 | $139,600 | $27,920 | $111,680 |

| 2022 | $1,463 | $139,600 | $27,920 | $111,680 |

| 2021 | $1,463 | $0 | $0 | $0 |

| 2020 | $1,463 | $0 | $0 | $0 |

| 2019 | $1,404 | $0 | $0 | $0 |

| 2018 | $1,317 | $0 | $0 | $0 |

| 2017 | $1,317 | $0 | $0 | $0 |

| 2016 | $1,304 | $0 | $0 | $0 |

| 2015 | $1,261 | $0 | $0 | $0 |

| 2014 | -- | $94,100 | $21,923 | $72,177 |

| 2012 | -- | $12,704 | $2,003 | $10,701 |

Source: Public Records

Map

Nearby Homes

- 4211 E Roosevelt Blvd

- 5233 Whitaker Ave

- 5157 Whitaker Ave

- 5233 Montour St

- 5166 Monturs St

- 786 Smylie Rd

- 736 Landis St

- 734 Landis St

- 728 Mayfair St

- 762 Herkness St

- 4003 E Roosevelt Blvd

- 5018 Pennway St

- 4704 E Roosevelt Blvd

- 5072 F St

- 5331 E Tabor Rd

- 678 Adams Ave

- 875 Foulkrod St

- 565 E Tabor Rd

- 5212 D St

- 926 Foulkrod St

- 4323 Roosevelt Blvd

- 4319 Roosevelt Blvd

- 4319 E Roosevelt Blvd

- 4323 E Roosevelt Blvd

- 4321 E Roosevelt Blvd

- 4317 Roosevelt Blvd

- 4325 Roosevelt Blvd

- 4317 E Roosevelt Blvd

- 4315 Roosevelt Blvd

- 4327 E Roosevelt Blvd

- 4313 Roosevelt Blvd

- 4329 Roosevelt Blvd

- 4311 Roosevelt Blvd

- 4311 E Roosevelt Blvd

- 4309 Roosevelt Blvd

- 4307 Roosevelt Blvd

- 4331 Roosevelt Blvd

- 4331-33 Roosevelt Blvd

- 4307 E Roosevelt Blvd

- 4305 E Roosevelt Blvd