4407 Petaluma Blvd N Petaluma, CA 94952

Estimated Value: $969,000 - $1,268,000

4

Beds

2

Baths

2,410

Sq Ft

$478/Sq Ft

Est. Value

About This Home

This home is located at 4407 Petaluma Blvd N, Petaluma, CA 94952 and is currently estimated at $1,151,769, approximately $477 per square foot. 4407 Petaluma Blvd N is a home located in Sonoma County with nearby schools including Petaluma Junior High School, Petaluma High School, and Cinnabar Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 27, 2004

Sold by

Obrien Martha E

Bought by

Obrien Martha E and Fietz Dale

Current Estimated Value

Purchase Details

Closed on

Jul 23, 2004

Sold by

Obrien John

Bought by

Obrien Martha E

Purchase Details

Closed on

Feb 18, 2000

Sold by

Pacheco Leo D

Bought by

Obrien John and Obrien Martha S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$303,750

Outstanding Balance

$100,118

Interest Rate

8.12%

Estimated Equity

$1,051,651

Purchase Details

Closed on

Jun 22, 1994

Sold by

Pacheco Leo D and Pacheco Leo

Bought by

Pacheco Leo D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$10,000

Interest Rate

8.6%

Purchase Details

Closed on

Jun 7, 1994

Sold by

Va

Bought by

Pacheco Leo D and Pacheco Olivia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$10,000

Interest Rate

8.6%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Obrien Martha E | -- | Financial Title Company | |

| Obrien Martha E | -- | Financial Title Company | |

| Obrien John | $405,000 | First American Title Co | |

| Pacheco Leo D | -- | Chicago Title Company | |

| Pacheco Leo D | -- | Chicago Title Company | |

| Pacheco Leo D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Obrien John | $303,750 | |

| Previous Owner | Pacheco Leo D | $10,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,924 | $622,469 | $476,466 | $146,003 |

| 2024 | $6,924 | $610,265 | $467,124 | $143,141 |

| 2023 | $6,924 | $598,300 | $457,965 | $140,335 |

| 2022 | $6,727 | $586,570 | $448,986 | $137,584 |

| 2021 | $6,572 | $575,070 | $440,183 | $134,887 |

| 2020 | $6,612 | $569,174 | $435,670 | $133,504 |

| 2019 | $6,507 | $558,015 | $427,128 | $130,887 |

| 2018 | $6,206 | $547,074 | $418,753 | $128,321 |

| 2017 | $6,106 | $536,348 | $410,543 | $125,805 |

| 2016 | $5,913 | $525,833 | $402,494 | $123,339 |

| 2015 | $5,776 | $517,936 | $396,449 | $121,487 |

| 2014 | $5,561 | $507,792 | $388,684 | $119,108 |

Source: Public Records

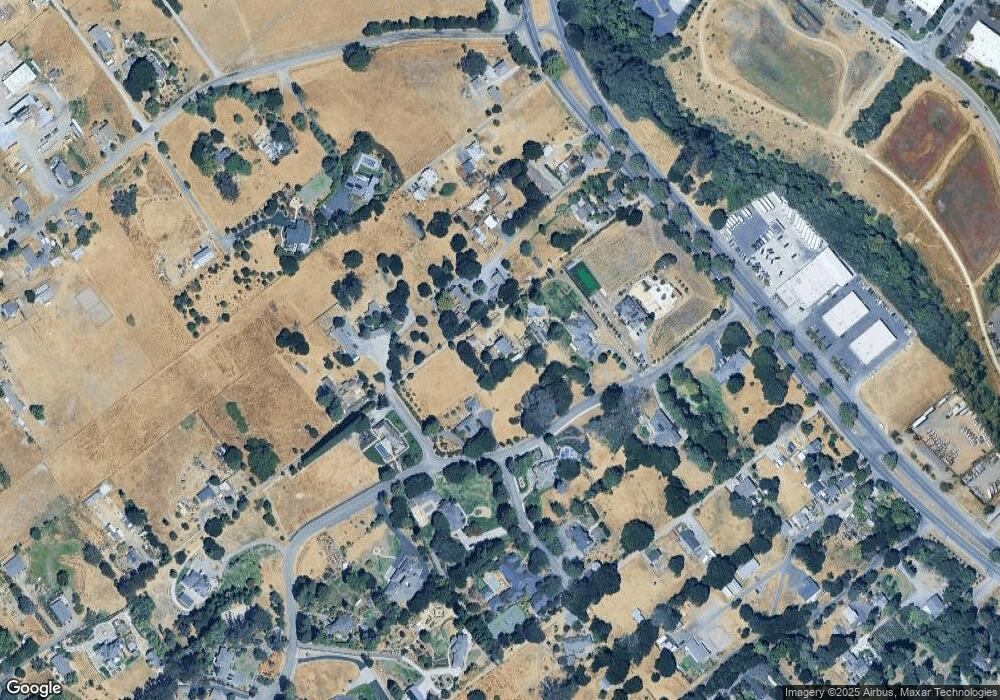

Map

Nearby Homes

- 3150 Skillman Ln

- 300 Stony Point Rd

- 300 Stony Point Rd Unit 503

- 1003 Sonoma Ct

- 36 N Napa Dr

- 594 Sonoma Dr

- 518 Vina Rose Dr

- 20 E Napa Dr

- 288 Ely Rd N

- 509 Rainsville Rd

- 829 Winton Dr

- 3234 Skillman Ln

- 249 Orchard Ln

- 1060 Lohrman Ln

- 1375 Gossage Ave

- 1501 Florence Way

- 1544 Crown Rd

- 487 Ormsby Ln

- 1757 Burgundy Ct

- 1548 Royal Oak Dr

- 135 Metz Ln Unit II

- 4545 Petaluma Blvd N

- 4350 Ryan Ln Unit II

- 310 Lily Vine Ln

- 115 Metz Ln

- 4290 Leigh Ln

- 4555 Petaluma Blvd N

- 4349 Ryan Ln

- 130 Lily Vine Ln

- 350 Lily Vine Ln

- 132 Lily Vine Ln Unit B

- 132 Lily Vine Ln

- 4685 Petaluma Blvd N

- 4295 Leigh Ln

- 120 Metz Ln

- 4481 Petaluma Blvd N

- 4270 Leigh Ln

- 195 Bailey Ave

- 100 Metz Ln

- 4271 Leigh Ln