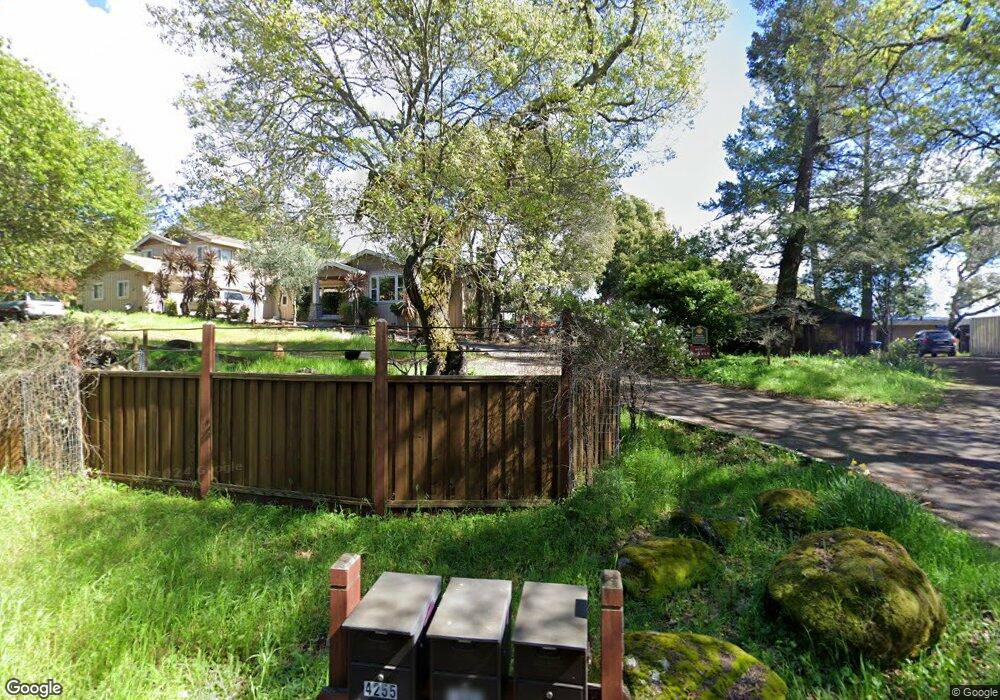

4420 Alta Vista Ave Santa Rosa, CA 95404

Montecito Heights NeighborhoodEstimated Value: $1,579,000 - $1,778,000

2

Beds

3

Baths

3,438

Sq Ft

$482/Sq Ft

Est. Value

About This Home

This home is located at 4420 Alta Vista Ave, Santa Rosa, CA 95404 and is currently estimated at $1,655,968, approximately $481 per square foot. 4420 Alta Vista Ave is a home located in Sonoma County with nearby schools including Madrone Elementary School, Rincon Valley Middle School, and Maria Carrillo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 15, 2024

Sold by

Rayner Mark Edward and Kraus-Rayner Lisa Sue

Bought by

Rkr Trust and Rayner

Current Estimated Value

Purchase Details

Closed on

Oct 18, 2013

Sold by

Schoch Ferdinand and Schoch Gretchen

Bought by

Rayner Mark Edward and Kraus Rayner Lisa Sue

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$350,000

Interest Rate

4.53%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 10, 1995

Sold by

Mueller William

Bought by

Fairacres Associates Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Interest Rate

9.29%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Nov 17, 1993

Sold by

Schween Noel B and Schween Jonni

Bought by

Schoch Ferdinand and Schoch Gretchen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,000

Interest Rate

8%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rkr Trust | -- | None Listed On Document | |

| Rkr Trust | -- | None Listed On Document | |

| Rayner Mark Edward | $1,287,000 | Fidelity National Title Co | |

| Fairacres Associates Inc | $210,000 | North American Title Company | |

| Schoch Ferdinand | $250,000 | North American Title Co Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rayner Mark Edward | $350,000 | |

| Previous Owner | Fairacres Associates Inc | $135,000 | |

| Previous Owner | Schoch Ferdinand | $280,000 | |

| Closed | Schoch Ferdinand | $170,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $18,081 | $1,577,554 | $612,928 | $964,626 |

| 2024 | $18,081 | $1,546,622 | $600,910 | $945,712 |

| 2023 | $18,081 | $1,516,297 | $589,128 | $927,169 |

| 2022 | $16,690 | $1,486,567 | $577,577 | $908,990 |

| 2021 | $16,359 | $1,457,419 | $566,252 | $891,167 |

| 2020 | $16,299 | $1,442,476 | $560,446 | $882,030 |

| 2019 | $16,153 | $1,414,193 | $549,457 | $864,736 |

| 2018 | $16,060 | $1,386,465 | $538,684 | $847,781 |

| 2017 | $15,769 | $1,359,280 | $528,122 | $831,158 |

| 2016 | $15,631 | $1,332,628 | $517,767 | $814,861 |

| 2015 | $15,164 | $1,312,612 | $509,990 | $802,622 |

| 2014 | $14,630 | $1,286,900 | $500,000 | $786,900 |

Source: Public Records

Map

Nearby Homes

- 796 Los Olivos Rd

- 3850 Montecito Ave

- 1362 Manzanita Ct

- 5104 Middlebrook Ct

- 1885 Los Olivos Rd

- 5346 Montecito Ave

- 1866 Happy Valley Rd

- 794 Los Olivos Rd

- 3611 Alta Vista Ave

- 2719 Rancho Cabeza Dr

- 3975 Chanate Rd

- 1124 Sunnyslope Dr

- 1846 Happy Valley Rd

- 2158 Rivera Dr

- 923 Shady Oak Dr

- 2060 Oak Ridge Dr

- 1859 Primavera Dr

- 802 Adobe Dr

- 94 Buckwood Place

- 3298 Hidden Valley Dr

- 4444 Alta Vista Ave

- 4440 Alta Vista Ave

- 1420 Quail Ct

- 1424 Quail Ct

- 4200 Alta Vista Ave

- 1416 Quail Ct

- 4142 Alta Vista Ave

- 4734 Alta Vista Ave

- 4730 Alta Vista Ave

- 4255 Alta Vista Ave

- 4088 Alta Vista Ave

- 4387 Alta Vista Ave

- 1412 Quail Ct

- 1419 Quail Ct

- 4121 Alta Vista Ave

- 1415 Quail Ct

- 4433 Alta Vista Ave

- 4070 Alta Vista Ave

- 4069 Alta Vista Ave