48 Bonaventure Ct Sacramento, CA 95823

North Laguna NeighborhoodEstimated Value: $388,000 - $438,000

2

Beds

2

Baths

1,323

Sq Ft

$308/Sq Ft

Est. Value

About This Home

This home is located at 48 Bonaventure Ct, Sacramento, CA 95823 and is currently estimated at $408,053, approximately $308 per square foot. 48 Bonaventure Ct is a home located in Sacramento County with nearby schools including Herman Leimbach Elementary School, Samuel Jackman Middle School, and Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 8, 2018

Sold by

Moore Gayle and Abel Rita

Bought by

Knox Carlton E and Knox Arnebry

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$294,405

Outstanding Balance

$254,611

Interest Rate

4.5%

Mortgage Type

VA

Estimated Equity

$153,442

Purchase Details

Closed on

Aug 9, 2005

Sold by

Abel Ernestine

Bought by

Abel Ernestine Bond and The Ernestine Bond Abel Family

Purchase Details

Closed on

Mar 28, 2003

Sold by

Cale Keith J and Cale Tylvena M

Bought by

Abel Ernestine

Purchase Details

Closed on

Nov 26, 1996

Sold by

Stockton Svgs Bank Fsb

Bought by

Cale Keith J and Cale Tylvena M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$45,000

Interest Rate

5.37%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Knox Carlton E | $285,000 | First American Title Company | |

| Abel Ernestine Bond | -- | -- | |

| Abel Ernestine | $185,000 | Placer Title Company | |

| Cale Keith J | $106,000 | North American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Knox Carlton E | $294,405 | |

| Previous Owner | Cale Keith J | $45,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,603 | $328,065 | $85,335 | $242,730 |

| 2024 | $3,603 | $321,633 | $83,662 | $237,971 |

| 2023 | $3,502 | $315,327 | $82,022 | $233,305 |

| 2022 | $3,453 | $309,145 | $80,414 | $228,731 |

| 2021 | $3,365 | $299,585 | $78,838 | $220,747 |

| 2020 | $3,313 | $296,514 | $78,030 | $218,484 |

| 2019 | $3,251 | $290,700 | $76,500 | $214,200 |

| 2018 | $1,091 | $87,643 | $16,914 | $70,729 |

| 2017 | $1,147 | $85,926 | $16,583 | $69,343 |

| 2016 | $1,128 | $84,242 | $16,258 | $67,984 |

| 2015 | $1,100 | $82,977 | $16,014 | $66,963 |

| 2014 | $1,092 | $81,353 | $15,701 | $65,652 |

Source: Public Records

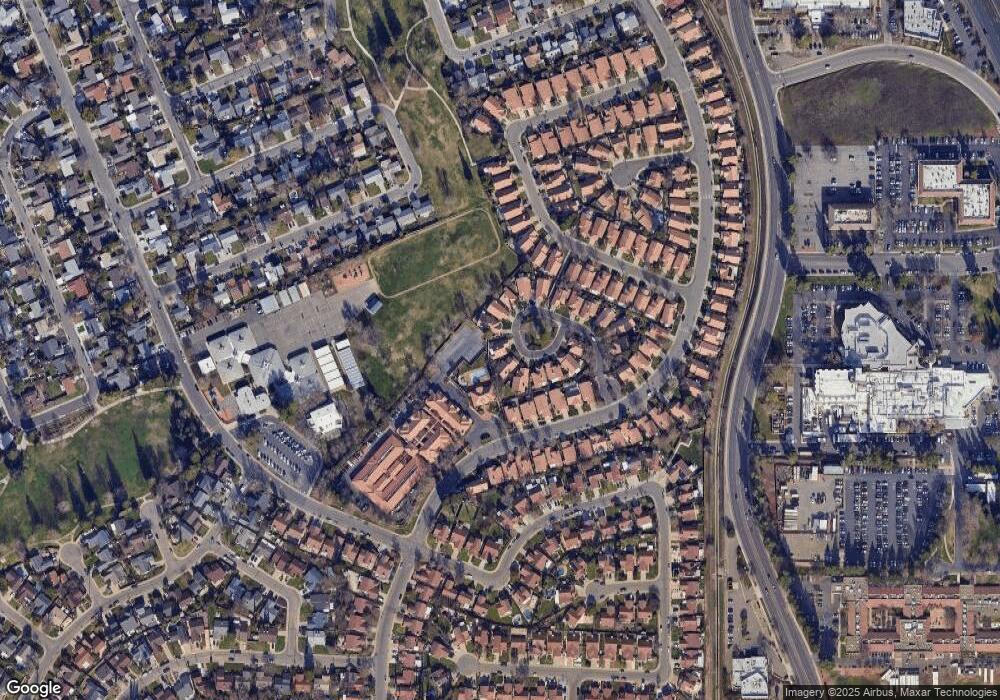

Map

Nearby Homes

- 8115 Gandy Dancer Way

- 8045 Arroyo Vista Dr

- 0 Rangeview Ln

- 57 Kennelford Cir

- 8210 Gandy Dancer Way

- 8095 E Stockton Blvd

- 6439 Valley hi Dr

- 7952 Grandstaff Dr

- 7948 Grandstaff Dr

- 7901 Stevenson Ave

- 8216 Center Pkwy

- 8220 Center Pkwy Unit 38

- 8228 Center Pkwy Unit 46

- 7711 Lenhart Rd

- 8244 Center Pkwy Unit 65

- 6028 Hollyhurst Way

- 8016 Stevenson Ave

- 8252 Center Pkwy

- 8252 Center Pkwy

- 8272 Center Pkwy Unit 111

- 44 Bonaventure Ct

- 40 Bonaventure Ct

- 56 Bonaventure Ct

- 60 Bonaventure Ct

- 36 Bonaventure Ct

- 64 Bonaventure Ct

- 32 Bonaventure Ct

- 8164 Arroyo Vista Dr

- 8168 Arroyo Vista Dr

- 68 Bonaventure Ct

- 8160 Arroyo Vista Dr

- 28 Bonaventure Ct

- 72 Bonaventure Ct

- 8058 Arroyo Vista Dr

- 24 Bonaventure Ct

- 8156 Arroyo Vista Dr

- 20 Bonaventure Ct

- 8152 Arroyo Vista Dr

- 16 Bonaventure Ct

- 8148 Arroyo Vista Dr