4979 Country Club Dr High Ridge, MO 63049

Estimated Value: $453,932 - $591,000

--

Bed

--

Bath

1,810

Sq Ft

$285/Sq Ft

Est. Value

About This Home

This home is located at 4979 Country Club Dr, High Ridge, MO 63049 and is currently estimated at $516,483, approximately $285 per square foot. 4979 Country Club Dr is a home located in Jefferson County with nearby schools including Northwest High School and St. Anthony School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 26, 2020

Sold by

Adams George T and Adams Lynn S

Bought by

Adams George T and Adams Lynn S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$263,750

Outstanding Balance

$233,532

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$282,951

Purchase Details

Closed on

Jun 29, 2000

Sold by

Williams Donald F and Williams Jacqueline

Bought by

Adams George T and Adams Lynn S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,640

Interest Rate

6%

Purchase Details

Closed on

Nov 19, 1997

Sold by

Busch Properties Inc

Bought by

Williams David F and Williams Jacqueline L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,800

Interest Rate

6.5%

Purchase Details

Closed on

Jan 16, 1997

Sold by

Kleiss Gary M and Kleiss Debra H

Bought by

Busch Properties Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Adams George T | -- | None Available | |

| Adams George T | -- | Commonwealth Title | |

| Williams David F | -- | Commonwealth Title | |

| Busch Properties Inc | -- | Commonwealth Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Adams George T | $263,750 | |

| Closed | Adams George T | $164,640 | |

| Previous Owner | Williams David F | $152,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,849 | $56,900 | $10,700 | $46,200 |

| 2024 | $3,849 | $53,300 | $10,700 | $42,600 |

| 2023 | $3,849 | $53,300 | $10,700 | $42,600 |

| 2022 | $3,593 | $50,300 | $7,700 | $42,600 |

| 2021 | $3,593 | $50,300 | $7,700 | $42,600 |

| 2020 | $3,285 | $44,900 | $7,000 | $37,900 |

| 2019 | $3,282 | $44,900 | $7,000 | $37,900 |

| 2018 | $3,325 | $44,900 | $7,000 | $37,900 |

| 2017 | $3,038 | $44,900 | $7,000 | $37,900 |

| 2016 | $2,464 | $36,100 | $7,000 | $29,100 |

| 2015 | $2,532 | $36,100 | $7,000 | $29,100 |

| 2013 | -- | $36,200 | $7,000 | $29,200 |

Source: Public Records

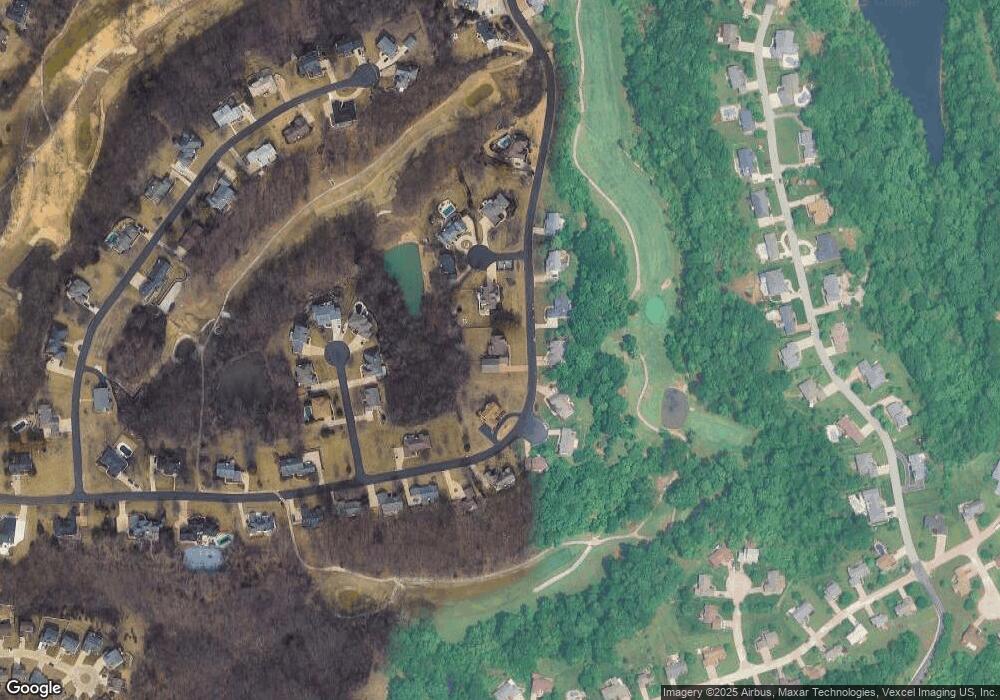

Map

Nearby Homes

- 2240 Fairway

- 5050 Schumacher Rd

- 1500 Gravois Rd

- TBD State Route 30

- 172 Brandy Mill Cir Unit 4E

- 2684 Carolyn Circle Dr

- 2566 Weymouth Dr

- 2373 Arkansas Dr

- 6029 Timber Hollow Ln

- 2141 Sunswept Ln

- 0 Mikel Ln

- 2908 Elderwood Cir

- 2436 Hillsboro Valley Park Rd

- 5211 Hunning Rd

- 2301 Arkansas Dr

- 3022 Timber View Dr

- 2132 Ridgedale Dr

- 9 Amber Ridge Ct

- 4316 Kings Acres Dr

- 1641 S Golden Cir

- 2405 Country Club Ct

- 4991 Country Club Dr

- 4980 Country Club Dr

- 2401 Country Club Ct

- 4984 Country Club Dr

- 2408 Oakmont Ct

- 5005 Country Club Dr

- 4972 Country Club Dr

- 2412 Oakmont Ct

- 2402 Country Club Ct

- 4992 Country Club Dr

- 2404 Oakmont Ct

- 4988 Lookout Point

- 4988 Country Club Dr

- 4996 Country Club Dr

- 2406 Country Club Ct

- 4968 Country Club Dr

- 5000 Country Club Dr

- 5004 Country Club Dr

- 2400 Oakmont Ct