507 Cardinal Trail Ct Richmond, TX 77469

Greatwood NeighborhoodEstimated Value: $436,137 - $525,000

5

Beds

4

Baths

3,938

Sq Ft

$121/Sq Ft

Est. Value

About This Home

This home is located at 507 Cardinal Trail Ct, Richmond, TX 77469 and is currently estimated at $476,784, approximately $121 per square foot. 507 Cardinal Trail Ct is a home located in Fort Bend County with nearby schools including Manford Williams Elementary School, Reading Junior High School, and George Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 6, 2006

Sold by

Inclan Dianna and Inclan Rodolfo

Bought by

Casler Kevin C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,000

Outstanding Balance

$128,153

Interest Rate

6.44%

Mortgage Type

New Conventional

Estimated Equity

$348,631

Purchase Details

Closed on

Jul 30, 2004

Sold by

First Texas Homes Inc

Bought by

Inclan Dianna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$184,250

Interest Rate

6.26%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 15, 2003

Sold by

274 Brazos Ltd

Bought by

Casler Kevin C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Casler Kevin C | -- | First American Title | |

| Inclan Dianna | -- | First American Title | |

| Casler Kevin C | -- | -- | |

| Casler Kevin C | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Casler Kevin C | $215,000 | |

| Previous Owner | Casler Kevin C | $184,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,396 | $464,137 | $55,913 | $408,224 |

| 2024 | $8,396 | $463,122 | $55,913 | $407,209 |

| 2023 | $11,450 | $487,629 | $43,010 | $444,619 |

| 2022 | $10,184 | $405,230 | $43,010 | $362,220 |

| 2021 | $8,509 | $321,730 | $43,010 | $278,720 |

| 2020 | $8,159 | $300,830 | $39,100 | $261,730 |

| 2019 | $8,345 | $289,370 | $39,100 | $250,270 |

| 2018 | $8,443 | $290,220 | $39,100 | $251,120 |

| 2017 | $8,481 | $289,040 | $39,100 | $249,940 |

| 2016 | $8,326 | $283,770 | $39,100 | $244,670 |

| 2015 | $4,934 | $262,980 | $39,100 | $223,880 |

| 2014 | $4,228 | $224,310 | $39,100 | $185,210 |

Source: Public Records

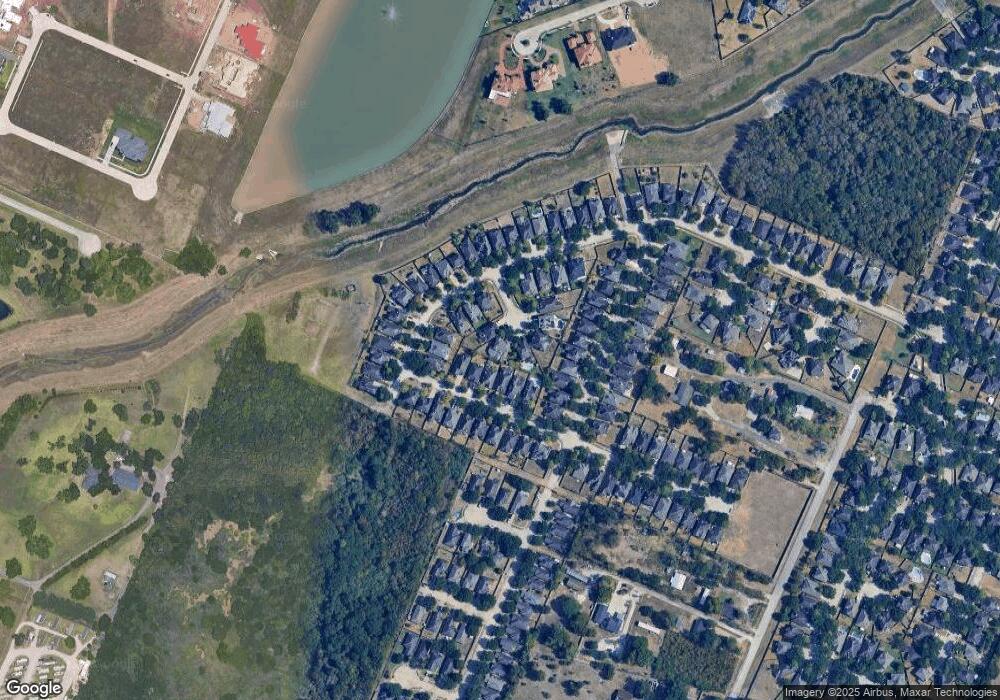

Map

Nearby Homes

- 5626 Indigo Trails Dr

- 506 Taskwood Dr

- 333 Gonyo Ln

- 63 St Catherine Way

- 1007 Williams Lake Dr

- 1011 Wavecrest Ct

- 5751 Wandering Creek Dr

- 3 Castle Terrace Ln

- 5767 Wandering Creek Dr

- 11 Alexandra Way Cir

- 1019 Grand Estates Dr

- 211 Payne Ln

- 5619 Capeview Cove Ln

- 1123 Grand Estates Dr

- 834 Stevens Creek Ln

- 415 Crabb River Rd

- 6002 Mettler Ln

- 1222 Watermoon

- 5703 Grande Gables Dr

- 6710 Cartwright Ct

- 511 Cardinal Trail Ct

- 503 Cardinal Trail Ct

- 5619 Indigo Trails Dr

- 5615 Indigo Trails Dr

- 5623 Indigo Trails Dr

- 5611 Indigo Trails Dr

- 502 Cardinal Trail Dr

- 502 Cardinal Trail Ct

- 5627 Indigo Trails Dr

- 5430 Carta Valley Ln

- 5426 Carta Valley Ln

- 5426 Carta Valley Ln

- 5414 Carta Valley Ln

- 5410 Carta Valley Ln

- 5631 Indigo Trails Dr

- 506 Cardinal Trail Ct

- 5406 Carta Valley Ln

- 5514 Carta Valley Ln

- 510 Cardinal Trail Ct

- 431 Taskwood Dr