515 Highland Ave Santa Cruz, CA 95060

Westlake NeighborhoodEstimated Value: $830,000 - $2,456,000

4

Beds

2

Baths

2,362

Sq Ft

$741/Sq Ft

Est. Value

About This Home

This home is located at 515 Highland Ave, Santa Cruz, CA 95060 and is currently estimated at $1,750,438, approximately $741 per square foot. 515 Highland Ave is a home located in Santa Cruz County with nearby schools including Westlake Elementary School, Mission Hill Middle School, and Santa Cruz High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 16, 2000

Sold by

Payne Rhys and Rummel Lynette

Bought by

Payne Rhys and Rummel Lynette

Current Estimated Value

Purchase Details

Closed on

Mar 20, 1997

Sold by

Rhys Payne and Cochran May B

Bought by

Hochler Richard and Ross Melissa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$322,200

Interest Rate

7.63%

Purchase Details

Closed on

Mar 27, 1996

Sold by

Payne Rhys and Cochran Mary Louise

Bought by

Hochler Richard and Ross Melissa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$332,500

Interest Rate

7.41%

Mortgage Type

Construction

Purchase Details

Closed on

Jan 5, 1996

Sold by

Rummel Lynette G

Bought by

Payne Rhys C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

7.18%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Payne Rhys | -- | -- | |

| Payne Rhys | -- | -- | |

| Payne Rhys | -- | -- | |

| Hochler Richard | $171,500 | First American Title Ins Co | |

| Hochler Richard | $160,000 | Santa Cruz Title | |

| Payne Rhys C | -- | Northwestern Title | |

| Payne Rhys C | -- | Northwestern Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hochler Richard | $322,200 | |

| Previous Owner | Hochler Richard | $332,500 | |

| Previous Owner | Payne Rhys C | $150,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,067 | $809,098 | $498,566 | $310,532 |

| 2023 | $8,958 | $777,682 | $479,208 | $298,474 |

| 2022 | $8,858 | $762,432 | $469,810 | $292,622 |

| 2021 | $8,674 | $747,482 | $460,598 | $286,884 |

| 2020 | $8,607 | $739,818 | $455,876 | $283,942 |

| 2019 | $8,418 | $725,314 | $446,938 | $278,376 |

| 2018 | $8,323 | $711,090 | $438,174 | $272,916 |

| 2017 | $8,217 | $697,146 | $429,582 | $267,564 |

| 2016 | $7,764 | $683,476 | $421,158 | $262,318 |

| 2015 | $7,576 | $673,210 | $414,832 | $258,378 |

| 2014 | $7,449 | $660,022 | $406,706 | $253,316 |

Source: Public Records

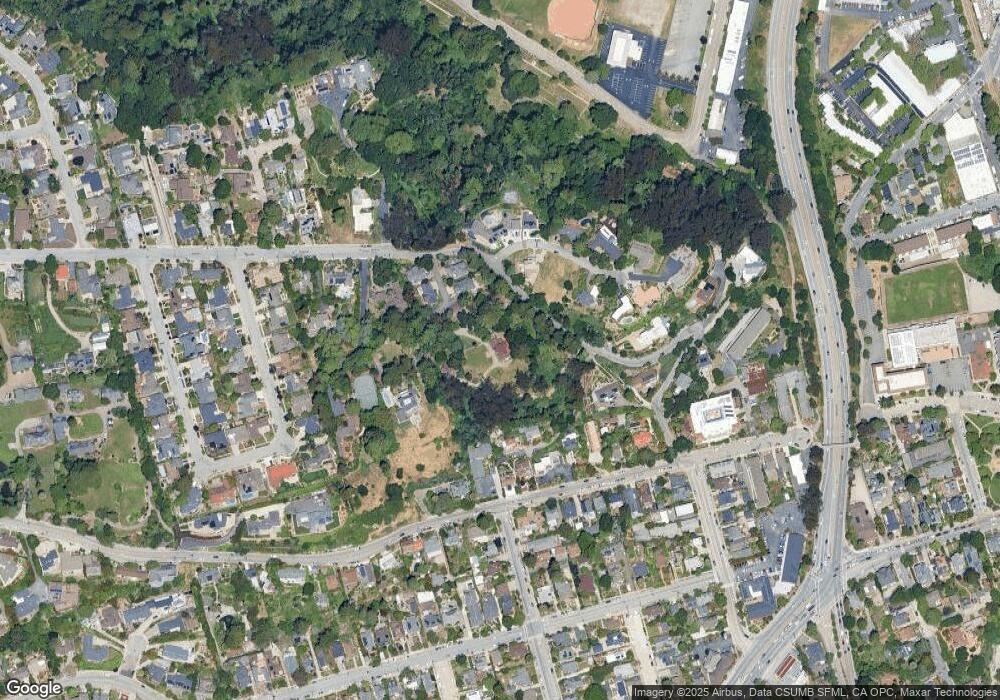

Map

Nearby Homes

- 350 Highland Ave

- 260 High St Unit 206

- 260 High St Unit 204

- 449 High St

- 603 Mission St

- 623 High St

- 1212 Laurent St

- 2030 N Pacific Ave Unit 314

- 901 River St

- 1103 Mission St

- 233 Rigg St

- 1124 Laurel St

- 33 Edgewood Way

- 514 Washington St

- 309 Village Cir

- 807 Laurel St

- 120 Maple St

- 1720 Ocean St

- 148 Myrtle St

- 113 Washburn Ave

- 507 Highland Ave

- 425 Highland Ave

- 423 Highland Ave

- 112 Hillcrest Terrace

- 108 Hillcrest Terrace

- 102 Hillcrest Terrace

- 519 Highland Ave

- 501 Highland Ave

- 130 Hillcrest Terrace

- 404 High St

- 404 High St Unit B

- 535 Highland Ave

- 521 Highland Ave

- 336 High St

- 332 High St

- 317 Highland Ave

- 334 High St

- 0 Hillcrest Terrace

- 346 High St

- 338 High St