530 SE 30th Rd Warrensburg, MO 64093

Estimated Value: $237,842 - $310,000

3

Beds

2

Baths

1,482

Sq Ft

$177/Sq Ft

Est. Value

About This Home

This home is located at 530 SE 30th Rd, Warrensburg, MO 64093 and is currently estimated at $262,614, approximately $177 per square foot. 530 SE 30th Rd is a home located in Johnson County with nearby schools including Maple Grove Elementary School, Martin Warren Elementary School, and Warrensburg Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 13, 2020

Sold by

Lee Diane Violet and Rutliff Troy

Bought by

Lester Dale

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$87,850

Outstanding Balance

$70,717

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$191,897

Purchase Details

Closed on

Mar 27, 2009

Sold by

Cartus Financial Copr

Bought by

Lee Diane Violet

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$99,170

Interest Rate

4.72%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 20, 2009

Sold by

Morris Edward W and Morris Dawn L

Bought by

Cartus Financial Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lester Dale | -- | Truman Title Inc | |

| Lee Diane Violet | -- | -- | |

| Cartus Financial Corp | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lester Dale | $87,850 | |

| Previous Owner | Lee Diane Violet | $99,170 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,174 | $16,116 | $0 | $0 |

| 2023 | $1,174 | $16,116 | $0 | $0 |

| 2022 | $1,137 | $15,540 | $0 | $0 |

| 2021 | $1,118 | $15,331 | $0 | $0 |

| 2020 | $1,089 | $14,756 | $0 | $0 |

| 2019 | $1,088 | $14,756 | $0 | $0 |

| 2017 | $1,052 | $14,851 | $0 | $0 |

| 2016 | $1,049 | $14,851 | $0 | $0 |

| 2015 | $1,080 | $14,851 | $0 | $0 |

| 2014 | $937 | $14,851 | $0 | $0 |

Source: Public Records

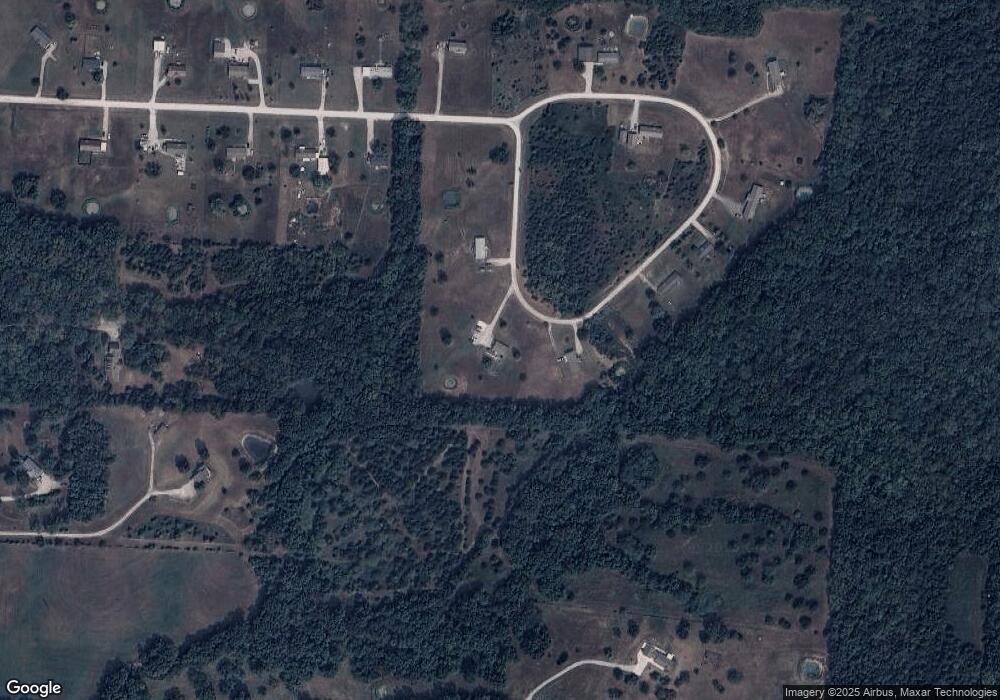

Map

Nearby Homes

- 463 SE 90th Rd

- 80 SE 451st Rd

- 133 SE 421st Rd

- 122 SE 411th Rd

- 137 SE 611th Rd

- 141 SE 621st Rd

- 176 SE 431st Rd

- 170 SE 411th Rd

- 365 SE 85th Rd

- 84 SE 351st Rd

- 628 SE 150th St

- 125 NE 641st Rd

- 83 SE 381st Rd

- 1211 Holland Square

- 1603 Roanoke Dr

- 46 NE 231st Rd

- 1226 Pembrooke Dr

- Cayhill Lot 216 Larson Ave

- Cayhill Lot 215 Larson Ave

- 210 Parkway Dr