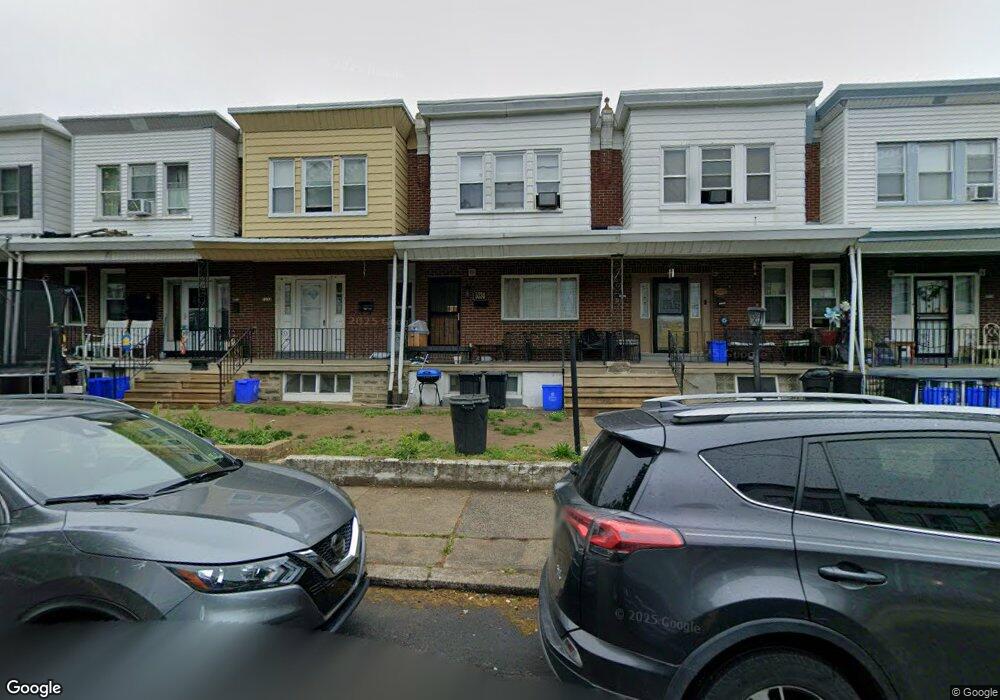

5334 Akron St Philadelphia, PA 19124

Frankford NeighborhoodEstimated Value: $180,000 - $216,000

3

Beds

1

Bath

1,164

Sq Ft

$171/Sq Ft

Est. Value

About This Home

This home is located at 5334 Akron St, Philadelphia, PA 19124 and is currently estimated at $199,274, approximately $171 per square foot. 5334 Akron St is a home located in Philadelphia County with nearby schools including Frankford High School, The Philadelphia Charter School for the Arts & Sciences, and Mastery Schools Smedley Elementary.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 23, 2009

Sold by

Cruz Silvio L and Cruz Gisela M

Bought by

Johnson Elnora

Current Estimated Value

Purchase Details

Closed on

May 5, 2006

Sold by

Jorge Idalecio N and Cruz Gisela M

Bought by

Cruz Silvio L and Cruz Gisela M

Purchase Details

Closed on

May 4, 2006

Sold by

Hud

Bought by

Jorge Idalecio N

Purchase Details

Closed on

Sep 30, 2004

Sold by

Wachovia Bank Na

Bought by

Hud

Purchase Details

Closed on

Aug 2, 2004

Sold by

Finnegan Michael and Finnegan April M

Bought by

First Union National Bank and Pa Housing Finance Agency

Purchase Details

Closed on

Mar 27, 1996

Sold by

Cusack John W

Bought by

Finnegan Michael and Finnegan April M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnson Elnora | $125,000 | None Available | |

| Cruz Silvio L | -- | None Available | |

| Jorge Idalecio N | $61,911 | None Available | |

| Hud | -- | -- | |

| First Union National Bank | $60,000 | -- | |

| Finnegan Michael | $44,900 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $1,869 | $165,800 | $33,160 | $132,640 |

| 2025 | $1,869 | $165,800 | $33,160 | $132,640 |

| 2024 | $1,869 | $165,800 | $33,160 | $132,640 |

| 2023 | $1,869 | $133,500 | $26,700 | $106,800 |

| 2022 | $722 | $88,500 | $26,700 | $61,800 |

| 2021 | $1,352 | $0 | $0 | $0 |

| 2020 | $1,352 | $0 | $0 | $0 |

| 2019 | $1,298 | $0 | $0 | $0 |

| 2018 | $890 | $0 | $0 | $0 |

| 2017 | $1,310 | $0 | $0 | $0 |

| 2016 | $890 | $0 | $0 | $0 |

| 2015 | $852 | $0 | $0 | $0 |

| 2014 | -- | $93,600 | $16,818 | $76,782 |

| 2012 | -- | $11,936 | $975 | $10,961 |

Source: Public Records

Map

Nearby Homes