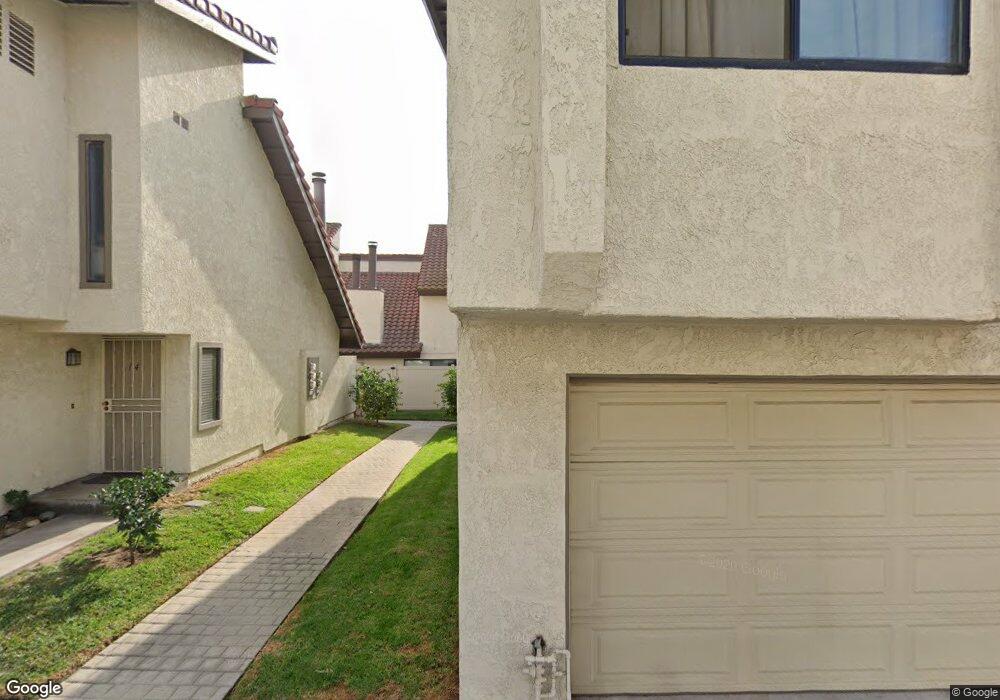

5577 Pioneer Blvd Unit 21 Whittier, CA 90601

West Whittier NeighborhoodEstimated Value: $578,000 - $607,938

3

Beds

3

Baths

1,245

Sq Ft

$481/Sq Ft

Est. Value

About This Home

This home is located at 5577 Pioneer Blvd Unit 21, Whittier, CA 90601 and is currently estimated at $599,235, approximately $481 per square foot. 5577 Pioneer Blvd Unit 21 is a home located in Los Angeles County with nearby schools including Orange Grove Elementary School, Walter F. Dexter Middle School, and Whittier High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 14, 1999

Sold by

Gonnella Jesse

Bought by

Zuniga Maria P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,062

Interest Rate

7.64%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 9, 1997

Sold by

Ramirez Ralph

Bought by

Ramirez Ralph and Ramirez Family Trust

Purchase Details

Closed on

Jan 19, 1997

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Gonnella Jessie and Ramirez Ralph

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,400

Interest Rate

7.62%

Purchase Details

Closed on

Oct 28, 1996

Sold by

Barajas Victor and Federal Home Loan Mortgage Cor

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Mar 22, 1996

Sold by

Barajas Victor

Bought by

New Haven Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zuniga Maria P | $125,000 | Southland Title | |

| Ramirez Ralph | -- | -- | |

| Gonnella Jessie | $112,000 | First American Title Co | |

| Federal Home Loan Mortgage Corporation | $110,000 | Fidelity National Title | |

| New Haven Corp | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Zuniga Maria P | $122,062 | |

| Previous Owner | Gonnella Jessie | $106,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,701 | $192,097 | $42,100 | $149,997 |

| 2024 | $2,701 | $188,331 | $41,275 | $147,056 |

| 2023 | $2,646 | $184,639 | $40,466 | $144,173 |

| 2022 | $2,584 | $181,020 | $39,673 | $141,347 |

| 2021 | $2,504 | $177,472 | $38,896 | $138,576 |

| 2019 | $2,467 | $172,211 | $37,744 | $134,467 |

| 2018 | $2,420 | $168,835 | $37,004 | $131,831 |

| 2017 | $2,391 | $165,526 | $36,279 | $129,247 |

| 2016 | $2,297 | $162,281 | $35,568 | $126,713 |

| 2015 | $2,450 | $159,844 | $35,034 | $124,810 |

| 2014 | $2,360 | $156,714 | $34,348 | $122,366 |

Source: Public Records

Map

Nearby Homes

- 5593 Pioneer Blvd Unit 18

- 5577 Pioneer Blvd Unit 5

- 10013 Obregon St

- 10050 Obregon St

- 5729 Juarez Ave

- 5903 Redman Ave

- 9900 Tagus St Unit 30

- 10605 Cordoba Ct

- 5518 Norwalk Blvd

- 5107 Vista Verde Way

- 9338 Via Azul

- 5115 Castelotte Ct

- 9332 Via Azul

- Plan 1560 at Azul

- Plan 1680 at Azul

- Plan 1706 Modeled at Azul

- 9341 Via Azul

- 9328 Via Azul

- 9326 Via Azul

- 9335 Via Azul

- 5577 Pioneer Blvd

- 5577 Pioneer Blvd Unit 19

- 5577 Pioneer Blvd Unit 20

- 5577 Pioneer Blvd Unit 22

- 5577 Pioneer Blvd Unit 23

- 5577 Pioneer Blvd Unit 7

- 5577 Pioneer Blvd Unit 8

- 5577 Pioneer Blvd Unit 9

- 5577 Pioneer Blvd Unit 24

- 5577 Pioneer Blvd Unit 10

- 5577 Pioneer Blvd Unit 11

- 5577 Pioneer Blvd Unit 12

- 5577 Pioneer Blvd Unit 13

- 5577 Pioneer Blvd Unit 14

- 5577 Pioneer Blvd Unit 15

- 5577 Pioneer Blvd Unit 16

- 5577 Pioneer Blvd Unit 17

- 5577 Pioneer Blvd Unit 18

- 5577 Pioneer Blvd Unit 1

- 5577 Pioneer Blvd Unit 2