59 Jimal Dr Middletown, NY 10940

Estimated Value: $226,844 - $248,000

1

Bed

1

Bath

945

Sq Ft

$252/Sq Ft

Est. Value

About This Home

This home is located at 59 Jimal Dr, Middletown, NY 10940 and is currently estimated at $237,711, approximately $251 per square foot. 59 Jimal Dr is a home located in Orange County with nearby schools including Presidential Park Elementary School, Middletown Twin Towers Middle School, and Monhagen Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 6, 2021

Sold by

Zubalsky George

Bought by

Batwinas Jamie and Pistone Stephen

Current Estimated Value

Purchase Details

Closed on

Feb 10, 2003

Sold by

Zubalsky Anuska

Bought by

Zubalsky Anuska

Purchase Details

Closed on

Oct 17, 2002

Sold by

Zubalsky Anuska

Bought by

Zubalsky Anuska and Zubalsky George

Purchase Details

Closed on

Sep 12, 2002

Sold by

Sessler Scott E

Bought by

Zubalsky Anuska

Purchase Details

Closed on

Sep 12, 2001

Sold by

Motola Steven

Bought by

Sessler Scott E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$65,550

Interest Rate

6.93%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Batwinas Jamie | $140,000 | First American Title | |

| Zubalsky Anuska | -- | Kenneth D. Johnson | |

| Zubalsky Anuska | -- | Lawyers Title Insurance Corp | |

| Zubalsky Anuska | $95,000 | -- | |

| Sessler Scott E | $69,000 | Old Republic Natl Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sessler Scott E | $65,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,554 | $12,800 | $3,000 | $9,800 |

| 2023 | $3,514 | $12,800 | $3,000 | $9,800 |

| 2022 | $3,442 | $12,800 | $3,000 | $9,800 |

| 2021 | $3,621 | $12,800 | $3,000 | $9,800 |

| 2020 | $599 | $12,800 | $3,000 | $9,800 |

| 2019 | $582 | $12,800 | $3,000 | $9,800 |

| 2018 | $582 | $12,800 | $3,000 | $9,800 |

| 2017 | $1,376 | $12,800 | $3,000 | $9,800 |

| 2016 | $639 | $12,800 | $3,000 | $9,800 |

| 2015 | -- | $12,800 | $3,000 | $9,800 |

| 2014 | -- | $12,800 | $3,000 | $9,800 |

Source: Public Records

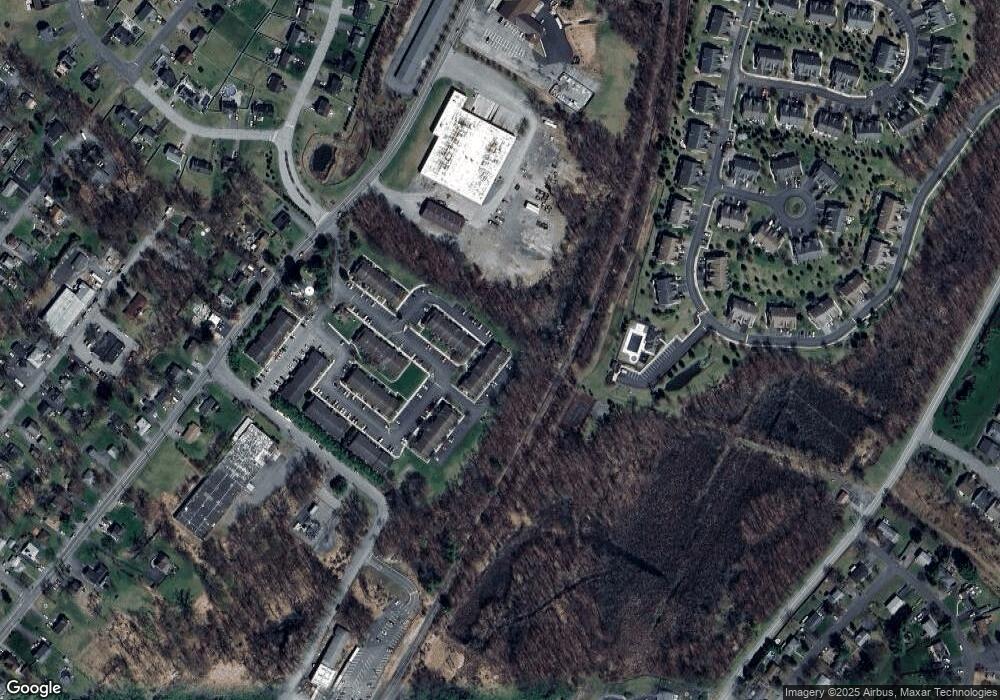

Map

Nearby Homes

- 5 Cobblestone Ln Unit 4301

- 115 Vincent Dr

- 1 Polly Kay Dr

- 4 Avoncroft Ln

- 26 Kyleigh Way

- 299 Highland Ave Extension

- 21 Cyprus Dr

- 30 Avoncroft Ln

- 23 Avoncroft Ln

- 19 Pleasant Ave

- 24 Juniper Cir

- 57 Overhill Rd

- 24 3rd St

- 143 N Beacon St

- 105 Sheffield Dr

- 37 Wisner Ave Unit 39

- 0 Maples Rd Unit KEY883753

- 10 Royce Ave

- TBD Silver Lake-Scotchtown Rd

- 15 Clark St