6600 Patricia Blvd Goshen, OH 45122

Estimated Value: $1,297,212

--

Bed

--

Bath

35,698

Sq Ft

$36/Sq Ft

Est. Value

About This Home

This home is located at 6600 Patricia Blvd, Goshen, OH 45122 and is currently estimated at $1,297,212, approximately $36 per square foot. 6600 Patricia Blvd is a home located in Clermont County with nearby schools including Marr/Cook Elementary School, Spaulding Elementary School, and Goshen Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 9, 2023

Sold by

Tpt Holdings Llc

Bought by

Briggs Stacey Sitter

Current Estimated Value

Purchase Details

Closed on

Sep 6, 2011

Sold by

Sbn Reo Llc

Bought by

Cincinnati Nature Center

Purchase Details

Closed on

May 24, 2011

Sold by

State Route 28 Commercial Property Llc and Sansalone Anthony M

Bought by

Sbn Reo Llc

Purchase Details

Closed on

Feb 26, 2009

Sold by

Gordon Real Estate Llc

Bought by

Summitbridge National Investments Llc

Purchase Details

Closed on

Dec 12, 2003

Sold by

Robert O Siller Family Lp

Bought by

Gordon Real Estate Llc

Purchase Details

Closed on

Oct 31, 2003

Sold by

Robert O Siller Family Lp

Bought by

D&D Real Estate Llc

Purchase Details

Closed on

May 3, 2001

Sold by

Razete Patricia J

Bought by

Robert Siller Family Ltd Ptns

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Briggs Stacey Sitter | $125 | None Listed On Document | |

| Cincinnati Nature Center | $159,650 | Attorney | |

| Sbn Reo Llc | -- | None Available | |

| Summitbridge National Investments Llc | $666,666 | Attorney | |

| Gordon Real Estate Llc | -- | -- | |

| D&D Real Estate Llc | $604,433 | -- | |

| Robert Siller Family Ltd Ptns | $535,000 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $11,676 | $197,650 | $52,750 | $144,900 |

| 2023 | $5,264 | $88,730 | $24,150 | $64,580 |

| 2022 | $5,407 | $88,730 | $24,150 | $64,580 |

| 2021 | $5,477 | $88,730 | $24,150 | $64,580 |

| 2020 | $5,245 | $89,150 | $24,570 | $64,580 |

| 2019 | $4,529 | $75,260 | $24,050 | $51,210 |

| 2018 | $9,795 | $160,270 | $76,410 | $83,860 |

| 2017 | $2,069 | $160,270 | $76,410 | $83,860 |

| 2016 | $2,069 | $33,430 | $10,850 | $22,580 |

| 2015 | $1,913 | $33,430 | $10,850 | $22,580 |

| 2014 | $1,911 | $33,430 | $10,850 | $22,580 |

| 2013 | $9,617 | $180,330 | $20,830 | $159,500 |

Source: Public Records

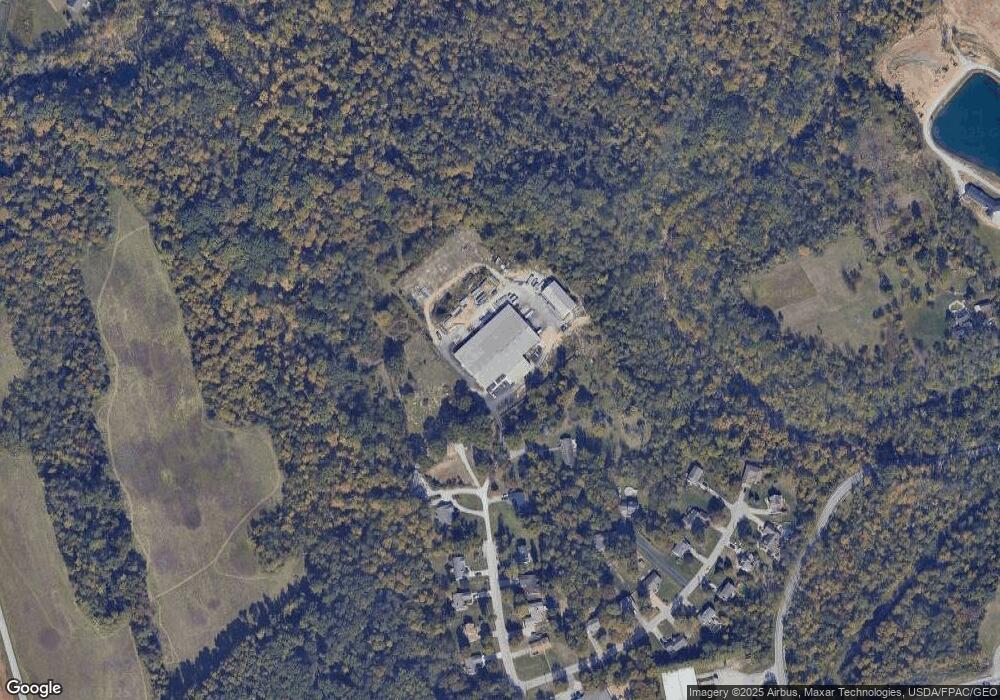

Map

Nearby Homes

- 6590 Rosewood Ln

- 6588 Rosewood Ln

- 6579 Rosewood Ln

- 1685 W Huntley Rd

- 1775 E Huntley Rd

- 6747 Wood St

- 6563 Hillside Dr

- 1811 Louis Ln

- 2213 Ohio 132

- 6677 Wood St

- 6907 Goshen Rd

- 6538 Glen Eagle Way

- 6536 Glen Eagle Way

- Cedar with Full Basement Plan at Barclay Woods

- Birch with Full Basement Plan at Barclay Woods

- Elder with Full Basement Plan at Barclay Woods

- Aspen with Full Basement Plan at Barclay Woods

- Tupelo with Full Basement Plan at Barclay Woods

- 1947 Main St

- 6637 Oakland Rd

- 6800 Patricia Blvd

- 6428 Patricia Blvd

- 2936 Rontina Blvd

- 2934 Rontina Blvd

- 6424 Patricia Blvd

- 2948 Rontina Blvd

- 6420 Patricia Blvd

- 6429 Patricia Blvd

- 2942 Rontina Blvd

- 2938 Rontina Blvd

- 2930 Rontina Blvd

- 2930 Rontina Dr

- 2926 Rontina Blvd

- 6425 Patricia Blvd

- 6416 Patricia Blvd

- 2922 Rontina Blvd

- 0 Patricia Blvd Unit 692408

- 0 Patricia Blvd

- 2952 Rontina Blvd

- 6421 Patricia Blvd